The US corporate income tax rate is now lower than the top rate in all other leading economies except for the United Kingdom. Corporate income tax revenues in the United States as a share of gross domestic product have been lower than the average in other leading economies, even before the 2017 reduction in the US corporate tax rate.

Corporate Tax Rates

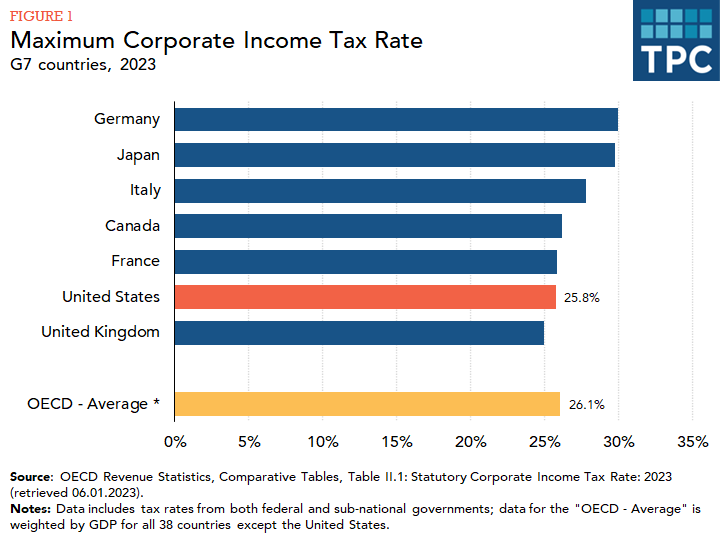

The 2017 Tax Cut and Jobs Act (TCJA) reduced the top US corporate tax rate from 35 percent to 21 percent and the average combined federal and state rate from 38.9 percent to 25.8 percent. As a result, in 2023, the top US corporate tax rate, including the average state and local corporate rate, is lower than that of all other leading economies in the G7 except the United Kingdom, with a 25 percent rate The U.S. rate is slightly below the average rate for the 37 other Organisation for Economic Co-operation and Development countries combined (26.1 percent, weighted by gross domestic product (GDP)) (figure 1).

Corporate Tax Revenues

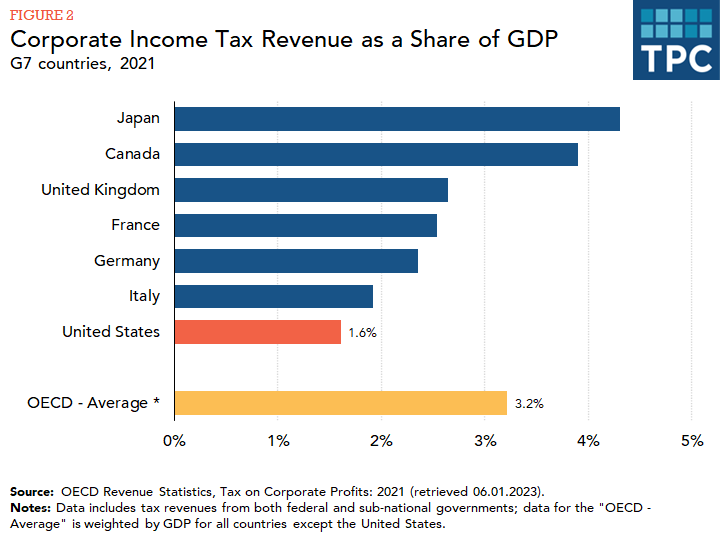

The United States raises less revenue from all corporate income taxes as a share of GDP than all other countries in the G7 and almost all other countries in the OECD (figure 2). In 2021, total federal, state, and local corporate income tax revenue as a share of GDP was 1.6 percent for the US, compared with the 3.2 percent average for the other 37 OECD countries.

The Congressional Budget Office projects that federal corporate tax revenues will have increased from 1.0 percent of GDP in fiscal year 2018 to 1.8 percent of GDP in fiscal year 2024 as temporary investment incentives enacted in the TCJA phase out. Corporate tax revenues will then decline to about 1.4 percent of GDP in the early 2030s due to the expiration of temporary tax collections from a one-time transition tax on foreign profits accrued prior to enactment of the TCJA. These projections assume that bonus depreciation enacted in the TCJA will phase out beginning in 2023, as currently scheduled, and that base-broadening measures and the 2026 increases in tax rates for global intangible low-taxed income and foreign-derived intangible income will also occur as scheduled.

US corporate tax revenues are a smaller share of GDP than in other leading economies because the US has a narrower tax base and an increasing share of business activity originating in businesses not subject to corporate tax (such as partnerships and subchapter S corporations).