Because high-income households pay a larger share of their income in total federal taxes than low-income households, federal taxes reduce income inequality. But federal taxes have done little to offset increasing income inequality over the past 40 years.

Increasing Before-Tax Income Inequality

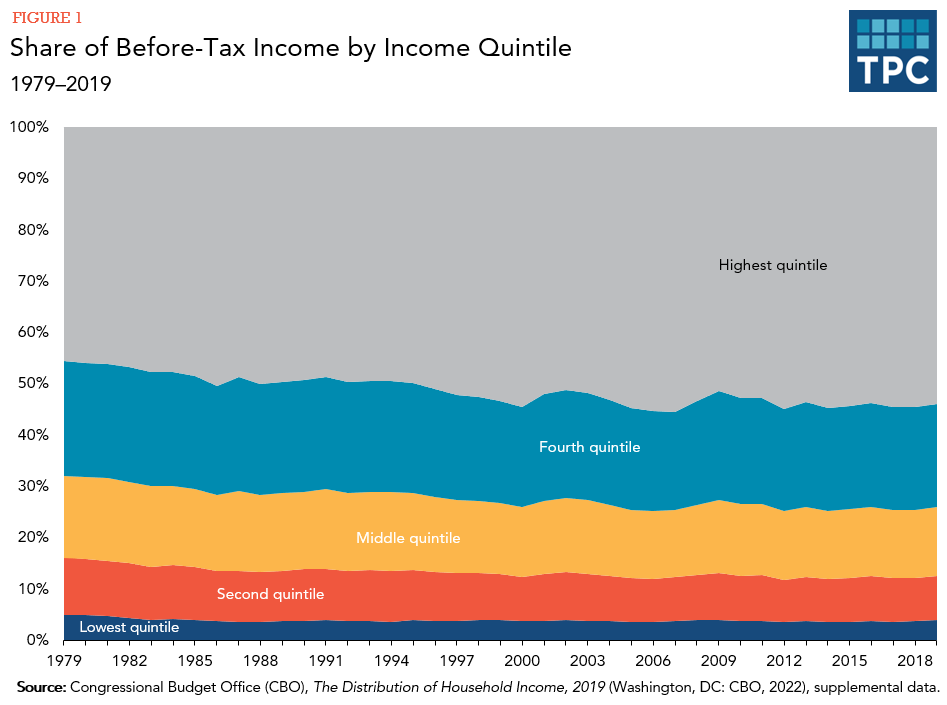

Income inequality has increased sharply over the past 40 years. A simple way to measure inequality is by looking at the share of income received by the highest-income people. Using a broad measure that includes labor, business, and capital income; and government social insurance benefits (such as Social Security and Medicare), the Congressional Budget Office finds that the fifth of the population with the highest income saw their share rise from 46 to 55 percent between 1979 and 2019 (figure 1).

The Role of Taxes

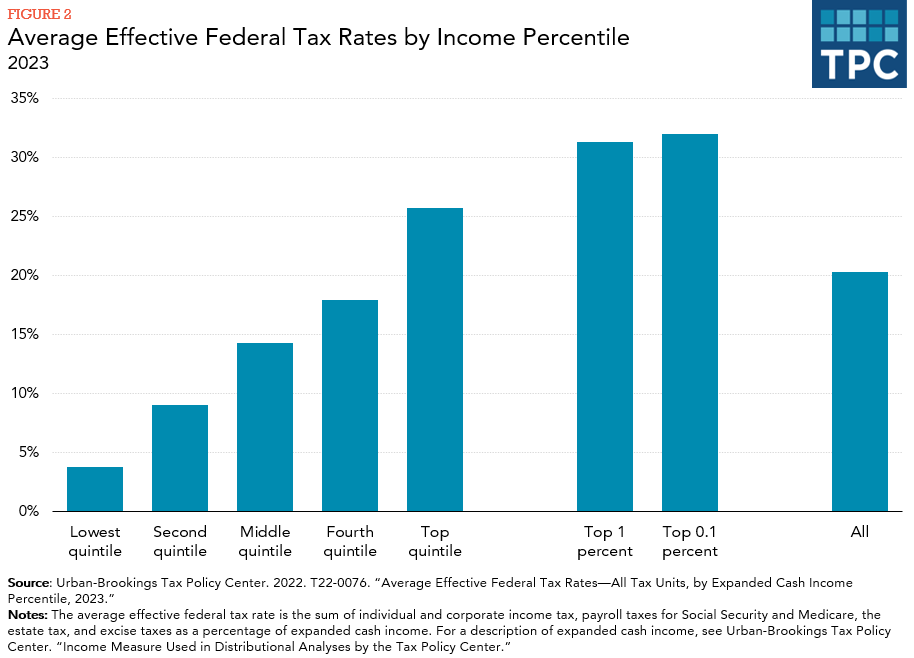

The US federal tax system mitigates income inequality. High-income households pay a larger share of their income in total federal taxes than low-income households (figure 2). State and local taxes, which are not included in this analysis, are much less progressive and some, such as sales taxes, are regressive (low-income households pay a higher share of their income in sales taxes than high-income households).

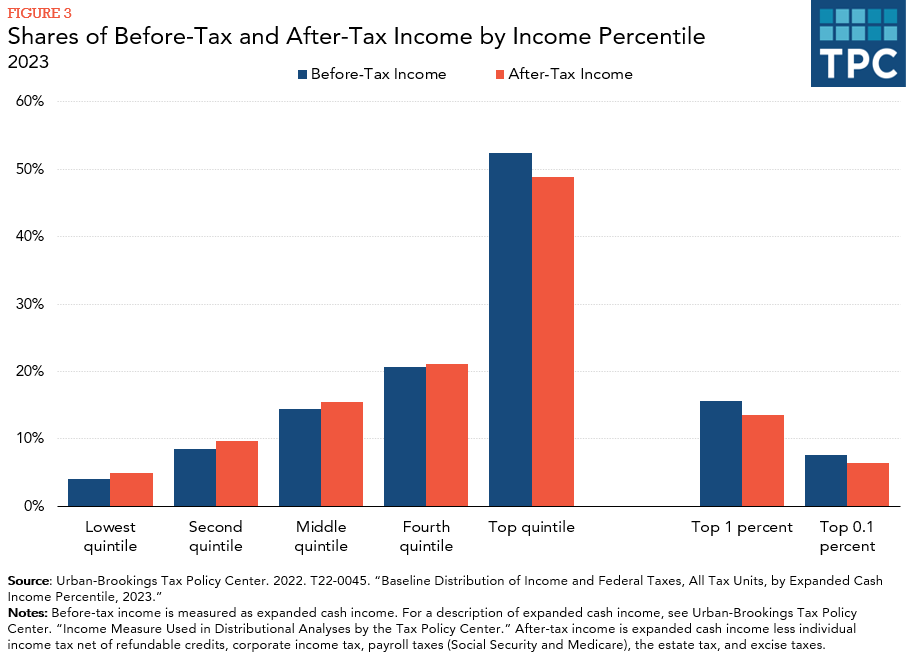

Because federal taxes are progressive, the distribution of after-tax income is more equal than income before taxes. High-income households have a slightly smaller share of total income after taxes than their share of income before taxes, while the reverse is true for other income groups (figure 3).

Effect of Taxes on Income Inequality

A more progressive tax system would reduce income inequality if nothing else changes. But while federal taxes have become more progressive, they also began shrinking in 2001 relative to before-tax income, thanks to tax cuts during the George W. Bush, Barack Obama, and Donald Trump administrations. A lower average tax rate offset the equalizing effect of increased tax progressivity, leaving the effect of federal taxes on income inequality little changed.

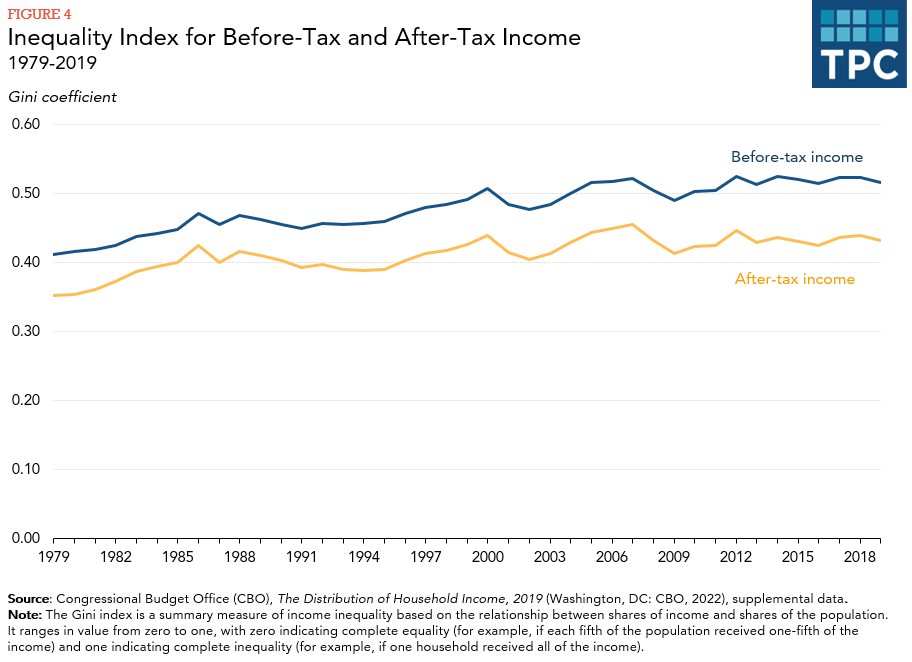

A widely used measure of income inequality is the Gini index. The index has a value of zero when income is distributed equally across all income groups and a value of one when the highest income group receives all the income. By this measure, inequality has been consistently lower for after-tax income than for before-tax income (figure 4).

The gap between the index for before-tax and after-tax incomes measures how much taxes reduce inequality. The bigger the difference, the more taxes equalize income. The gap narrowed during the 1980s as taxes relative to income fell more for high-income households than for low-income groups. But as federal taxes became more progressive starting in the 1990s, the gap between before-tax and after-tax income inequality widened. In percentage terms, it remains today at roughly the pre-1980 value.

The bottom line is that before-tax income inequality has risen since the 1970s, despite an increase in government transfer payments. Because high-income people pay higher average tax rates than others, federal taxes reduce inequality. But the mitigating effect of taxes is about the same today as before 1980. Thus, after-tax income inequality has increased about as much as before-tax inequality. Taxes have not exacerbated increasing income inequality, but have not done much to offset it.

Updated January 2024

Organisation for Economic Co-operation and Development. 2014. "FOCUS on Top Income and Taxation in OECD Countries: Was the Crisis a Game Changer?.” Paris, France.

Urban-Brookings Tax Policy Center. 2023. “Income Measure Used in Distributional Analyses by the Tax Policy Center.” Washington, DC.