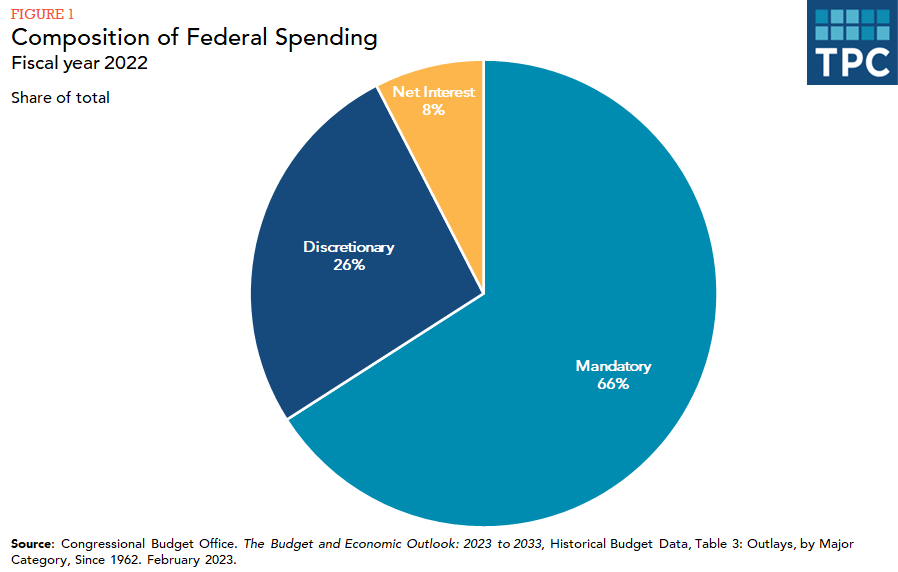

Mandatory Spending

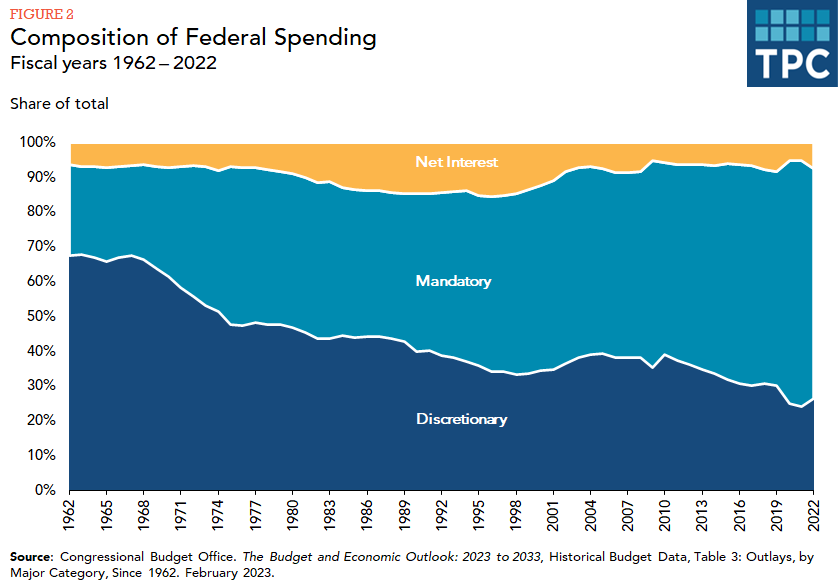

Mandatory spending covers outlays controlled by laws other than appropriations acts. Almost all such spending is for “entitlements,” for which expenditures depend on individual eligibility and participation; they are funded at whatever level needed to cover the resulting costs. Mandatory spending has grown from about 26 percent of the budget in 1962 to 66 percent in 2022 (figure 2). This growth is largely because of new entitlements, including Medicare and Medicaid (both of which started in 1965), the earned income tax credit (1975), and the child tax credit (1997). In addition, both increases in Social Security benefits during the 1960s and early 1970s and rapid growth of both the elderly and the disabled populations have contributed to increased Social Security and Medicare spending.

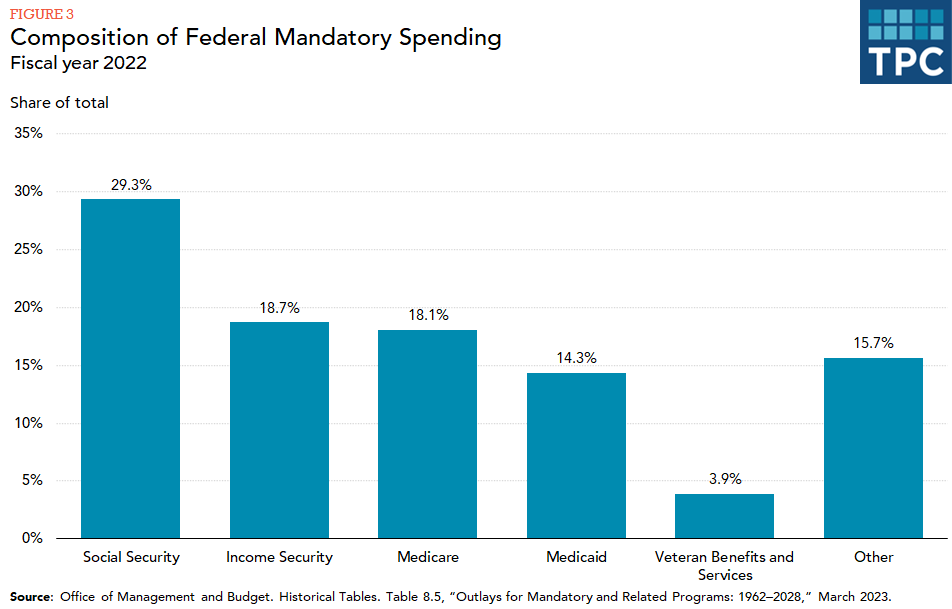

Nearly half of mandatory spending in 2022 was for Social Security and other income support programs such as the Child Tax Credit, food and nutrition assistance, and federal employee benefits (figure 3). Most of the remainder paid for the two major government health programs, Medicare and Medicaid.

Discretionary Spending

Discretionary spending covers programs that require appropriations by Congress. Unlike mandatory spending, both the programs and the authorized levels of spending require regular renewal by Congress. The share of the budget going for discretionary spending has fallen from two-thirds in 1962 to 26 percent now.

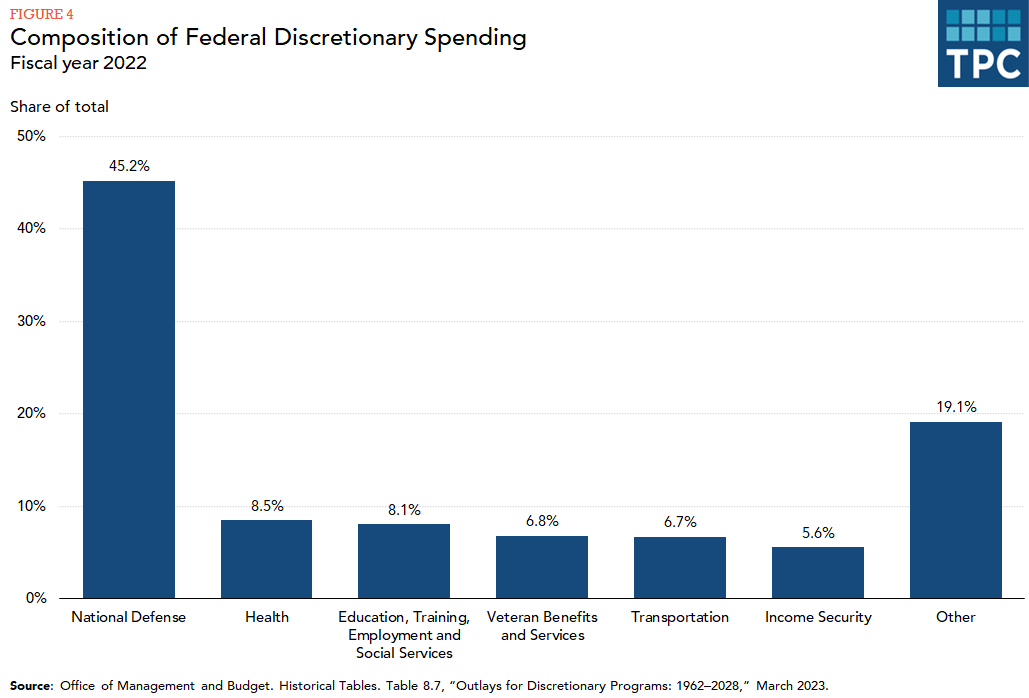

About 45 percent of FY 2022 discretionary spending went towards national defense, and most of the rest went for domestic programs, including transportation, education and training, veterans’ benefits, income security, and health care (figure 4). About 4 percent of discretionary spending funded international activities, such as foreign aid.

Debt Service

Interest on the national debt has fluctuated over the past half century along with the size of the debt and interest rates. It climbed from 6.4 percent of total outlays in 1962 to over 15 percent in the mid-1990s, fell to 6 percent in 2015, but climbed back to 7.6 percent by 2022 (figure 2). Since 2016, historically low interest rates have held down interest payments despite the national debt reaching a peacetime high of 97 percent of GDP in 2022, in part due to the federal stimulus to tackle the COVID-19 pandemic. Overall, interest payments as a share of outlays are projected to rise because of projected increases in both the national debt and interest rates.