Research has shown that the dramatic reduction of incentives in the 2017 Tax Cuts and Jobs Act only slightly reduced home prices. Local supply and demand conditions, plus prevailing interest rates, play a larger role than tax incentives.

Tax incentives reduce the after-tax cost of owner-occupied housing at any given level of housing prices.

The most well-known example of a housing tax incentive is the mortgage interest deduction (MID). This allows homeowners to deduct the interest paid on the mortgage of their primary residence from their taxable income, lowering their taxes. The MID effectively lowers the cost of borrowing money to buy a home, allowing buyers to take out larger loans and afford more expensive homes. However, the effect of the MID may vary depending on local housing market conditions, including the level of demand, the responsiveness of housing supply to higher prices, and the state of the economy.

The local property tax deduction is another example of a tax incentive that can affect home values. By allowing homeowners to deduct property taxes paid from their taxable income, the deduction reduces the after-tax cost of homeownership. This can increase demand. But, as with the MID, this effect may vary depending on local market conditions and economic forces.

Both of those effects have become less important since the 2017 Tax Cuts and Jobs Act (TCJA). The TCJA raised the standard deduction from $6,350 for single taxpayers ($12,700 for married couples filing jointly) in 2017 to $12,000 for single taxpayers ($24,000 for married couples filing jointly) in 2018. Taxpayers with itemized deductions less than the new threshold can lower their taxable income more by using the standard deduction compared with itemizing. The TCJA also limited the deduction for state and local taxes, including property taxes, to $10,000.

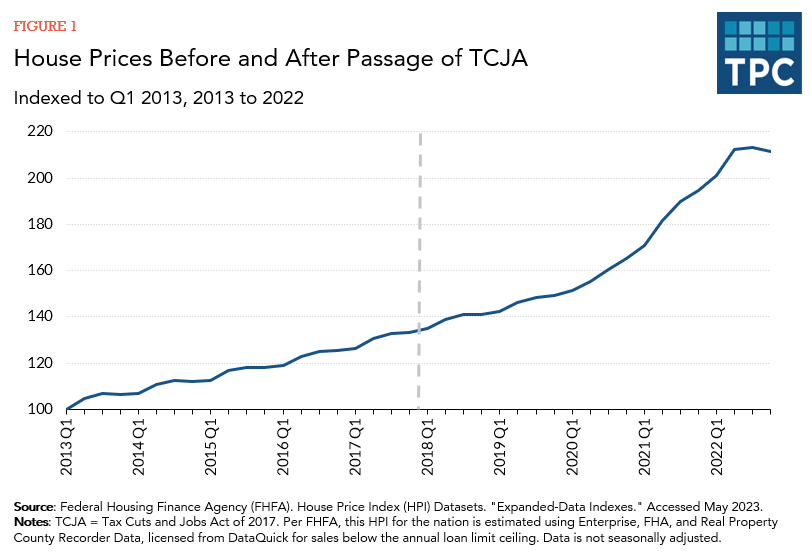

As shown in figure 1, when the TCJA lowered the tax incentives for homeownership, home prices were largely unaffected.

Several possible reasons for this exist. Deductions for mortgage interest and property taxes are only available to homeowners who itemize their deductions, limiting their effect on price. But raising the standard deduction may not reduce home prices because those who lowered their taxes by switching to the standard deduction could have applied some of their tax savings towards their mortgage payments. In addition, some homeowners have access to financial assets that could be used for home purchases in the absence of tax subsidies.

Updated January 2024

Harris, Benjamin H. 2013. “What Changes in the Mortgage Deduction Would Mean for Home Prices.” TaxVox. Washington, DC: Urban-Brookings Tax Policy Center.

Li, Wenli and Edison G. Yu. 2022. “Real Estate Taxes and Home Value: Evidence from TCJA.” Review of Economic Dynamics 43: 125–151.

Lu, Chenxi. 2019. “Homeowners, Can You Pay Down Mortgage Debt through Asset Rebalancing?.” TaxVox. Washington, DC: Urban-Brookings Tax Policy Center.

McClelland, Robert, Livia Mucciolo, and Safia Sayed. 2022. “New Evidence on the Effect of the TCJA on the Housing Market.” Washington, DC: Urban-Brookings Tax Policy Center.