Most low-income households do not pay federal income taxes, typically because they owe no tax (as their income is lower than the standard deduction) or because tax credits offset the tax they would owe. Some receive substantial rebates via refundable tax credits. However, nearly all low-income workers are subject to the payroll tax.

What Federal Tax Rates Do Low-Income Households Pay?

Low-income households typically pay some federal tax. The largest tax burden for households in the bottom income quintile (the bottom fifth) comes from the payroll tax, followed by excise taxes and a small amount of corporate tax. The average federal tax burden is much lower for low-income households than for high-income households.

The Urban-Brookings Tax Policy Center estimates that in 2023, households in the lowest income quintile have a negative average income tax rate as a result of refundable credits—namely the earned income tax credit (EITC) and the child tax credit (CTC). That is, the payments the lowest-income households receive from refundable credits exceed any income tax they owe.

In contrast, the average payroll tax rate for households in the lowest income quintile is 6.3 percent (just below the 6.8 percent average rate for all households). The payroll tax is by far the largest federal tax for households in the lowest income quintile.

Low-income households also pay federal excise taxes on specific products, including cigarettes, alcohol, and gasoline, and indirectly pay some corporate income tax, to the extent that corporations pass tax burdens back to workers’ wages.

What Share of Low-Income Households Owe Federal Income or Payroll Tax?

About 12 percent of households in the bottom income quintile will pay federal income tax in 2023. In contrast, 60 percent of households in the lowest income quintile will owe payroll taxes. Combined, 61 percent of households in the lowest income quintile will owe federal income or payroll taxes.

In many cases, low-income households owe no income tax. All households can claim a standard deduction to reduce their taxable income, and many families with children can offset income taxes with the child tax credit. In 2023, the standard deduction is $27,700 for married couples, $20,800 for single parents, and $13,850 for singles. Prior to the Tax Cuts and Jobs Act, families could also reduce the amount of income they owed tax on by a per-person exemption. The TJCA eliminated the personal exemption through the end of 2025, but increased the child credit for each child under 17 from $1,000 to $2,000 and added a new $5000 for other dependents, including older children. . Households with income above the standard deduction therefore often still do not owe federal income tax because of these credits for children and other dependents.

Why Do Low-Income Households Face Negative Average Federal Income Tax Rates?

Households can have negative federal income tax rates if they receive refundable tax credits. The EITC is a refundable credit that subsidizes earnings, particularly for workers with children. The CTC provides workers with children a credit of up to $2,000 per child under age 17, up to $1,400 of which can be refunded beyond the limit of total taxes paid. Together, these credits deliver substantial assistance to low-income families with children. (A small EITC is also available to childless workers.) If refundable credits exceed taxes owed, households receive the excess as a payment. The net refunds created by these credits show up as negative average tax rates.

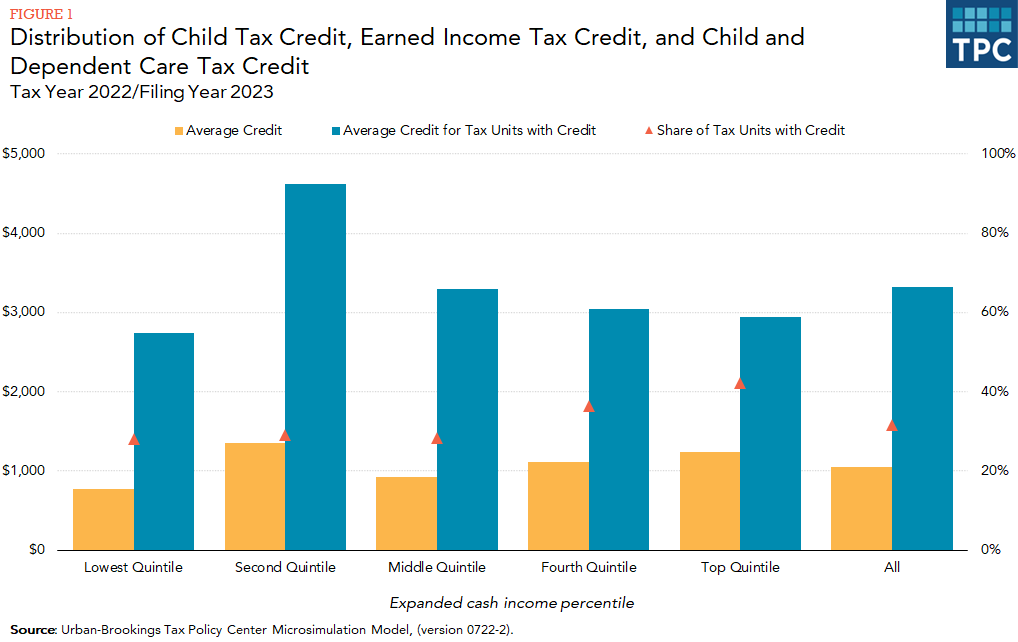

The Tax Policy Center estimates that in 2022, the CTC, the EITC, and the Child and Dependent Care Tax Credit (CDCTC) combined averaged $770 for households in the lowest income quintile. About 30 percent of households in the lowest quintile received the EITC, CTC, or both (figure 1), and those refundable credits, unlike the nonrefundable CDCTC, comprise nearly all of the total tax benefits for households in the lowest income quintile.

How Have Effective Tax Rates for Low-Income Households Changed Over Time?

Average tax rates for low-income households have changed markedly over the past quarter-century. Creation of the CTC and expansion of the EITC both lowered the effective individual income tax rate for low-income households from about 0.5 percent in the early 1980s to its negative value today (figure 2). In contrast, the effective payroll tax rate for households in the lowest income quintile increased by more than 50 percent over the same period (except for a temporary payroll tax reduction in 2011 and 2012). The effective corporate income tax rate borne by low-income households has also fallen since 1979, while the effective excise tax rate has hovered around two percent.

Updated January 2024

Berube, Alan. 2006. “The New Safety Net: How the Tax Code Helped Low-Income Working Families During the Early 2000s.” Washington, DC: Brookings Institution.

Burman, Leonard E., Jeff Rohaly, and Elaine Maag. 2005. “Tax Credits to Help Low-Income Families Pay for Child Care.” Tax Policy Issues and Options Brief 14. Washington, DC: Urban-Brookings Tax Policy Center.

Congressional Budget Office. 2019. “The Distribution of Household Income and Federal Taxes, 2016.” Washington, DC: Congressional Budget Office.

Gale, William G., J. Mark Iwry, and Peter Orszag. 2005. “Making the Tax System Work for Low-Income Savers: The Saver’s Credit.” Tax Policy Issues and Options Brief 13. Washington, DC: Urban-Brookings Tax Policy Center.

Hamersma, Sarah. 2005. “The Work Opportunity and Welfare-to-Work Tax Credits.” Tax Policy Issues and Options Brief 15. Washington, DC: Urban-Brookings Tax Policy Center.

Maag, Elaine. 2006. “Analyzing Recent State Tax Policy Choices Affecting Low-Income Working Families: The Recession and Beyond.” Perspectives on Low-Income Working Families Brief 3. Washington, DC: Urban Institute.

Maag, Elaine, and Deborah Kobes. 2003. “Tax Burden on Poor Families Has Declined over Time.” Tax Notes. February 3.