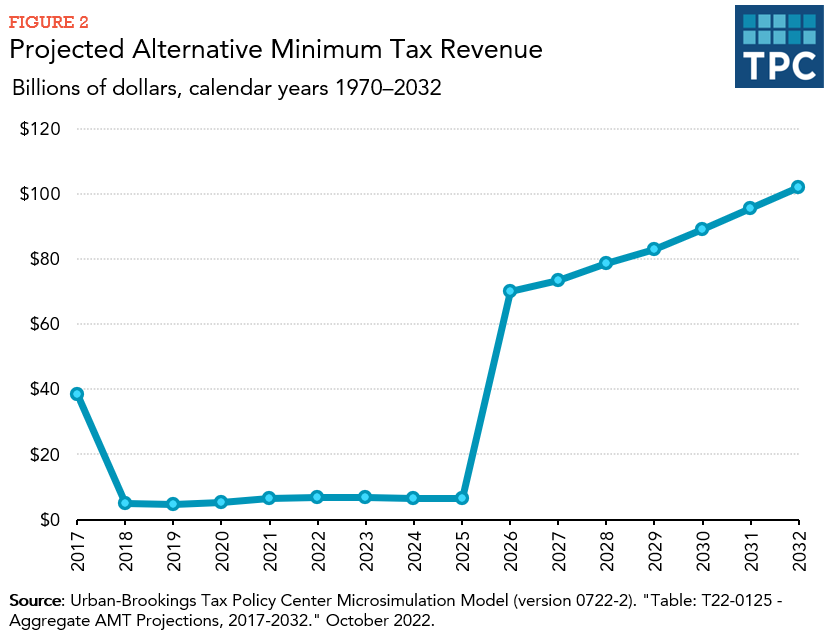

About $6.7 billion in 2023, or 0.3 percent of all individual income tax revenue. That is down significantly from $38.3 billion—2.5 percent of income tax revenue—in 2017, primarily because of the 2017 Tax Cuts and Jobs Act (TCJA). When most of the TCJA individual income tax provisions expire at the end of 2025, AMT revenue will soar, reaching $102.1 billion by 2032, or 3.06 percent of all individual income tax revenue.

Congress enacted the original minimum tax in 1969. It was an “add-on” tax households paid in addition to any regular income tax they owed. It applied to certain income items (“preferences”) taxed lightly or not at all under the regular income tax. The largest preference item was the portion of capital gains excluded from the regular income tax. Revenue from the add-on tax grew from $122 million (0.14 percent of aggregate individual income tax revenue) in 1970 to $1.5 billion (0.84 percent) by 1978 (figure 1).

Congress enacted the modern individual alternative minimum tax (AMT) in 1979 to operate alongside the add-on minimum tax. The main preference items, including capital gains, moved from the add-on tax to the new AMT. As a result, revenue from the add-on tax plummeted to $300 million in 1979. Congress subsequently repealed the add-on tax, effective in 1983. Revenue from the new AMT climbed rapidly from $870 million (about 0.4 percent of all individual income tax revenue) in its inaugural year of 1979 to $6.7 billion (2.0 percent) in 1986.

The Tax Reform Act of 1986 (TRA86) changed both the regular income tax and the AMT. The TRA eliminated much tax-sheltering activity and thus shifted much of the AMT base to the regular income tax system. In particular, the TRA86 eliminated the partial exclusion of capital gains, which had accounted for 85 percent of total AMT preferences in 1985. As a result, AMT revenue fell to $1.7 billion in 1987, back to the same 0.4 percent of aggregate individual income tax revenue that it had raised in 1979, even though TRA86 added some new AMT preferences, including the state and local income tax deduction and interest on certain private purpose tax-exempt bonds.

Unlike the regular income tax system, Congress did not index the AMT for inflation. Each year, the standard deduction, personal exemptions, and tax bracket thresholds in the regular income tax would rise to keep pace with inflation. In contrast, the AMT exemption and brackets stayed fixed. Thus, over time, as a taxpayer’s income rose with inflation, AMT liability rose relative to regular income tax liability. Because taxpayers paid the larger of the two taxes, inflation pushed more people onto the AMT, and AMT revenue increased steadily after 1987.

In 2001, Congress passed the Economic Growth and Tax Relief Reconciliation Act, which substantially reduced regular income taxes but provided only temporary relief from the AMT. Over the following decade, Congress repeatedly passed legislation—known as the AMT “patch”—to prevent an explosion in the number of AMT payers. Despite the annual patches, AMT revenue continued to grow, reaching $37.4 billion—or 3.5 percent of individual income tax revenue—in 2012.

The American Taxpayer Relief Act of 2012 (ATRA) enacted an AMT “fix” by establishing a permanently higher AMT exemption, indexing the AMT parameters for inflation, and allowing certain tax credits under the AMT. Combined with the fact that ATRA raised regular income taxes on high-income taxpayers, the permanent AMT fix reduced AMT revenue to $27.4 billion, or 2.4 percent of income tax revenue, in 2013.

The 2017 Tax Cuts and Jobs Act (TCJA), included provisions that greatly reduce the revenue the AMT will generate. For 2018, the TCJA enacted a higher AMT exemption and a large increase in the income level at which the exemption begins to phase out. It also repealed or scaled back some of the largest AMT preference items, further limiting the tax’s scope. As a result, AMT revenue fell from $38.3 billion in 2017 to just $4.8 billion in 2018—a drop from 2.5 percent to 0.3 percent of all individual income tax revenue.

Projections

The AMT provisions in TCJA, along with almost all its other individual income tax measures, are set to expire at the end of 2025. Thus, barring new legislation, AMT revenue will explode from $6.6 billion in 2025 to $70.0 billion in 2026. It will continue to rise to $102.1 billion—3.0 percent of all individual income tax revenue—by 2032 (figure 2).

Updated January 2024

Burman, Leonard E. 2007a. “The Alternative Minimum Tax: Assault on the Middle Class.” Milken Institute Review. Santa Monica, CA.

Burman, Leonard E. 2007b. “The Individual Alternative Minimum Tax.” Testimony before the United States Senate Committee on Finance. Washington, DC.

Gleckman, Howard. 2018. “The Tax Cuts and Jobs Act and the Zombie AMT.” TaxVox (blog). Washington, DC: Urban-Brookings Tax Policy Center.

Harvey, Robert P., and Jerry Tempalski. 1997. “The Individual AMT: Why it Matters.” National Tax Journal 50 (3): 453–74.

Leiserson, Greg, and Jeff Rohaly. 2007. “What is Responsible for the Growth of the AMT?.” Washington DC: Urban Institute.