In November, voters will consider ballot initiatives to raise the minimum wage in eight states, following the decision by the California legislature to phase in its own version. Overall, workers will benefit, but because government aid and taxes are based on income, other state and federal policies can either amplify higher wages or reduce them. We used the Urban Institute’s Net Income Change Calculator (NICC) to get a sense of how these wage changes would affect the bottom line for a sample family.

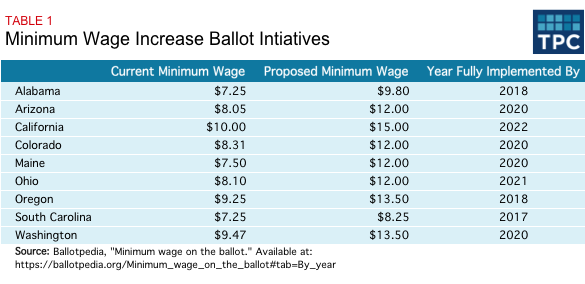

The table below shows the pending ballot proposals.

For our calculations, we assume tax and transfer policies stay the same as they were in 2012 (pretty close to what they will likely look like) and examine earnings after the higher minimum wages are fully phased in.

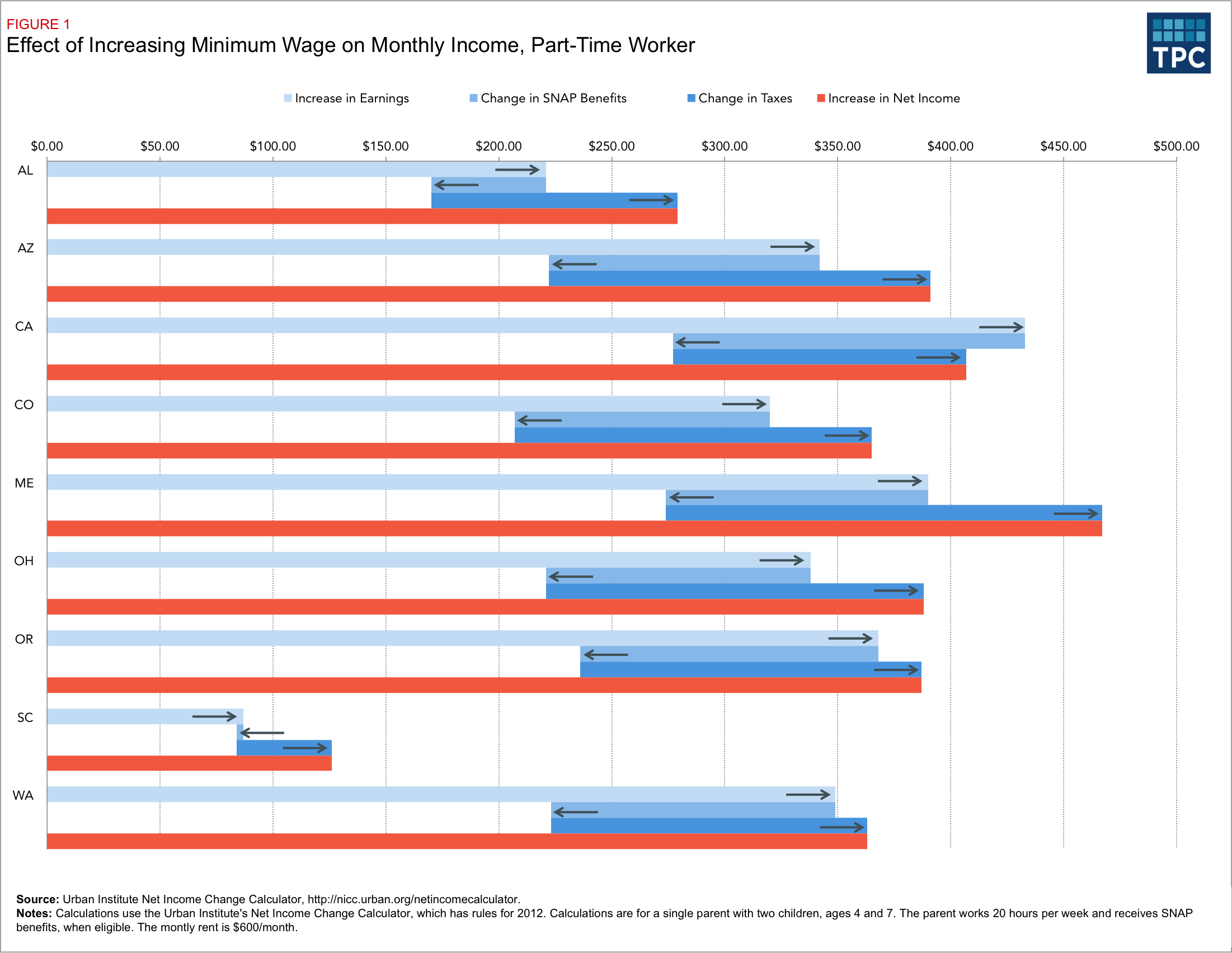

Because the higher wages will boost earnings, affected workers will see their SNAP benefits (Supplemental Nutrition Assistance Program, formerly food stamps) fall—but by less than their earnings increase. Workers’ taxes may rise or fall, depending on whether higher payroll taxes or state income taxes are offset by increases in federal and state earned income tax credits (EITC) and child tax credits (CTC). For part-time workers in most states that are considering raising the wage, larger tax credits would more than offset their SNAP cuts.

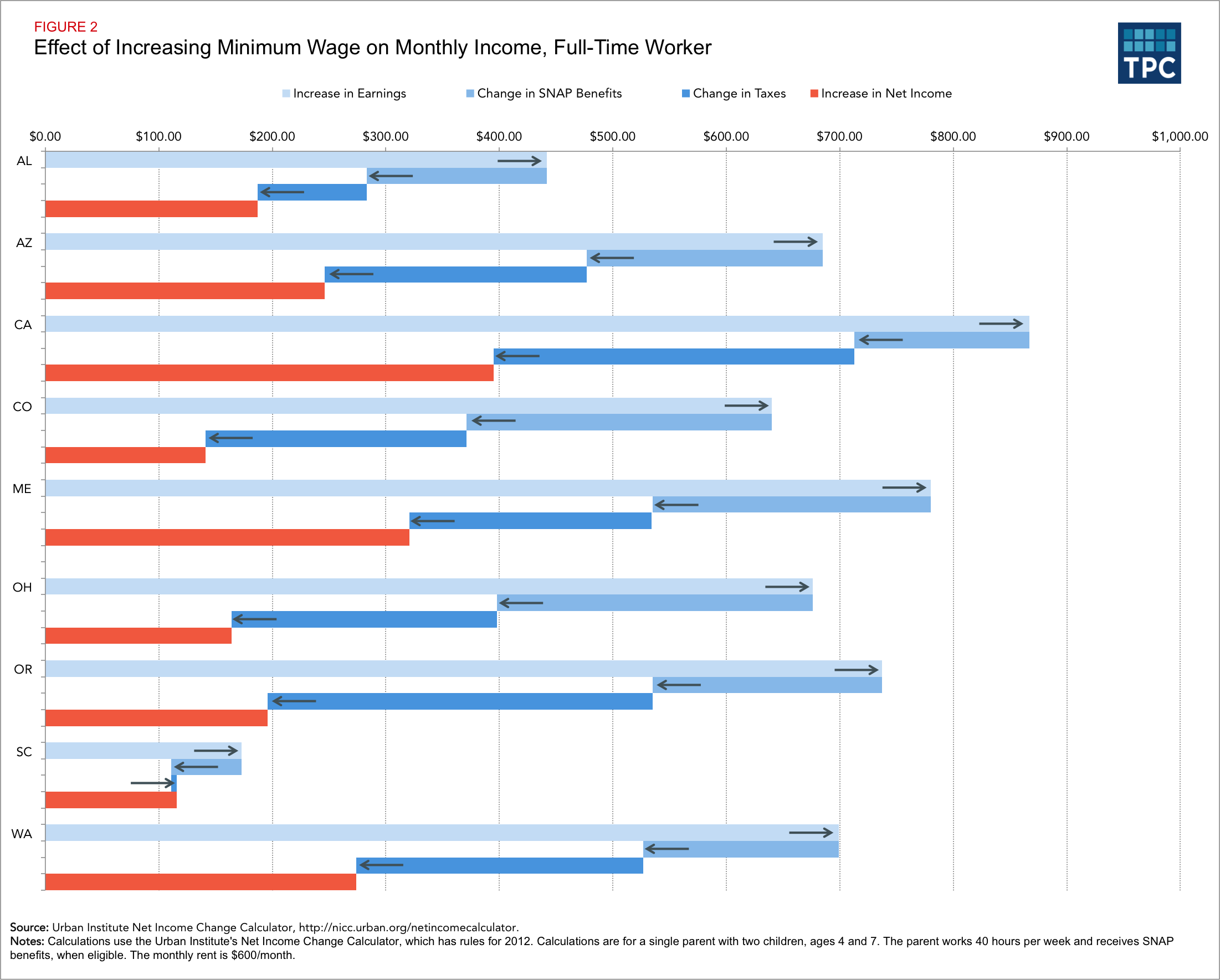

As a result, most part-time workers with children would enjoy a net increase in cash incomes and transfers (figure 1). For full-time workers, both SNAP and tax benefits would drop but their higher wages would more than make up for the loss (figure 2).

We analyze the effects of higher minimum wages by looking at a hypothetical single mom with two children ages 4 and 7. We assume she pays $600 per month in rent, earns the state minimum wage working either part-time for 20 hours per week or full-time for 40, and gets SNAP benefits. She pays payroll and income taxes, and qualifies for refundable tax credits. Although there is some debate about what would happen to employment if the minimum wage is increased, we assume she works the same number of hours. A minimum wage increase could affect other families differently.

The next two figures show what would happen to her, first if she were a part-time worker, and then if she worked full time.

Figure 1 shows what would happen to that part-time worker in each state. In South Carolina, her monthly earnings would increase by $87 while her SNAP benefits would fall by $3. Because she’s in the phase-in range of both the EITC and the CTC, those credits would increase and cut her net tax bill by $42, more than offsetting her SNAP cut. On net, she’d be ahead by $126 a month – more than just the wage increase would imply.

That pattern would apply in most states, except in California, where the $15 minimum wage would lead to bigger SNAP cuts. There, her monthly wages would increase by $433 but her $130 net tax cut wouldn’t fully offset her $156 cut in SNAP. On net, she’d still be ahead by $407 a month, but it would be a bit less than the wage increase alone would imply.

Figure 2 shows how the pattern would be different if this mom were a full-time worker. While she’d still gain from the wage increases, she’d lose a substantial share of her higher wages because her SNAP benefits would be cut and her taxes would rise. In South Carolina, she’d lose about 40 percent of her higher wages after a $62 monthly cut in SNAP and a small net tax cut of $5. In California: a $154 SNAP cut plus a $318 net tax increase would eat up nearly 55 percent of her $867 wage boost. In Colorado, lost benefits and higher taxes would offset as much as 78 percent of her higher wages.

Overall, workers would still be better off with a higher minimum wage, even if they lose some SNAP benefits and have to pay more taxes. How much better off would depend on their on their specific situations. To see how wage increases would affect other families, check out the NICC for yourself.