The fiscal response to the COVID-19 pandemic included a total of about $5.6 trillion in federal tax cuts and spending hikes. Those policies helped increase the federal debt from 79 percent of GDP in 2019 to 97 percent of GDP in 2022. However, most of the pandemic fiscal policies were temporary. Therefore, the impact on the federal budget outlook is more modest and stems primarily from the interest costs generated by the additional debt.

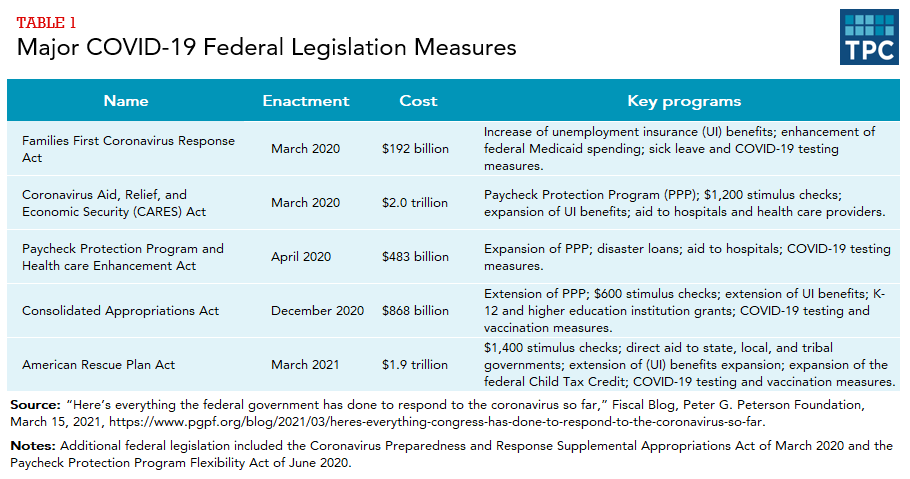

Five major COVID-19 fiscal relief measures were enacted in 2020 and 2021 by the federal government (table 1).

During the Great Recession, the American Recovery and Reinvestment Act of 2009’s total bill of $840 billion was considered a mammoth federal government investment (Boddupalli et al. 2021). In contrast, since the start of the COVID-19 pandemic, federal relief measures have totaled over $5 trillion. The largest were the Coronavirus Aid, Relief, and Economic Security Act of March 2020, with a total cost of $2.0 trillion; the Consolidated Appropriations Act of December 2020, with a cost of $868 billion; and the American Rescue Plan Act of March 2021, with a cost of $1.9 trillion. Those included various programs, such as stimulus checks (or direct payments to taxpayers), enhanced unemployment benefits, the Paycheck Protection Program to help small businesses, funding for health care providers, COVID-19 testing and vaccination sites, the expansion of the Child Tax Credit, and aid for state, local, and tribal governments.

Altogether, the federal fiscal measures, along with the direct effects of the COVID-19 pandemic, resulted in deficits of 14.9 percent of GDP in 2020 and 12.4 percent of GDP in 2021—the largest ratios since World War II. The deficits drove up the national debt from 79 percent of GDP at the end of fiscal year 2019 to 97 percent at the end of fiscal year 2022.

The COVID-19 pandemic relief policies were largely temporary, however. Most of their direct budgetary effects occurred in the first few years. Going forward, the primary budgetary effect of the policies will be increased interest payments on the additional federal debt. At the average interest rate of 3.1 percent that the Congressional Budget Office forecasts for debt in 2033, the interest payments on the $5.6 trillion in additional debt from the COVID-19 pandemic’s tax and spending policies amounts to about $170 billion per year.

Updated January 2024

Congressional Budget Office. 2023. “The Budget and Economic Outlook: 2023 to 2033.” Washington, DC: Congressional Budget Office.

US Government Accountability Office. 2023. “COVID-19 Relief: Funding and Spending as of Jan. 31, 2023.” Washington, DC: US Government Accountability Office.

Boddupalli, Aravind, Nikhita Airi, Tracy Gordon, and Solomon Greene. 2021. “Lessons from the American Recovery and Reinvestment Act for an Inclusive Recovery from the Pandemic.” Urban-Brookings Tax Policy Center: Washington, DC.

Congressional Research Service. 2021. “Tallying Federal Funding for COVID-19: In Brief.” Washington, DC: Congressional Research Service.