There will be another recession. The only question is when. Bank of America warns one could start as soon as next year. Colorado’s most recent revenue report includes a section entitled “Predicting the Next Recession.” Arizona’s legislative economists are worried about one coming in the next two years. But no state has built a recession into their budget forecast yet. And they may not be prepared for one.

Only 23 states and the District of Columbia (DC) had higher per capita real Gross Domestic Product in 2014 than when the national economy’s peaked in 2007. And due to various combinations of slow economic growth, legislated tax cuts, and a collapse in energy prices, overall state tax revenues remain below historic averages and have not recovered pre-recession peaks in about half of the states.

And the trend is likely to continue: Median growth of nominal state general fund revenues over the next few years is expected to be about 3.5 percent. Several states are struggling to pay for current levels of government services, much less greater needs due to demographic changes or likely cuts in real federal spending.

How will states manage? The most effective way for state governments to weather a recession is by building up their rainy day funds. Ideally states would add to these reserve funds in fat years so they can maintain critical services in lean ones. These funds helped states weather the 2001 economic slump, but the Great Recession of 2007-2009 overwhelmed the reserves, leaving most state rainy day funds drained.

Back in the day, the rule-of-thumb suggested states bank 5 percent of their annual operating expenditures. But ratings agencies now demand more and the Government Finance Officers Association recommends about 15 percent. Only 10 states are estimated to have met this goal in 2016.

These rules are a good starting point but each state has its own advantages and obstacles. Energy states may want larger reserves because their revenue is so volatile. Ditto for states heavily reliant on income taxes especially given the volatility of capital gains. States may also be vulnerable to a changing federal tax environment.

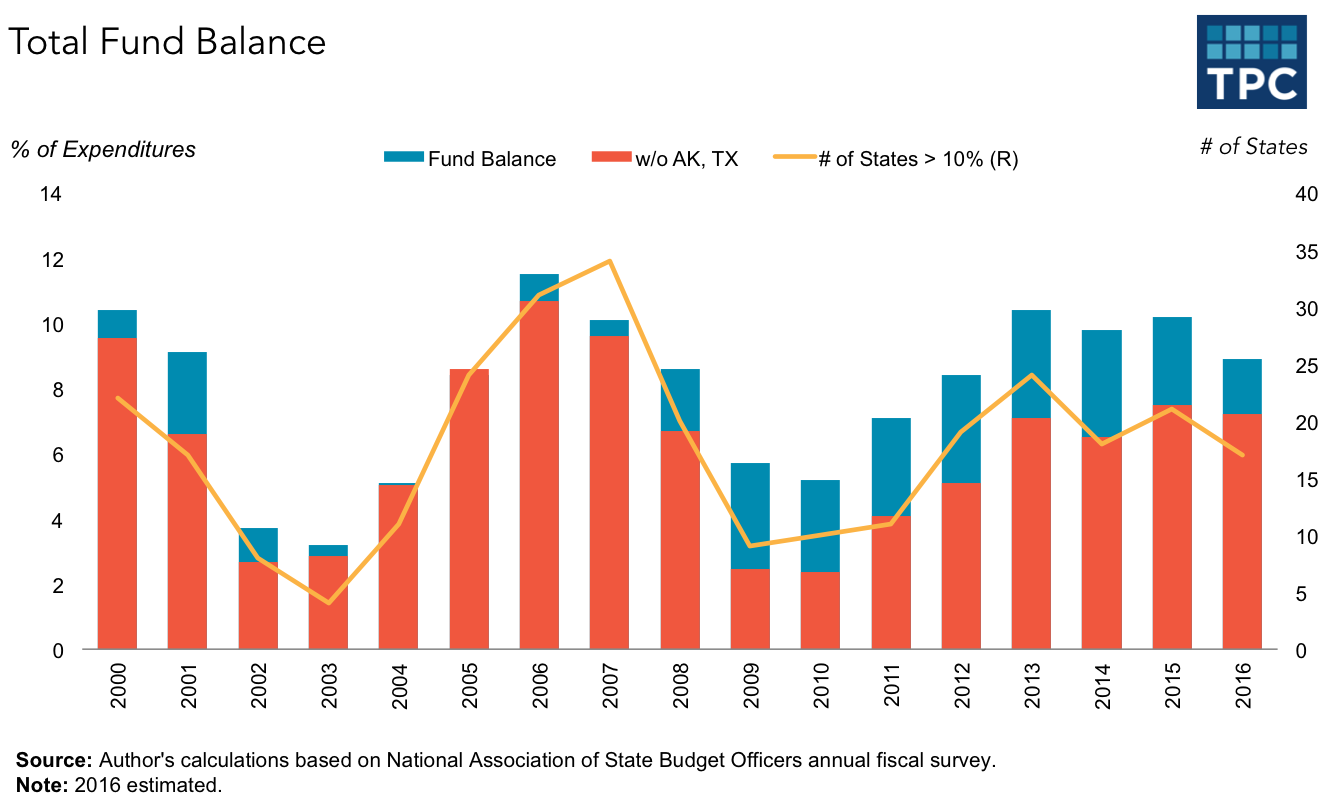

Recent history is instructive. By 2000, states had built up a combined 10.4 percent of their expenditures in year-end balances and rainy day funds, according to the National Association of State Budget Officers (NASBO). Forty states reported a balance of at least 5 percent and 23 had more than 10 percent saved up. By fiscal year 2004, after the 2001 recession, total balances had fallen to 3.2 percent and only 12 states had reserves over 5 percent in fiscal year 2004. Because those balances helped states through the recession, several additional states enacted rainy day funds.

By 2007, states had rebuilt their cumulative fund balances to 10.1 percent. And 33 had balances over 10 percent (10 more than 2000) until they cratered in the Great Recession. After the recovery, 11 states had restored their balances to more than 10 percent but the cumulative balance among all states was only about 7 percent. That number, however, was somewhat misleading because two states-- Alaska and Texas—had built up enormous reserves thanks to strong energy related revenues. Without these two states, fund balances were 4.5 percent of expenditures in 2011, less than half the level of 2007.

NASBO’s Spring 2016 survey reports that by last year total state balances had been rebuilt to more than 10 percent (7.5 percent excluding Alaska and Texas). In 2016, it is expected to fall to 8.9 percent in large part because Alaska had to take about $3 billion from reserves to shore up spending in the face of collapsing oil prices.

More troubling, the number of states with reserves over 10 percent fell from 21 states in 2015 to 17 in 2016 and is expected to fall to 13 in 2017. This is not a good trend, especially when combined with forecasts of anemic state revenue growth despite economic growth.