Various forms of state-sanctioned gambling, including lotteries, casinos, parimutuel wagering (e.g., horse racing), sports betting, and video games (e.g., video poker), are taxed. State and local governments collected a combined $35 billion from state-sanctioned gambling in 2021.

For lotteries, the state government collects a share of revenue from all purchased tickets. The remaining money goes to prizes, retailer commissions, and administrative expenses (including advertising). For most other forms of gambling, the government typically taxes a gambling operator’s revenue. That is, the state taxes what the operators collected after they paid out winning wagers.

Revenues from gambling are often lumped in with other forms of “sin taxes.” But unlike taxes on cigarettes, for example, state and local governments do not tax gambling to discourage people from it. In fact, most states promote and encourage state-approved gambling. Like taxes on cigarettes, though, a part of the resulting revenue from taxes on gambling is often spent on programs that offset the harmful costs related to it, such as gambling addiction.

How much revenue do state and local governments raise from various forms of gambling?

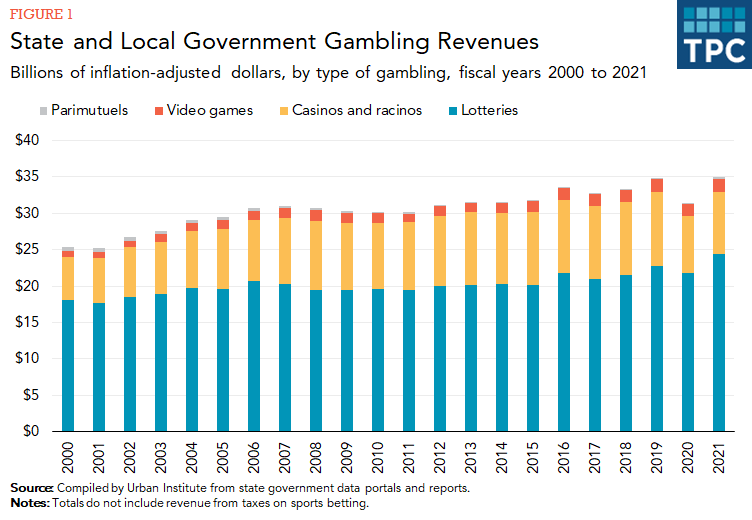

State and local governments collected roughly $35 billion from various forms of gambling in fiscal year 2021. That was about 1 percent of state and local general revenue that year.

That amount does not include revenues from tribal casinos, which typically are not regulated or taxed by state and local governments. However, some states collect revenue from tribal casinos through revenue-sharing agreements with the operating tribes.

Over two-thirds of gambling revenue came from lotteries ($24.4 billion) in fiscal year 2021. Casino gambling (including "racinos," which are casino-style gambling establishments at racetracks and riverboats) generated another $8.5 billion and video gaming provided $1.9 billion. Parimutuel wagering accounted for the remainder ($0.2 billion).

In inflation-adjusted dollars, state and local government revenue from gambling rose modestly from around $25 billion in fiscal year 2000 to $35 billion in fiscal year 2020. Revenue had dipped to $30 billion in fiscal year 2020 because of the COVID-19 pandemic.

One limit on gambling revenue is that an abundance of gambling options can cannibalize a state's collections. That is, if a state builds a new casino, it will most likely draw gamblers who were already using existing casinos (in the state or a neighboring state) rather than add new gamblers to the pool. As such, over the past decade, inflation-adjusted gambling revenue only increased 6 percent, and it declined 3 percent when measured per adults ages 18 and older.

[Note: These revenue data are from the Urban Institute, which collected them directly from government sources as part of its revenue data subscription project, and not the US Census Bureau. As such, the revenue data reported here may differ from Census lottery totals. Census classifies some revenue from video lottery terminals and video games as lottery revenue. Further, states' reporting of prizes distributed and other operating expenses may vary.]

In fiscal year 2021, among states with state-sanctioned gambling, total gambling revenue ranged from $4.1 million in Alabama (the state only offered parimutuel wagers) to over $3.1 billion in New York. Alaska, Hawaii, and Utah were the only states that collected no gambling-related revenue that year. As with the national total, the statewide totals were mostly driven by lottery revenue. In fact, 24 states collected over 70 percent of their gambling revenue from lotteries. Still, 11 states collected a majority of their gambling revenue from casinos (e.g., Nevada and Rhode Island) and four states (Montana, Oregon, South Dakota, and West Virginia) collected a majority from video games.

These totals do not include revenue from taxes on sports betting, which was mostly illegal outside of Nevada until a 2018 Supreme Court decision ended federal restrictions on this type of gambling. As of March 2023, 28 states and the District of Columbia offered legal sports betting and collected tax from the operators. Tribal casinos offer sports betting in six additional states, but these bets are not regulated and taxed by the state. According to the website Legal Sports Report, 27 states collected $1.5 billion in sports betting tax revenue in calendar year 2022, with collections ranging from less than $1 million in South Dakota and Wyoming to $144 million in Pennsylvania and $691 million in New York (the state with by far the most revenue collected).

Which states allow lotteries, casinos, and sports betting?

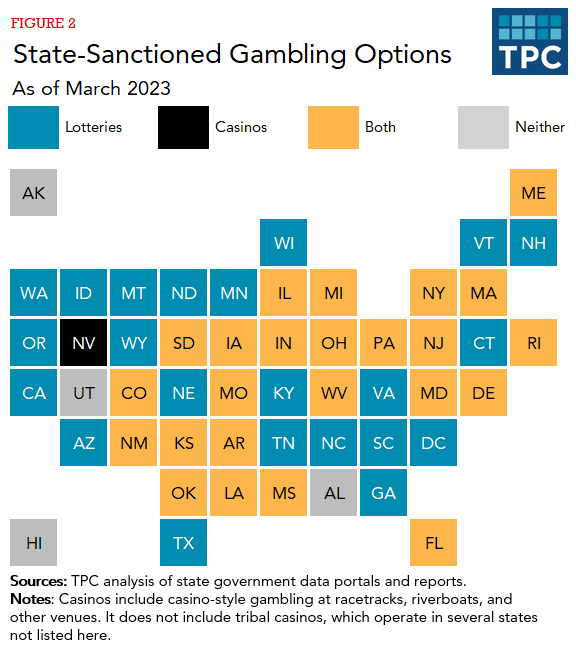

Forty-five states and the District of Columbia operate lotteries. Only Alabama, Alaska, Hawaii, Nevada, and Utah do not. The first state lottery was authorized in New Hampshire in 1964, and by the 1990s a majority of states operated a lottery. Mississippi became the most recent state to authorize a lottery in 2018.

The share of lottery revenue that goes to the state (as opposed to winnings and administration) varies by state, but most governments collect between 20 and 30 percent of gross lottery revenues. States typically dedicate lottery revenue to specific programs such as education, veteran services, or environmental protection.

As of March 2023, state-sanctioned casino gambling, including commercial casinos and casino betting permitted at racetracks, riverboats, and other facilities, was available in 25 states. (That total does not include tribal casinos.) Before 1991, no commercial casinos existed outside of Nevada and New Jersey. Nevada is still home to more than 50 percent of all the commercial casinos in the United States, even though it now collects less tax revenue from casino gambling ($886 million) than Pennsylvania ($1.4 billion) and roughly as much as Maryland ($730 million).

State top tax rates on casino revenues (i.e., what the casino collects after paying out to winners) range from 0.25 percent in Colorado to 62.5 percent in Maryland. Some states levy a flat tax rate on casino revenues but others levy graduated rates that increase as a casino’s adjusted gross revenue increases. Moreover, many states tax table games at lower rates than other types of gaming, such as slot machines. In general, early adopters of commercial casinos—particularly Nevada and New Jersey—have lower gambling tax rates than late-adopter states such as Maryland and Pennsylvania.

For sports betting, most states levy a flat tax rate on a sportsbook’s revenues, with rates ranging from 6.75 percent in Iowa and Nevada to 51 percent in New Hampshire, New York, and Rhode Island.

Updated January 2024

Dadayan, Lucy. 2019. Are States Betting on Sin? The Murky Future of State Taxation. Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard C. 2019. States Learn to Bet on Sports: The Prospects and Limitations of Taxing Legal Sports Gambling. Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard C. 2019. Three Tax Lessons from the First Year of Widespread Legal Sports Betting. Washington, DC: Urban-Brookings Tax Policy Center.

Auxier, Richard C., and Lucy Dadayan. 2020. Critical Value Podcast: #46 Sin Taxes Are Sweeping the States!. Washington, DC: Urban-Brookings Tax Policy Center.