In 2022’s Inflation Reduction Act (IRA), Congress provided the IRS with additional funding of nearly $80 billion through 2031. Nine months later, however, Congress and the White House agreed to reduce the IRA funds by $21.4 billion.

The goal of IRA’s 10-year budget boost is to improve the IRS’s ability to administer the federal tax system efficiently, effectively, and fairly. The unique multiyear funding stream allows the IRS to make long-term investments in its technological infrastructure and to recruit, train, and retain new staff. Congress intended that the mandatory spending would supplement the annual appropriations used to finance current operations (Inflation Reduction Act, 2 Pub. L. No 117–169, 136 Stat. 2013 [2022]).

How Was the 10-Year IRA Budget Boost Allocated across IRS Functions?

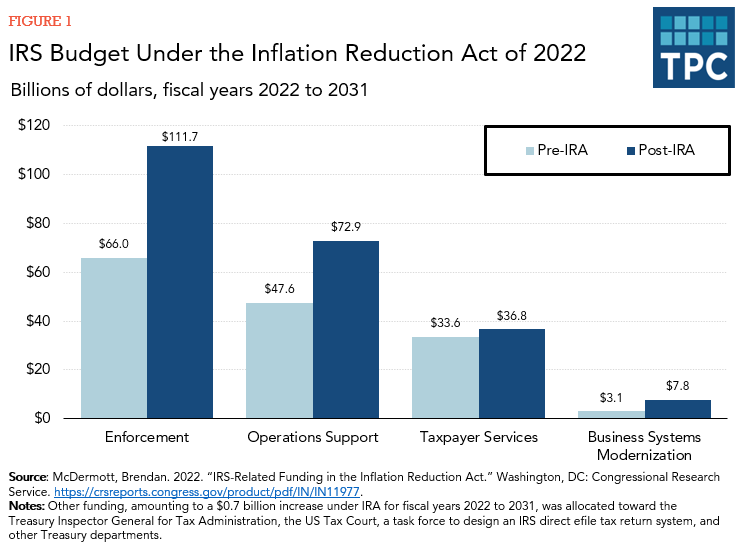

IRA divided the $80 billion funding across the four major IRS budget accounts: about 57 percent ($46 billion) was allocated to enforcement, 32 percent ($25 billion) to operations support, 6 percent ($5 billion) to business systems modernization, and 4 percent ($3 billion) for taxpayer services. The remaining 1 percent ($0.7 billion) was provided to the Treasury Inspector General for Tax Administration, other offices in the Treasury, and the US Tax Court. Beyond those broad allocations, Congress did not mandate how the funding would be used.

IRS Strategic Operating Plan (April 2023)

In April 2023, the IRS released a strategic operating plan outlining how the $80 billion boost will be invested over the next several years. The IRS’s plan includes five goals, each supported by broad initiatives and specific projects:

- Improve taxpayers’ services by making it easier for taxpayers to interact with the IRS through their preferred method, which could be a visit to a taxpayer assistance center, a phone call, or a new digital tool; accelerate guidance on gray areas of the tax code; and help taxpayers claim appropriate deductions and credits.

- Resolve more issues quickly through prefiling programs for taxpayers facing complicated tax challenges; identify return issues as they are processed; and provide real-time notifications of anomalies using simple language.

- Expand enforcement and focus on taxpayers with complex tax returns and high-dollar noncompliance by using more analytics-driven and risk-based methods to select returns for audit and by hiring specialists equipped with the expertise to handle those types of returns, while also regularly assessing if there are disparities by race, ethnicity, age, and gender, in targeting of enforcement activities.

- Modernize the IRS’s technology by replacing legacy systems with up-to-date systems; harness data and analytics to improve customer service and audit selection; and improve employees’ and taxpayers’ access to data while protecting privacy and security.

- Hire and retain a highly skilled workforce by adopting more appealing recruitment campaigns; streamline hiring and onboarding; review the compensation system to assess its competitiveness; and offer more flexible work schedules.

In the plan, the IRS indicated that pilots and evaluations of some initiatives would occur before full implementation.

Fiscal Responsibility Act (June 2023)

In June 2023, the Biden Administration and Congress agreed to reduce the 10-year IRA funding by 27 percent as part of an agreement to raise the federal debt ceiling. The Fiscal Responsibility Act (FRA) of 2023 immediately rescinded $1.4 billion in 2023 funding of enforcement and operations support. Although not included in the 2023 legislation, the administration and Congress committed to a $10 billion rescission in 2024 to be followed by another $10 billion recission in 2025.

As of September 2023, the IRS had not announced how the strategic operating plan would be revised in response to the FRA cutbacks.

Who Would Be Audited?

Immediately after IRA’s passage, some critics of the funding boost claimed that the IRS would use the funds to hire “87,000 armed agents” to audit taxpayers, including moderate-income families. The 87,000 figure came from a Treasury report, issued the year before, which included estimates of the number of new hires if the IRS received $80 billion. The IRS subsequently clarified that many of the new hires would replace employees who were expected to retire over the next decade or who had already left the agency and due to hiring freezes and budget cutbacks had not been replaced.

That report, moreover, suggested that the IRS would largely hire more customer service representatives, examiners who could audit complicated tax returns, and computer scientists, but did not provide more detail on employee deployments. To put the claims of armed agents in perspective, only about 2 percent of IRS employees are currently authorized to carry weapons, and they are largely special agents attached to criminal investigations of such activities, as narcotics-related tax and money laundering crimes.

The Biden Administration has maintained that the IRS will focus new enforcement initiatives on high income taxpayers and large businesses including partnerships and corporations and that small businesses and taxpayers with total positive income—the sum of income before losses and deductions—below $400,000 will not be audited above historical levels.

Initially, the IRS plans to use 2018 audit rates as the cap on new audits of taxpayers with income below $400,000. Overall, 0.3 percent of 2018 individual income tax returns with positive income below $500,000 were audited—a historically low level due to the combination of the cutbacks in the IRS budget and the COVID-19 pandemic, which slowed the IRS operations during a period when 2018 tax returns would have been audited.

In September 2023, the IRS announced more details about its plans to increase audits on high-income taxpayers and large businesses. Among the first steps will be to intensify collection work on taxpayers with total positive income of at least $1 million and more than $250,000 of recognized tax debt and leverage new artificial intelligence tools to select audits of the largest partnerships.

Does the Plan Have Enough Money for Customer Services?

Out of the $80 billion increase to the IRS’s budget, the smallest share—$3 billion—was directed to taxpayer services. The FRA did not rescind the additional funds for taxpayer services.

Most of the initial expenditures were for hiring new customer service representatives to expedite return processing and other taxpayer services during the 2023 filing season. In its strategic operating plan, the IRS has estimated that the $3 billion allocation could be exhausted in less than four years if the annual appropriations are not increased.

Updated January 2024

Holtzblatt, Janet. 2023. “Details Emerge on How the IRS Will Navigate the $400K Pledge.” TaxVox. Washington, DC: Urban-Brookings Tax Policy Center.

Internal Revenue Service. 2023. Inflation Reduction Act Strategic Operating Plan FY 2023-FY 2031. Publication 3744. Washington, DC: Internal Revenue Service.

Internal Revenue Service. 2023. “IRS Announces Sweeping Effort To Restore Fairness To The Tax System With Inflation Reduction Act Funding; New Compliance Efforts Focused On Increasing Scrutiny On High-Income, Partnerships, Corporations, And Promoters Abusing Tax Rules On The Books.” Washington, DC: Internal Revenue Service.

US Department of the Treasury. 2021. The American Families Plan Tax Compliance Agenda. Washington, DC: US Department of the Treasury.