Cost recovery is the ability to recover (deduct) the costs of an investment. The recovery of investments in tangible assets happens through depreciation, and the recovery of intangible assets is through amortization. Depreciation and amortization can be measured for economic, financial, or tax purposes.

Economic Depreciation

Economic depreciation represents the decline in an asset’s market value over time. Economic depreciation of tangible assets occurs from wear and tear, lower productivity, new technology replacing old technology, and the perishability of certain investments. Economic depreciation of intangibles also occurs because of technological changes, and from the expiration of rights, such as patents, licenses, or trademarks.

Financial Depreciation

Financial depreciation and amortization follow accounting methods used by companies to calculate income in their financial statements. Corporations can typically choose how they depreciate assets as long as the method is allowed under generally accepted accounting principles (GAAP). Public companies must follow GAAP to prepare their financial statements, but it is optional for private companies.

Tax depreciation

Tax depreciation and amortization are used by companies in determining their taxable income. The federal income tax provides specific rules for how to depreciate classes of assets for tax purposes. Tax depreciation is often “accelerated” compared with economic depreciation. This means that businesses can deduct a larger fraction of their investment from taxable income earlier in the life of the asset than they would under rules that reflect economic depreciation.

Although all three depreciation methods are used to capture the decline in value of an asset over time, they are calculated differently for important reasons. Economic depreciation aims to follow the actual economic value of an asset. Financial depreciation uses specific accounting rules for transparency, consistency, and comparability. Tax depreciation is often accelerated compared with true economic depreciation to provide an incentive for investment in favored assets.

What are US tax depreciation rules for tangible assets?

Tangible assets include short-lived assets, such as computers, office supplies and furniture, medium-lived assets, such as larger machinery or infrastructure equipment, and longer-lived assets, such as structures and real estate property.

The general tax depreciation method applied to domestic US assets is the modified accelerated cost recovery system (MACRS). MACRS includes two categories: general and alternative depreciation. Most assets used domestically follow the generalized depreciation system (GDS). Some assets, such as assets owned by US taxpayers but used in foreign countries, must be depreciated according to the alternative depreciation system (ADS).

The two main methods of depreciation are the straight-line method and the declining balance method.

1. The straight-line (SL) method evenly distributes a fraction of the asset value over its assessed lifetime. For example, if a company purchases an asset worth $10,000 with a 10-year expected lifespan and zero residual value, the company will depreciate $1,000 a year ($10,000/10). This method is primarily used for industrial structures and commercial and residential real estate property.

2. The declining balance (DB) method is an accelerated method compared to SL that applies to most assets other than structures. A DB regime is defined by a coefficient of allowed depreciation. The double declining balance (DBB), or 200 percent DB method has a coefficient of 2 that allows a firm to deduct twice the depreciation percentage of the remaining book value. Following the above example and using 200 percent DB, the company could deduct $2,000 the first year (2 x 10% x $10,000), $1,600 the second year (2 x 10 % x $8,000), etc.

Businesses typically switch to straight-line when the allowed depreciation under straight-line becomes larger than under DB. This method applies to most tangible assets.

The DB method can result in accelerated depreciation compared with economic depreciation. But it is sometimes a good approximation of economic depreciation. For example, cars depreciate rapidly in the first couple of years of usage. The preferential treatment of tax depreciation often comes from using a time span for depreciation that is shorter than the actual life span of the asset.

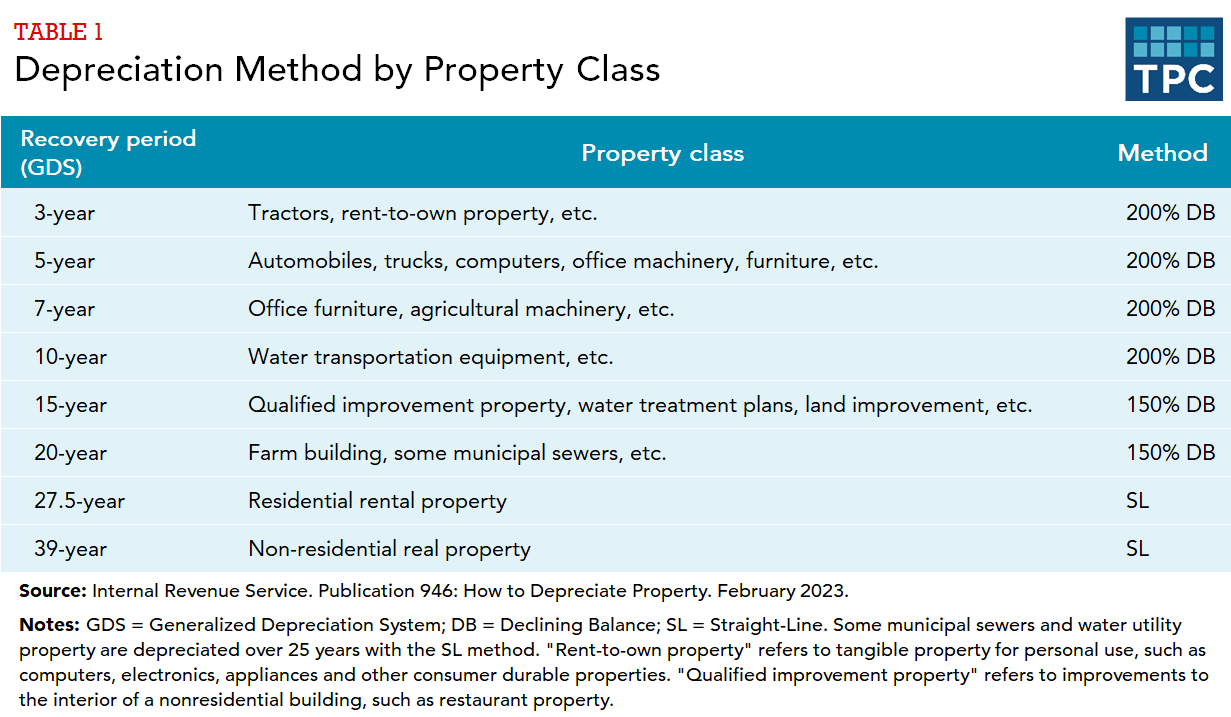

The following table describes the largest types of property classes, and the typical depreciation method used for each class.

In addition, the United States has a half-year convention for most assets, which means that regardless of when the asset was purchased, it gets a half year of depreciation in the first year.

Assets used outside the United States, property that is tax-exempt, and assets used less than 50 percent for business (e.g., many automobiles) are required to be depreciated following the alternative depreciation system (ADS). This method typically has a longer cost recovery and more closely follows real depreciation. It typically requires straight-line depreciation.

What is bonus depreciation or expensing?

The extreme of accelerated depreciation is expensing, or immediate deduction of the full cost of investment. The US introduced partial expensing or “bonus depreciation” as a temporary stimulus in 2002. Congress then renewed the provision several times, and it has become a permanent fixture of the tax code. Under partial expensing, a fraction of the asset’s cost is deducted in the first year and the remainder is recovered using the otherwise applicable depreciation schedule.

The Tax Cuts and Jobs Act of 2017 increased bonus depreciation from 50 to 100 percent for most tangible assets except for structures and real property until 2023. In 2023, bonus depreciation ramps down to 80 percent, and will continue declining by 20 percent each year to 60 percent for 2024, 40 percent for 2025, 20 percent for 2026, and 0 thereafter. Under current law, bonus depreciation will not be available for most businesses after 2026.

Small businesses also benefit from expensing of qualified assets (typically machinery and equipment) under section 179. Businesses are allowed a maximum deduction for tangible investments of $1,160,000 in 2023. The amount allowed phases out dollar for dollar when businesses invest more than $2,890,000 for 2023. This means that a business with investment in eligible assets of $3,000,000 in 2023 can expense up to $1,050,000 under section 179. Unlike regular bonus depreciation, no expiration date exists for section 179.

What are US tax depreciation rules for intangible assets?

Intangible assets represent a growing share of investments and asset holdings. They include a broad range of assets such as patents, software, licenses, trademarks, data systems, etc.

Although intangible assets don’t physically deteriorate, they nonetheless lose value over time, and when a company purchases an intangible asset, it must amortize it. Like tangible assets, a fraction of the cost of these acquired assets can be deducted each year, based on their expected lifetime and the type of asset.

Businesses could fully expense self-created intangibles arising from US research and experimentation (R&E) between 1954 and 2021. From 2022 on, however, businesses must capitalize and amortize domestic R&E expenses using the SL method over five years. Although more burdensome than expensing, this depreciation regime is still accelerated relative to most other intangibles. However, some R&D expenses do not result in valuable assets, in which case the depreciation regime is not accelerated.

In addition, a large fraction of R&E expenditures is eligible for the R&E tax credit, introduced in 1981. The rationale behind the generous tax treatment of R&D spending are positive externalities—R&D is believed to have more social than private value.

Foreign R&E expenditures made by US multinationals are capitalized and amortized SL over 15 years. Purchased intangibles, whether owned onshore or off, are also generally amortized over 15 years, with some exceptions (e.g., purchased software is amortized over three years). In contrast to the direct purchase of an intangible asset, goodwill acquired by merger, or through acquisition of another company cannot be amortized.

Updated January 2024

Internal Revenue Service (IRS). 2023. “Publication 946: How to Depreciate Property.” Washington, DC: Internal Revenue Service.

Congressional Research Service. 2015. Research Tax Credit: Current Law and Policy Issues for the 114th Congress. Washington, DC: Congressional Research Service.