Yes. Low-income families can receive a refundable child tax credit equal to 15 percent of earnings above $2,500, up to a maximum credit of $1,600.

How the Child Tax Credit Works

Taxpayers can claim a child tax credit of up to $2,000 per child under age 17. The credit is reduced by 5 percent of adjusted gross income over $200,000 for single parents ($400,000 for married couples). If the credit exceeds taxes owed, taxpayers can receive up to $1,600 of the balance as a refund, known as the additional child tax credit (ACTC) or refundable CTC. The ACTC is limited to 15 percent of earnings above $2,500. For other dependents, including children ages 17–18 and full-time college students ages 19–24, the CTC provides a nonrefundable credit of up to $500.

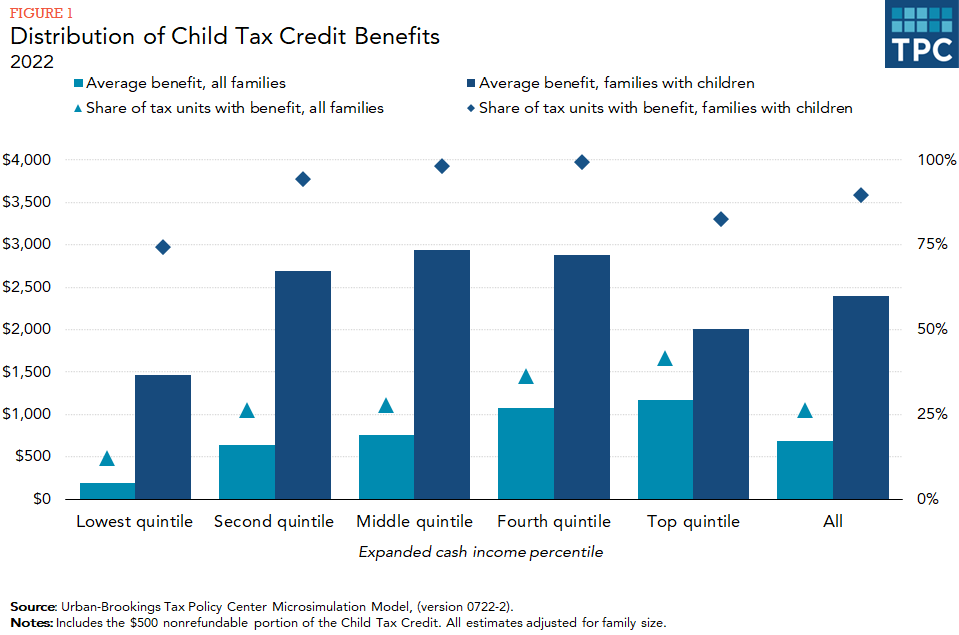

Families of nearly all incomes benefit from the CTC. In 2022, the largest average benefits (about $2,940) went to families in the middle-income quintiles. Families in the lowest income quintile received the smallest average credit ($1,280) because many had earnings too low to qualify for the full $2,000 credit. Families in the lowest income quintile instead received some of their CTC as a refundable credit, which was limited to $1,500 per child under 17 in 2022. The average credit value for families in the highest income quintile was about $2,170. Families in this income range can have their credits limited by its phasing out, which begins at $200,000 for single parents and $400,000 for married couples (figure 1).

Neither the credit amount nor the phaseout point is indexed for inflation. Over time, the value of the credit will decline in real terms and as incomes grow, more people will be subject to the credit’s phaseout. The $1,600 limit on the refundable credit, however, is indexed for inflation after 2018 until it reaches $2,000—the full value of the regular credit. The credit grows in $100 increments. As of 2023, inflation had been high enough to push the refundable portion of the credit from $1,400 to $1,600.

Updated January 2024

Center on Budget and Policy Priorities. 2019. “Policy Basics: The Child Tax Credit.” Washington, DC.

Maag, Elaine. 2019. “Shifting Child Tax Benefits in the TCJA Left Most Families About the Same.” Washington, DC: Urban Institute.

Maag, Elaine. 2013. “Child-Related Benefits in the Federal Income Tax.” Washington, DC: Urban Institute.

Maag, Elaine. 2015. “Reforming the Child Tax Credit: How Different Proposals Change Who Benefits.” Washington, DC: Urban Institute.

Maag, Elaine, and Lydia Austin. 2014. “Implications for Changing the Child Tax Credit Refundability Threshold.” Tax Notes. July 24.

Maag, Elaine, Stephanie Rennane, and C. Eugene Steuerle. 2011. “A Reference Manual for Child Tax Benefits.” Washington, DC: Urban-Brookings Tax Policy Center.