Severance taxes are taxes on the extraction of natural resources such as oil and natural gas. State and local governments collected a combined $11.8 billion in revenue from severance taxes in 2021.

These taxes constitute only a small percentage of state and local general revenue nationally, but can account for a substantial revenues in a few, natural resource-rich states—notably, Alaska, North Dakota, Texas, and Wyoming.

How much revenue do state and local governments raise from severance taxes?

State and local governments collected a combined $11.8 billion in revenue from severance taxes in 2021, or 0.3 percent of general revenue. That total was down from $15 billion in 2019. Severance tax revenue is inherently volatile. Over the past decade, it reached a high of $20 billion in 2012 and a low of $9 billion in 2016 (all in 2021 inflation-adjusted dollars). However, even at its peak, severance tax revenue was less than 1 percent of state and local general revenue.

Further, severance tax revenue is highly concentrated in a few states. Texas collected the most severance tax revenue in 2021 ($5 billion), followed by New Mexico ($1.8 billion), North Dakota ($1.7 billion), and Oklahoma ($754 million). In fact, combined revenue from those four states accounted for nearly four-fifths of all state and local severance tax revenue in 2021.

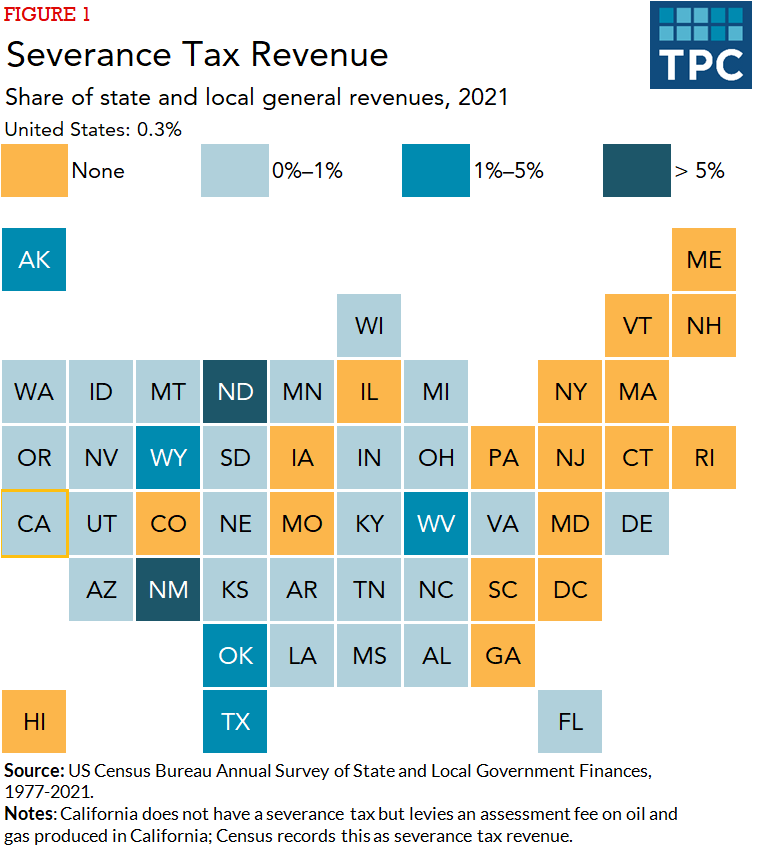

As a share of general revenue, the tax was a major revenue source in only a few states. In 2021, severance tax revenue accounted for 14 percent of North Dakota’s state and local general revenue, followed by New Mexico (6 percent), Wyoming (4 percent), and Alaska (3 percent). Oklahoma, Texas, and West Virginia were the only other states in 2021 where the tax accounted for over 1 percent of state and local general revenue.

In the early 2010s, Alaska depended on severance tax revenue more than any other state, in part due to the state's production and the high price of oil at the time. In fact, in 2012, Alaska collected $6.8 billion in real severance tax revenue (in 2021 dollars) and the tax accounted for 34 percent of Alaska’s state and local general revenue. However, because of changes in production and price, Alaska’s real severance tax revenue fell sharply over the next few years: $4.7 billion in 2013, $2.8 billion in 2014, and $729 million in 2015 (all in 2021 dollars). In 2021, Alaska collected $388 million in severance tax revenue.

Seventeen states and the District of Columbia did not have a severance tax in 2021. California does not have a severance tax but does levy a small assessment fee on oil and gas produced in California, and the Census Bureau records this as severance tax revenue.

The volatility of severance taxes poses a challenge to states in which they are an important revenue source, requiring such states to have flexible budgeting arrangements, other readily exploitable revenue sources, or significant rainy-day funds to accommodate unforeseen changes in severance tax revenue flows.

The COVID-19 pandemic and the war in Ukraine both significantly affected oil prices and made severance tax collections especially volatile.

Updated January 2024

Dadayan, Lucy. 2021. State Tax and Economic Review. Washington, DC: Urban-Brookings Tax Policy Center. (Reports are updated quarterly)

Francis, Norton. 2014. What Falling Oil Prices Will Mean for State Budgets. Washington, DC: Urban-Brookings Tax Policy Center.

Interactive data tools