HSAs are tax-exempt savings accounts used in conjunction with a high-deductible health insurance plan to pay for qualifying medical expenses.

Individuals who participate in a qualifying high-deductible health insurance plan (HDHP) can establish a health savings account (HSA) to pay for qualifying medical expenses. Both employees and employers can make contributions to an HSA.

HSAs have many tax advantages. Contributions made by employers are exempt from federal income and payroll taxes, and account owners can deduct their contributions from income subject to federal income taxes. Further, any income earned on the funds in an HSA accrues tax-free, and withdrawals for qualifying medical expenses are not taxed. Withdrawals used for nonqualifying expenses are subject to income tax and an additional 20 percent penalty. But the penalty is waived for account holders who are disabled, who are ages 65 or older, or who have died. Unused balances can be carried over from year to year without limit.

Annual HSA contributions in 2023 are limited to 3,850 for an individual and $7,750 for a family. Account holders ages 55 or older can contribute an additional $1,000 to either type of account. The contribution limits are indexed annually for inflation.

In 2020, employers contributed over $31 billion to HSAs, and individual tax filers contributed nearly $7 billion. The Joint Committee on Taxation (JCT) estimates the tax preference for HSAs reduced income taxes by $11 billion in 2022. (The JCT figure does not include the impact of employer contributions on payroll taxes).

Employers must offer an HSA-qualified insurance plan—usually an HDHP—for an employee to be eligible for an HSA. Individuals may also purchase an HSA-qualified insurance plan through the individual insurance market. A plan is HSA-qualified if it meets certain requirements; in 2022, these include a minimum deductible of $1,400 for individual coverage and $2,800 for family coverage.

HSAs are an expanded version of medical savings accounts (MSAs), established in 1996. Similar to HSAs, MSAs have many of the same tax advantages and also require account holders to have an HDHP. They are limited, however, to the self-employed or workers in small firms (50 or fewer employees). The Medicare Prescription Drug, Improvement, and Modernization Act authorized HSAs in 2003 to address the rising cost of medical care and the increasing number of uninsured individuals. No new contributions to MSAs could be made after 2007, except for individuals who previously made contributions to an MSA or who work for employers that had already established MSAs.

HSAs and their associated HDHPs place more of the health care financing burden on out-of-pocket costs and are intended to encourage more cost-conscious health care spending. In practice, HSAs are most attractive to higher-income individuals because the tax exemptions associated with contributions, account earnings, and withdrawals are of greater value for higher income-tax brackets. Additionally, high-wage workers are more likely to be constrained by contribution limits for retirement accounts and use HSAs as an additional means of tax-preferred saving.

While the IRS regularly publishes tables on the distribution of individual HSA contributions, generally, data on the distribution of employer HSA contributions are not publicly available. However, in 2017 the US Department of Treasury, Office of Tax Analysis published special tabulations of employer and individual HSA contributions by income level for tax year 2014.

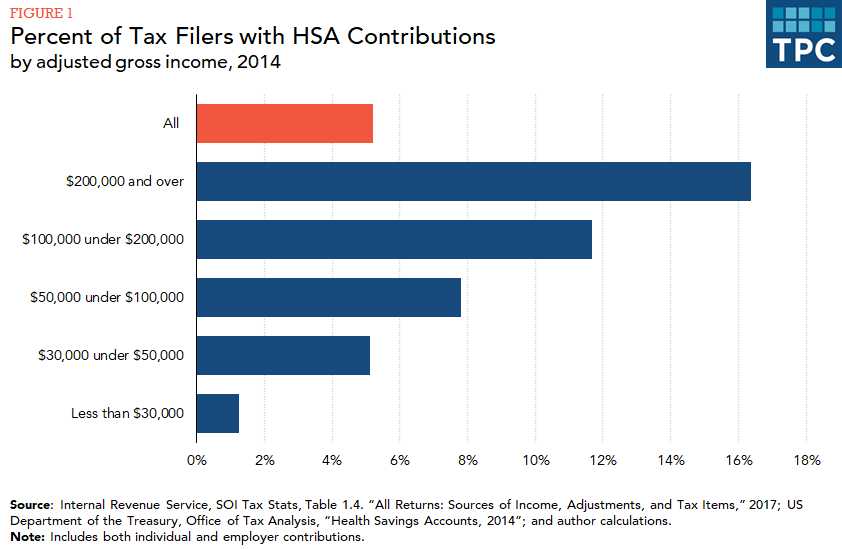

In 2014, 11.7 percent of taxpayers with income between $100,000 and $200,000 had own or employer HSA contributions, as did 16.4 percent of taxpayers with income over $200,000 (figure 1).

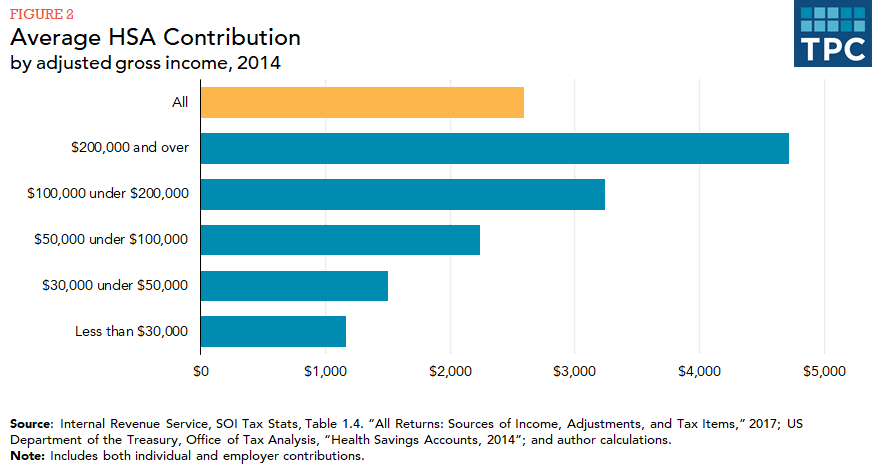

In comparison, only 5.1 percent of taxpayers with income between $30,000 and $50,000 had such contributions. The average contribution for taxpayers with income over $200,000 was $4,716, compared with an average contribution of $1,500 for taxpayers with income between $30,000 and $50,000 (figure 2).

HSAs are also attractive to those who expect low health care expenses. These individuals enjoy the premium cost savings associated with HDHPs, as well as the HSA tax benefits, without fear of eventually paying a high deductible.

Updated January 2024

Blumberg, Linda J., and Lisa Clemans-Cope. 2009. “Health Savings Accounts and High-Deductible Health Insurance Plans: Implications for Those with High Medical Costs, Low Incomes, and the Uninsured.” Washington, DC: Urban Institute.

Helmchen, Lorens A., David W. Brown, Ithai Z. Lurie, and Anthony T. Lo Sasso. 2015. “Health Savings Accounts: Growth Concentrated among High-Income Households and Large Employers.” Health Affairs 34 (9): 1594–98.

Internal Revenue Service. 2022. “Revenue Procedure 2022-24.” Washington, DC.

Rapaport, Carol. 2013. “Tax-Advantaged Accounts for Health Care Expenses: Side-by-Side Comparison, 2013.” Washington, DC: Congressional Research Service.