Idaho Gov. Butch Otter signed a $100 million tax cut last Monday. The bill would reduce Idaho’s individual and corporate income tax rates and lower taxes for many residents with one notable exception—it would raise taxes on many large families.

The reason: recent changes in federal tax law that automatically flow through to Idaho’s tax. The bill the governor signed was supposed to complement those changes, but it did not prevent this oddly targeted tax hike. Idaho policymakers are already trying to fix the problem with more legislation, but understanding why they didn’t resolve it in the first bill could help the many other states confronting the effects of the Tax Cuts and Jobs Act (TCJA).

All states with an income tax link their system to federal rules (or "conform") to some degree, but Idaho has a stronger connection than most. It, along with seven other states and the District of Columbia, allows taxpayers to claim the full amount of both the federal standard deductions and personal exemption on their state income tax returns.

The TCJA nearly doubled the federal standard deduction amounts and eliminated personal exemptions. Idaho needed to decide whether to maintain conformity and let the federal changes flow through to its tax system or decouple and establish new rules. The governor and legislature chose the former.

But this created a new issue because the Idaho Tax Commission estimated conforming would increase state tax revenue by $100 million next year. Anticipating this revenue “windfall,” Idaho policymakers reduced each of Idaho’s seven individual income tax rates and the state’s corporate income tax rate by 0.475 percentage points. With lower income tax rates across the board, everybody wins, right? Not exactly.

The new money is a windfall only if you ignore that someone is paying for it with higher taxes. And that someone mostly will be low- and middle-income families. Some Idaho families will pay more under the new rules because losing personal exemptions (worth $4,150 for each family member) will more than offset the increased standard deduction (from $13,000 to $24,000 for a married couple and from $9,550 to $18,000 for a single head of household). The fiscal note accompanying the new tax bill makes this clear: The larger standard deduction amounts reduce Idaho taxes $340 million but eliminating personal exemptions raise them $412 million.

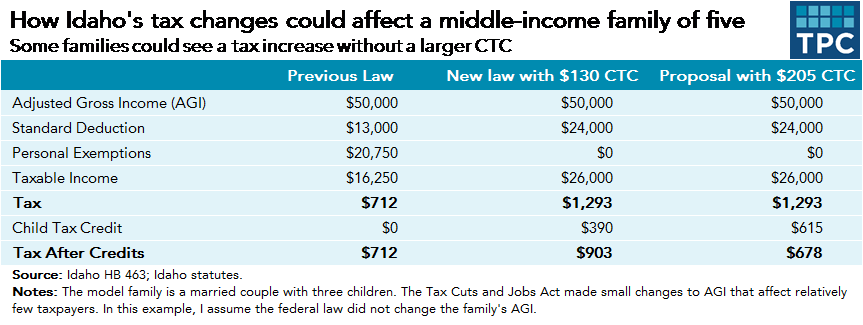

The TCJA didn’t create the same problem at the federal level because it also expanded the child tax credit (CTC) and created a new tax credit for dependents who do not qualify for the CTC. Like all but a few states, Idaho did not have a CTC before the TCJA, but the new tax bill includes a $130 CTC per qualifying child. However, that will not be enough to make up for the lost personal exemptions for many large families, even with the corresponding tax rate reductions.

For example, a married couple with three children earning $50,000 will see their Idaho income taxes increase nearly $200 because of the recently passed “tax cut.” If that family had four kids, they’d pay roughly $300 more per year.

Higher-earning families will get a tax cut under Idaho’s new legislation because the income tax rate reductions are more valuable to them (the top rate, which applies to income above $22,000 for a married couple, fell from 7.4 percent to 6.925 percent). Further, these families will benefit from Idaho’s CTC because it does not phase-out at higher incomes—unlike the current federal CTC and the prior-law personal exemption. Meanwhile, some low-income Idaho families, who do not have taxable income, will see no benefit from the new Idaho CTC because (unlike the federal CTC) it is not refundable.

Idaho lawmakers began work on a partial fix even before Gov. Otter signed their first tax bill. The new proposal would raise Idaho’s CTC to $205 per eligible child. This will help many families (including our hypothetical one) avoid a tax increase. But it won’t make everyone whole. According to Idaho’s Legislative Services Office, a $287 CTC would be needed to fully offset the loss of personal exemptions for all households.

Regardless, increasing Idaho’s CTC costs money. Raising the credit to $205 would reduce state income tax revenue by another $25 million on top of the $100 million reduction in the just-signed tax bill. And unlike Congress, Idaho cannot deficit finance its tax cuts. In fact, the state has strict balanced budget requirements, which will require it to raise other taxes or cut spending to pay for these additional tax cuts.

But revenue did not need to be a problem. According to an Idaho think tank, the state could have conformed and used the new revenue to create a $285 refundable CTC. Or Idaho could have decoupled from federal law, keeping its personal exemptions in place, as Maryland and Michigan have done and Vermont is considering.

The idea of a revenue windfall generated by conformity to federal tax law is alluring. Idaho is not the only state looking to cut income tax rates (South Carolina is on a similar path) or solve budget problems with this revenue. But money does not fall from the sky. State lawmakers must carefully examine who and where the money is coming from before deciding what to do with it.