Charges, sometimes referred to as user charges, are public payments connected with a specific government service. These include tuition paid to a state university, payments to a public hospital, tolls on highways, sewerage fees, and parking meter payments collected by a city. State and local governments collected a combined $570 billion in revenue from charges in 2021.

Although individual charges can be as little as a few dollars, in aggregate, charges are cumulatively a substantial revenue source for state and local governments. This is especially true in states that collect relatively little tax revenue.

How much revenue do state and local governments raise from charges?

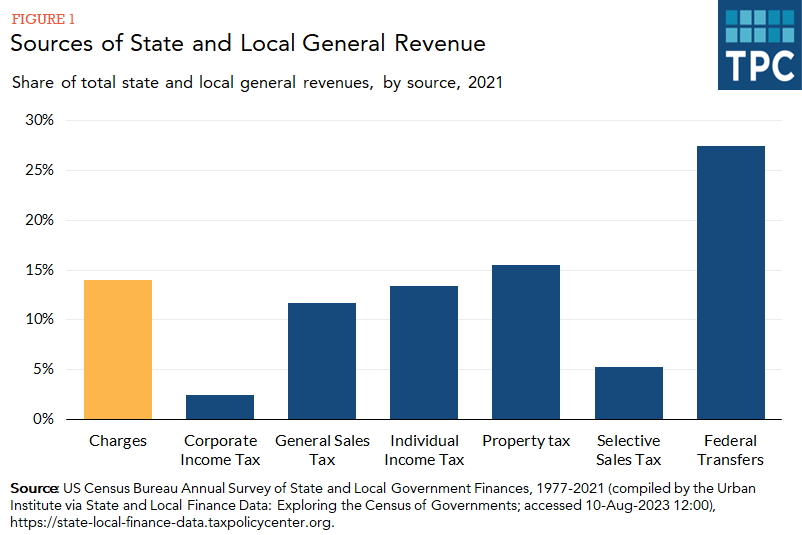

State and local governments collected a combined $570 billion in revenue from charges in 2021, or 14 percent of general revenue. As a group, charges accounted for roughly as much revenue as property taxes and provided more revenue than general sales taxes and individual income taxes.

Charges are a large source of revenue for both states and local governments. State governments collected $244 billion (9 percent of general revenue) from charges in 2021 and local governments collected $326 billion (16 percent of general revenue).

Reliance on charges has grown over time. In 1977, revenue from charges was $139 billion (in inflation-adjusted terms), or 11 percent of state and local general revenue.

Which charges generate the most revenue?

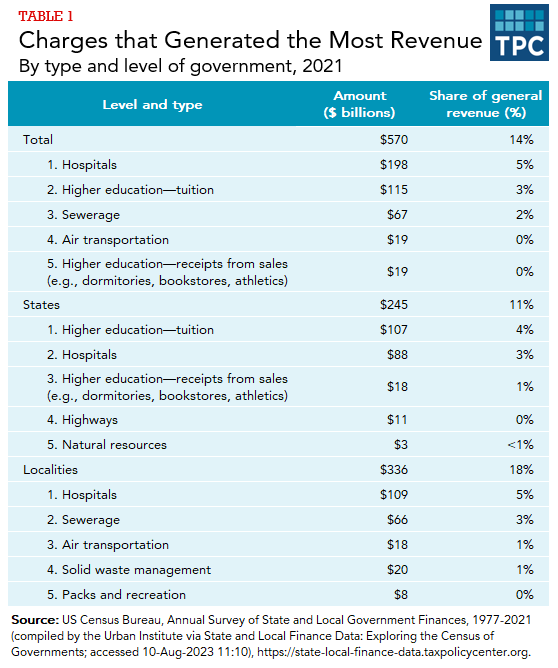

Among the $570 billion in revenue state and local government collected from charges in 2021, the largest contributors were hospital fees (charges collected from patients, private insurance companies, and public insurance programs such as Medicare), higher education payments (mostly tuition payments plus money spent on dormitories, athletic contests, and books), sewerage fees, and air transportation (hangar rentals and landing fees).

State governments collected the most revenue from charges related to higher education, hospitals, and highways (primarily from toll roads). Local governments collected the most revenue from charges related to hospitals, sewerage, air transportation, solid waste management (fees for garbage and recycling collection and disposal), and parks and recreation (fees from swimming pools or camping areas).

Census excludes utility charges from these totals and reports them in their own category. Fines and forfeitures—financial penalties imposed for violations of the law—are not included on these lists and are considered a separate form of revenue. For more information on the types of charges, see the US Census Bureau’s classification manual page.

Which states are most reliant on revenue from charges?

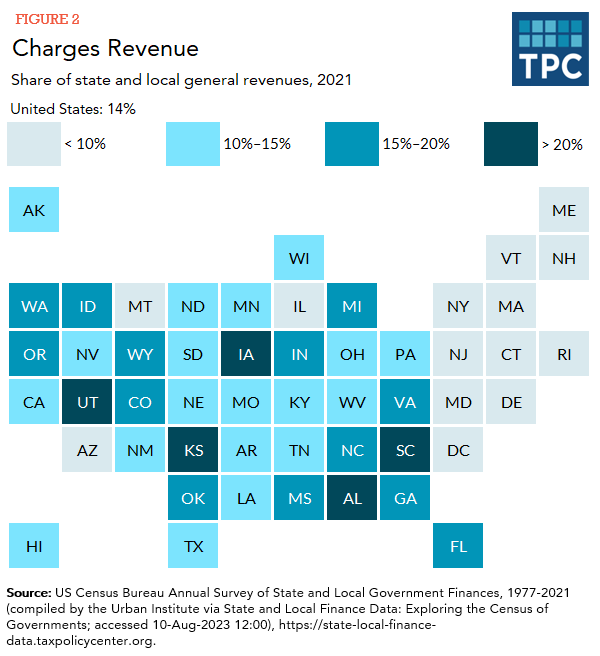

Among the 50 states in 2021, charges as a percentage of state and local general revenue ranged from 5 percent in Connecticut to 24 percent in South Carolina and Alabama. Charges were 5 percent of general revenue in the District of Columbia. Charges accounted for more than 20 percent of state and local general revenue in 5 states, there are 14 states where charges accounted for less than 10 percent of state and local revenue.

Data: View and download each state's general revenue by source as a percentage of general revenue

Updated January 2024

Boddupalli, Aravind, Tracy Gordon, and Lourdes German. 2021. More Than Fines and Fees: Incorporating Equity into City Revenue Strategies. Washington, DC: Urban-Brookings Tax Policy Center.

Baum, Sandy, Michael McPherson, Breno Braga, and Sarah Minton. 2018. Tuition and State Appropriations. Washington, DC: Urban Institute.

Gordon, Tracy, Richard Auxier, and John Iselin. 2016. Assessing Fiscal Capacities of States: A Representative Revenue System–Representative Expenditure System Approach, Fiscal Year 2012. Washington, DC: Urban Institute.

Interactive data tools