A state child tax credit (CTC), like the federal version, is a tax credit for households with eligible children. However, both the amount of the credit and the eligibility rules for households vary considerably across states.

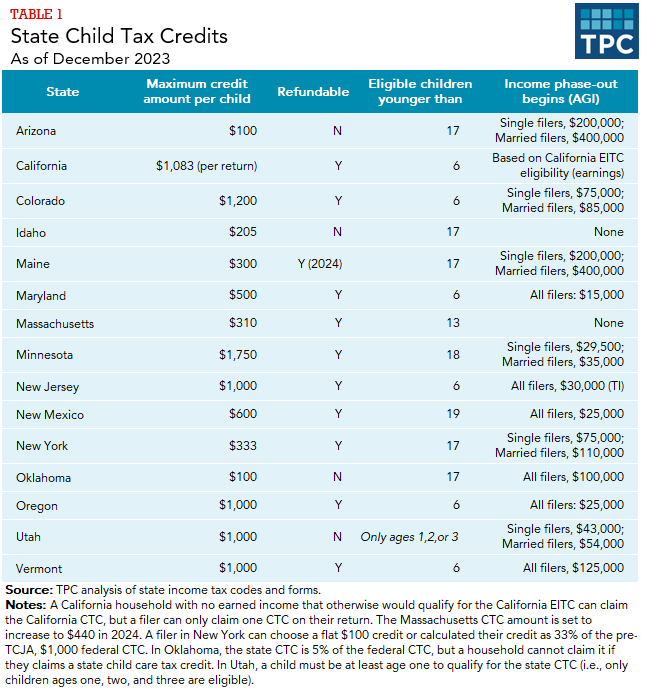

As of December 2023, 15 states offered a state CTC. Among these states, 11 offered a refundable CTC (if the credit exceeds a filer’s state income tax liability, then the filer receives the excess amount as a payment), and four offered a nonrefundable CTC (the credit can only reduce the filer’s tax liability to $0).

Notably, 12 of these state CTCs were either enacted or expanded since 2021, when Congress temporarily expanded the federal CTC as part of the American Rescue Plan Act..

This count of state CTCs does not include states that offer a personal credit to all eligible members of a household (e.g., Arkansas’s $29 personal credit functions similar to a personal exemption) or states that offer a per child tax deduction (e.g., North Carolina, which changed its child tax credit to a deduction in tax year 2018). Instead, these 15 states specifically offer a tax credit for children in addition to their state personal exemption or a relatively large state standard deduction.

Unlike the state earned income tax credit (EITC), which most states deliver simply as a share of the federal credit, state policymakers have a lot of flexibility when designing a state CTC. Specifically, state policymakers get to decide the amount of the credit, age eligibility rules for children, income limitations for the filer, and whether or not the credit is refundable.

In 2023, per eligible child credit amounts ranged from $100 in Arizona to $1,750 in Minnesota (see Table 1). In total, six of the 15 states provided a credit amount of $1,000 or more per child. Most states provided their CTC as a flat amount, but New York and Oklahoma calculated their credit as a percentage of the federal CTC in 2023. And every state but one provided a credit for each eligible child on their tax return—California, the exception, provided a single credit to an eligible household.

The federal CTC is available to filers with eligible children younger than age 17, and five states used the same age cutoff for their state CTC. Meanwhile, six states limited their credit to children younger than age 6. Limiting the credit to younger children is a way for states to provide relatively large tax benefits but to fewer households. Young children are often specifically targeted because evidence shows that a child’s early years are crucial to their development.

Other than Idaho and Massachusetts, all states prevented households with federal adjusted gross income (AGI) above a certain threshold from claiming their state CTC. The income thresholds at which point a filer began to lose their CTC varied widely across states: Maryland limited its credit to households with less than $15,000, regardless of filing status, while Maine and Arizona both began to phase-out their credits at $200,000 for a single filer and $400,000 for a married couple. Most states phased out their CTC over a range of income. For example, a Vermont household's credit was reduced by $20 for every additional $1,000 in income above the $125,000 threshold (for all filers) until the credit was completely eliminated. Thus, Vermont has a 2 percent phase-out rate. The federal CTC phase-out rate is 5 percent.

Eleven state child tax credits were refundable and four were nonrefundable as of December 2023. (Maine is counted as having a refundable credit even though its credit does not become refundable until tax year 2024.) If a refundable tax credit exceeds a household’s state income tax liability, the household receives the excess amount as a refund payment from the state. In contrast, a nonrefundable credit can only offset a household’s state income tax liability. One important difference between most state refundable CTCs and the federal refundable CTC is that all 11 refundable state credits are “fully refundable.” That is, a household in these states with an eligible child gets a CTC even if they have little or no income. In contrast, a household must have earned income of at least $2,500 to get any benefit from the federal CTC and earned roughly $25,000 to get the full federal refundable CTC. Thus, some low-income households in these states get a state CTC, but not a federal CTC.

Updated January 2024

Airi, Nikhita, and Richard Auxier. 2024. Three Lessons for Policymakers Designing a State Child Tax Credit. TaxVox (blog). Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard, David Weiner, and Nikhita Airi. 2024. Constructing a Child Tax Credit That Fits Every State. Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard and David Weiner. 2023. Who Benefited from 2022's Many State Tax Cuts and What is in Store for 2023?. Washington, DC: Urban-Brookings Tax Policy Center.

Maag, Elaine and David Weiner. 2021. How Increasing the Federal EITC and CTC Could Affect State Taxes. Washington, DC: Urban-Brookings Tax Policy Center.

Maag, Elaine and Richard Auxier. 2018. Addressing the Family-Sized Hole Federal Tax Reform Left for States. Washington, DC: Urban-Brookings Tax Policy Center.