Before the 2017 Tax Cuts and Jobs Act (TCJA), the individual alternative minimum tax (AMT) primarily affected well-off households, but not those with the very highest incomes. It was also more likely to hit taxpayers with large families, those who were married, and those who lived in high-tax states. The TCJA shields almost all upper-middle and high-income taxpayers from the reach of the AMT. The AMT is now most likely to hit those at the top of the income scale who are engaged in certain tax sheltering activities.

Taxpayers pay the higher of their tax calculated under regular income tax rules or under the rules for the alternative minimum tax (AMT). In 2017—before enactment of the Tax Cuts and Jobs Act (TCJA)— the 39.6 percent top rate under the regular income tax was much higher than the 28 percent top statutory AMT rate. Thus, households with very high incomes who did not attempt to shelter much income typically paid the regular income tax. Households not at the very top of the income scale but still with high income faced somewhat lower statutory tax rates under the regular tax and were therefore more likely to pay the AMT.

Only about 3.1 percent of households overall were on the AMT in 2017 but the percentage was much higher among high-income groups. The AMT increased taxes for 18.4 percent of households with “expanded cash income” (a broad measure of income) between $200,000 and $500,000, 69.5 percent of those with incomes between $500,000 and $1 million, and 24.6 percent of households with incomes greater than $1 million (table 1).

The AMT After the TCJA

The TCJA enacted a higher AMT exemption and a large increase in the income at which the exemption begins to phase out. The act also repealed or scaled back some of the largest AMT “preference items”—items allowable under the regular tax but not the AMT—such as personal exemptions, job-related and other miscellaneous expenses, and the deduction for state and local taxes. As a result, the TCJA shielded almost all upper-middle and high-income taxpayers from the AMT. The tax is now most likely to affect those at the top of the income scale who take advantage of certain tax shelters allowed under the regular tax but not the AMT.

In 2022, the AMT impacted just 0.1 percent of households overall. This includes 0.3 percent of households with income between $200,000 and $500,000, 2.1 percent of those with incomes between $500,000 and $1 million, and 9.8 percent of households with incomes greater than $1 million (table 1).

The AMT provisions in TCJA, along with almost all of its other individual income tax measures, are set to expire at the end of 2025. Thus, barring congressional legislation, the AMT will return in force in 2026. It will increase taxes for more than a fifth of taxpayers in the $200,000 to $500,000 income range and more than 70 percent of those with incomes between $500,000 and $1 million. It will again be less likely to affect those at the top of the income scale, hitting only about 21 percent of taxpayers with incomes greater than $1 million.

The AMT and Marriage Penalties

Under the regular income tax, many married couples receive a “marriage bonus” because they pay less tax than they would if they were filed as single returns. This is not true under the AMT, which imposes significant marriage penalties. AMT tax brackets are identical for married and single taxpayers, and the AMT exemption for married couples is only about one and a half times as large as the exemption for singles.

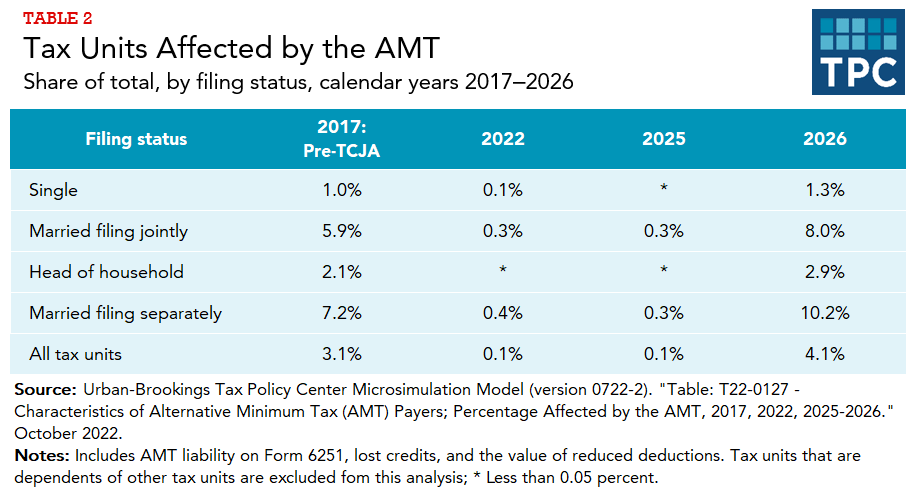

In contrast, the standard deduction for married couples under the regular income tax is twice that for singles, and all but the highest tax brackets for married couples are twice as wide as those for singles. The TCJA reduced AMT marriage penalties somewhat by increasing and adjusting the income at which the exemption begins to phase out so that it is twice as large for married couples as for singles. AMT marriage penalties, combined with married couples tending to have higher incomes than single individuals, make married couples more likely to pay the AMT than singles (table 2).

Updated January 2024

Burman, Leonard E. 2007a. “The Alternative Minimum Tax: Assault on the Middle Class.” Milken Institute Review. Santa Monica, CA.

Burman, Leonard E. 2007b. “The Individual Alternative Minimum Tax.” Testimony before the United States Senate Committee on Finance. Washington, DC.

Gleckman, Howard. 2018. “The Tax Cuts and Jobs Act and the Zombie AMT.” TaxVox (blog). Washington, DC: Urban-Brookings Tax Policy Center.