General sales taxes are taxes on goods and services purchased by consumers, and the tax is a calculated as a percentage of the listed retail cost and added to the final purchase price paid by the consumer. State and local governments collected a combined $477 billion in revenue from general sales taxes and gross receipts taxes in 2021.

General sales taxes are separate from “selective sales taxes” on specific purchases such as alcohol, motor fuel, and tobacco. The Census Bureau includes revenue from gross receipts taxes in its revenue totals for either general sales taxes or other selective sales taxes. A gross receipts tax is also a tax on sales, but the tax is paid by the seller (not the consumer) and is levied on each business's total sales over a given time period instead of on an individual retail transaction.

How much revenue do state and local governments raise from general sales taxes and gross receipts taxes?

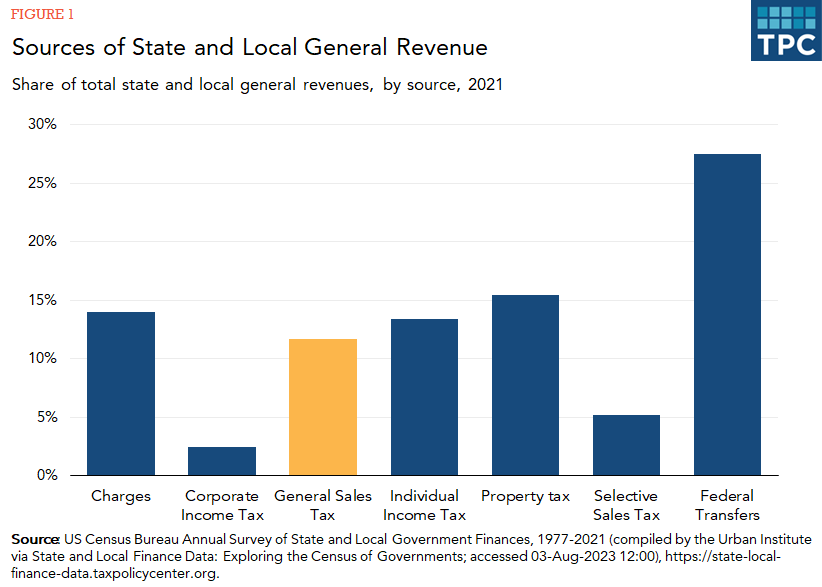

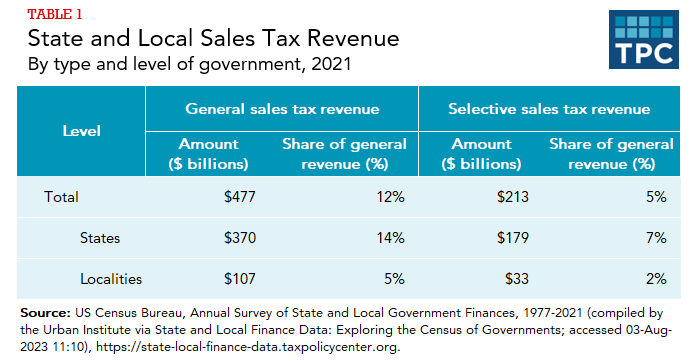

State and local governments collected a combined $477 billion in revenue from general sales taxes and gross receipts taxes in 2021, or 12 percent of general revenue. General sales taxes provided less revenue than property taxes and roughly the same amount as individual income taxes. Additionally, state and local governments collected $213 billion from selective sales taxes, or 5 percent of general revenue, in 2021.

States rely on general sales tax revenue more than local governments. State governments collected $370 billion (14 percent of state general revenue) from general sales taxes in 2021, while local governments collected $107 billion (5 percent of local general revenue). By comparison, states collected $179 billion in combined selective sales taxes (7 percent) and local governments collected $33 billion (2 percent).

(For more on selective sales taxes, please see our pages on alcohol taxes, cigarette and vaping taxes, and motor fuel taxes.)

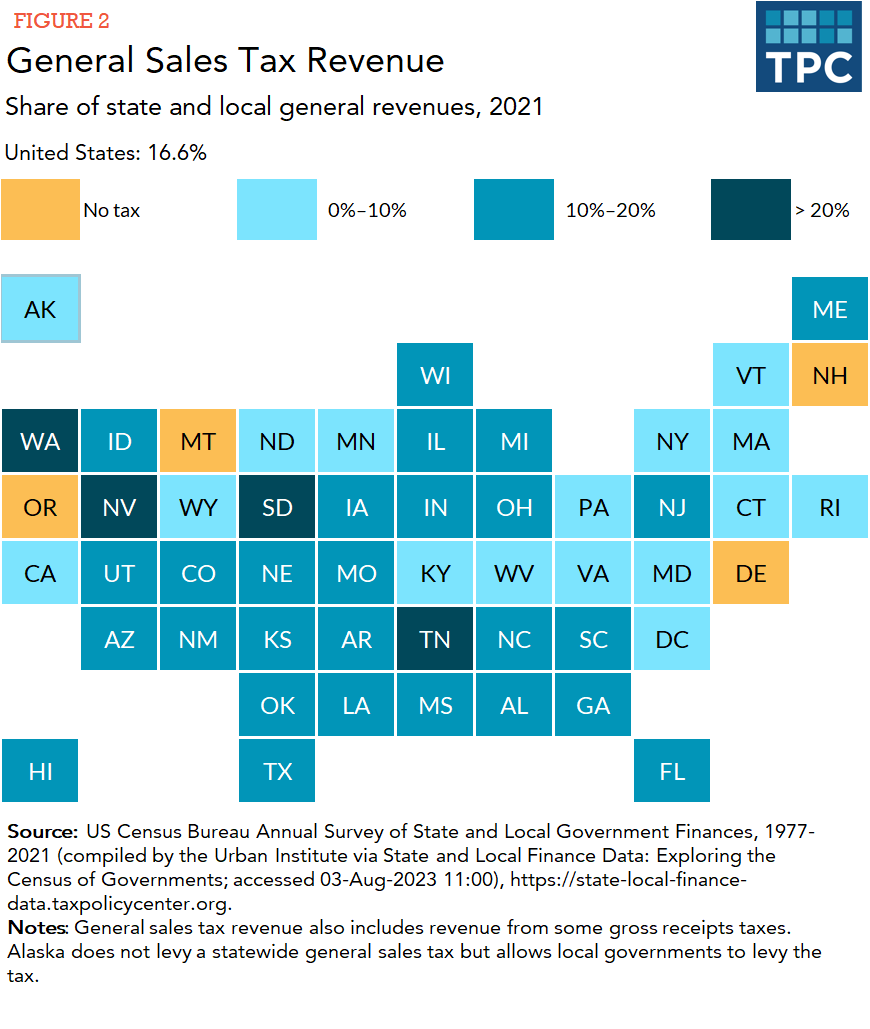

Nevada and Washington relied on general sales tax revenue more than any other state in 2021 as general sales taxes accounted for roughly a quarter of each state’s combined state and local general revenues. South Dakota and Tennessee also collected more than 20 percent of combined state and local general revenues from general sales taxes in 2021. Among the states with a statewide general sales tax, Vermont (6 percent) relied the least on general sales tax revenue in 2021. In total, 14 states with a statewide general sales tax and the District of Columbia collected less than 10 percent of state and local general revenue from the tax that year.

Data: View and download each state's taxes as a percentage of general revenue

Alaska, Delaware, Montana, New Hampshire, and Oregon do not levy a general state sales tax. However, Alaska allows local governments to levy their own general sales taxes, and those taxes accounted for 2 percent of its combined state and local general revenue in 2021.

Delaware levies a gross receipts tax but Census counts its revenue as "other selective sales tax" revenue and not general sales tax revenue. The other states that levy a gross receipts tax (Nevada, Ohio, Oregon, Tennessee, Texas, and Washington) also levy a general sales tax so revenue from both taxes may be included in the states' collection totals.

What are gross receipts taxes and which states levy them?

Gross receipts taxes are also taxes on sales, but unlike a general sales tax, the tax is levied on the seller rather than the consumer. That is, the business pays a percentage of its total sales (or gross receipts) as tax to the government rather than the consumer paying a percentage of the purchase price during a transaction (and the business remitting it to the government). However, while levied on the business, the cost of the gross receipts tax is still mostly if not entirely passed on to the consumer in a higher retail price. Importantly, a gross receipts tax typically has few or no exemptions and thus taxes business-to-business purchases. (In contrast, a general sales tax has numerous exemptions. See “What purchases are subject to the general sales tax?” below for more information.)

There are currently statewide gross receipts taxes in Delaware (gross receipts tax), Nevada (commerce tax), Ohio (commercial activity tax), Oregon (corporate activity tax), Tennessee (gross receipts tax), Texas (franchise tax), and Washington (business and occupation tax). The District of Columbia also levies a gross receipts tax on some industries. Each state (except for Ohio and Oregon) uses different tax rates for different industries, but nearly all the gross receipts tax rates are well below 1 percent (for example, Ohio's single rate is 0.26 percent).

Proponents argue a gross receipts tax is a far simpler business tax than a state corporate income tax. Opponents argue taxing business-to-business purchases, at multiple stages of production, can cause "tax pyramiding" which drives up the cost of products for consumers and creates different effective tax rates for different industries.

How much do general sales tax rates differ across states?

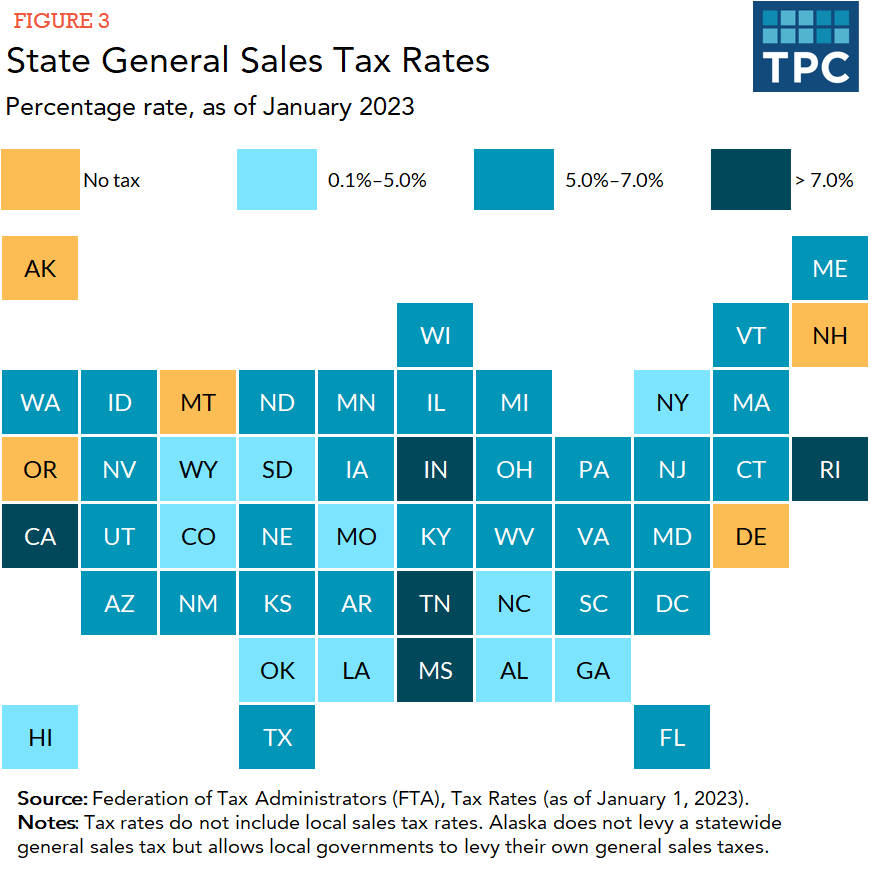

State general sales tax rates in 2022 range from 2.9 percent in Colorado to 7.25 percent in California. After Colorado, the next-lowest state general sales tax rate is 4.0 percent in Alabama, Georgia, Hawaii, New York, and Wyoming. California is the only state with a state general sales tax rate above 7.0 percent, but the state general sales tax rate is exactly 7.0 percent in Indiana, Mississippi, Rhode Island, and Tennessee.

Data: View and download each state's general sales tax rate and local general sales tax rates

However, the general sales tax rate paid by consumers is well above 7.25 percent in some states when local general sales tax rates are included. Thirty-eight states (including Alaska, which has no statewide general sales tax) allow local governments to impose their own general sales taxes in addition to the state general sales tax. (That total includes Mississippi and New Jersey, even though the Census Bureau did not record any local general sales tax revenue for them in 2020. Census puts revenue from these local taxes in another tax's total, most likely "other selective sales tax.")

As of 2018, the maximum sales tax rates levied by a state’s local governments (excluding the state tax rate) ranged from 0.5 percent in Hawaii to 8.3 percent in Colorado. The number of taxing jurisdictions also varies significantly across states. For example, only three localities in Hawaii levy general sales taxes while thousands of localities levy the tax with different rates in California and Iowa.

What purchases are subject to the general sales tax?

State general sales taxes apply to the purchase of all tangible goods unless the state explicitly exempts the purchase from tax. For example, one common exception is food purchased at grocery stores. In 2023, only 12 states tax groceries, and six of those states tax grocery food at a lower rate than their general sales tax rate. Virginia eliminated its state tax on groceries in 2022 and Kansas passed legislation that will eventually phase-out the state’s grocery tax. Both states maintained local taxes on grocery food, though. Similarly, the state does not tax grocery food, but local governments do in Arizona, Georgia, Louisiana, and North Carolina. Hawaii, Idaho, Kansas, and Oklahoma tax grocery food but offer individual income tax credits to low-income residents to help offset the tax. Some states also exempt nonprescription drugs, textbooks, or personal hygiene products from their general sales taxes.

The taxation of services (such as dry cleaning, carpentry, and hairdressing) is more complicated. All states tax some services, but exemptions and omissions are common, and very few states tax professional services such as those rendered by doctors and lawyers. Hawaii and New Mexico are exceptions to the rule and tax a wide range of services. However, unlike tangible goods, services are often not taxed because of legislative inaction rather than action. States typically defined only tangible goods as taxable purchases when general sales taxes were established roughly a century ago. Thus, to tax most services, states must specifically add these purchases to their tax base via legislation (a politically challenging task). For similar reasons, state taxation has only become more complicated as consumers purchase digital products. Many states tax digital products, including streaming services, but definitions of what is and is not taxable vary across states.

A 2021 Tax Policy Center study found that the amount of purchases subject to the sales tax, including general sales taxes and excise taxes like the motor fuel tax, ranges from 5 percent in Delaware (no general sales tax) to 36 percent in Vermont and 91 percent in Hawaii. This variation was driven almost entirely by the various state approaches to taxing services. The US average is 39 percent (because most states don't tax many services).

Additionally, in 2023, 18 states have sales tax holidays, where specific purchases, often clothes and school supplies right before the start of a new school year, are sold tax free for a short period of time.

Do general sales taxes apply to online purchases?

The treatment of online and other remote sales is also complex. In 1992 the Supreme Court ruled (Quill Corp. v. North Dakota) that under the commerce clause of the US Constitution, a retailer with no physical presence in the purchaser’s state of residence is not required to collect a state or local sales tax from the consumer. That is, if someone in Kansas bought something online from a store in California, and that store did not have a physical presence in Kansas (technically called a "nexus" requirement), then the California store was not required to collect and remit the online sales tax to Kansas.

However, the Supreme Court revisited this issue in 2018 in South Dakota v. Wayfair, Inc., overturned Quill, and gave states broad authority to collect the tax. In that case, the Supreme Court upheld a South Dakota law requiring any entity with sales of $100,000 or more or with over 200 transactions in South Dakota to collect and remit the state's sales tax. In short, the Supreme Court ruled that the business's economic activity in the state created "nexus" even if it did not have a physical presence. Other states quickly began enacting similar laws and all states with a general sales tax and the District of Columbia now have laws requiring the collection of online sales tax. The last two states to pass such laws were Florida and Missouri.

Additionally, every state with a general sales tax now have laws requiring "marketplace facilitators" (i.e., Amazon and other organizations that allow third-party retailers to sell items on their platform) to collect state sales taxes on third-party sales as well.

The ability for states to tax online transactions was critical during the COVID-19 pandemic, as consumers increasingly made purchases online instead of in "brick and mortar" stores.

Consumers paying a general sales tax on an online purchase is not completely new, though. Many large retailers voluntarily collected the tax on their sales before the recent Supreme Court decision. Most notably, Amazon has collected state general sales taxes on their sales in every state with a general sales tax since April 2017.

Further, even if a business does not collect a general sales tax on an online transaction, the consumer is still required to pay the tax because states levy use taxes in addition to sales taxes. That is, consumers are subject to use taxes in their home state on all goods purchased outside their state of residence for consumption in their home state. The use tax rate is the same as the sales tax rate, but few consumers are aware of the tax and actually pay it. Most states with both a sales tax and an individual income tax (including California, Kentucky, Virginia, and Utah) give taxpayers a chance to pay use taxes on their income tax returns.

Updated January 2024

Dadayan, Lucy. 2023. State Tax and Economic Review. Washington, DC: Urban-Brookings Tax Policy Center. (Reports are updated quarterly.)

Dadayan, Lucy, and Kim S. Rueben. 2022. Surveying State Leaders on the State of State Taxes. Washington, DC: Urban-Brookings Tax Policy Center.

Airi, Nikhita, and Frank Sammartino. 2021. How Broad Are State Sales Tax Bases?. Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard C., and Kim S. Rueben. 2018. The Evolution of Online Sales Taxes and What's Next For States. Washington, DC: Urban-Brookings Tax Policy Center.

Gleckman, Howard. 2018. Congress Has Had 26 Years to Address Online Sales Taxes. It Is About To Fail One More Time. TaxVox (blog). Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard C. 2016. Do You Pay Sales Tax on Your Online Holiday Shopping?. TaxVox (blog). Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard C. 2016. Missouri Voters Were Sold a Bill of (Taxable) Goods. TaxVox (blog). Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard C. 2014. Do Sales Tax Holidays Ever Make Sense?. TaxVox (blog). Washington, DC: Urban-Brookings Tax Policy Center.

Interactive Data Tools

State and Local Finance Data: Exploring the Census of Governments