The IRS administers the federal tax laws that the Congress enacts. However, from 2010 through 2022, the IRS budget was cut by 24 percent, after accounting for inflation, leading to cutbacks in taxpayer services and enforcement.

The Internal Revenue Service (IRS) administers the federal tax laws that Congress enacts. The IRS performs three main functions—tax return processing, taxpayer services, and enforcement. In addition, the IRS conducts criminal investigations and oversees tax-exempt organizations and qualified retirement plans.

In recent years, Congress has steadily cut appropriations for the IRS, even as the tax law has become more complex and the agency has taken on new tasks. In 2022’s Inflation Reduction Act (IRA), Congress boosted the IRS’s budget by $80 billion through 2031, on top of its annual appropriations over the decade. Nine months later, however, Congress and the White House agreed to reduce the IRA funds by $21.4 billion, leaving a total of $58.6 billion.

IRS Appropriations

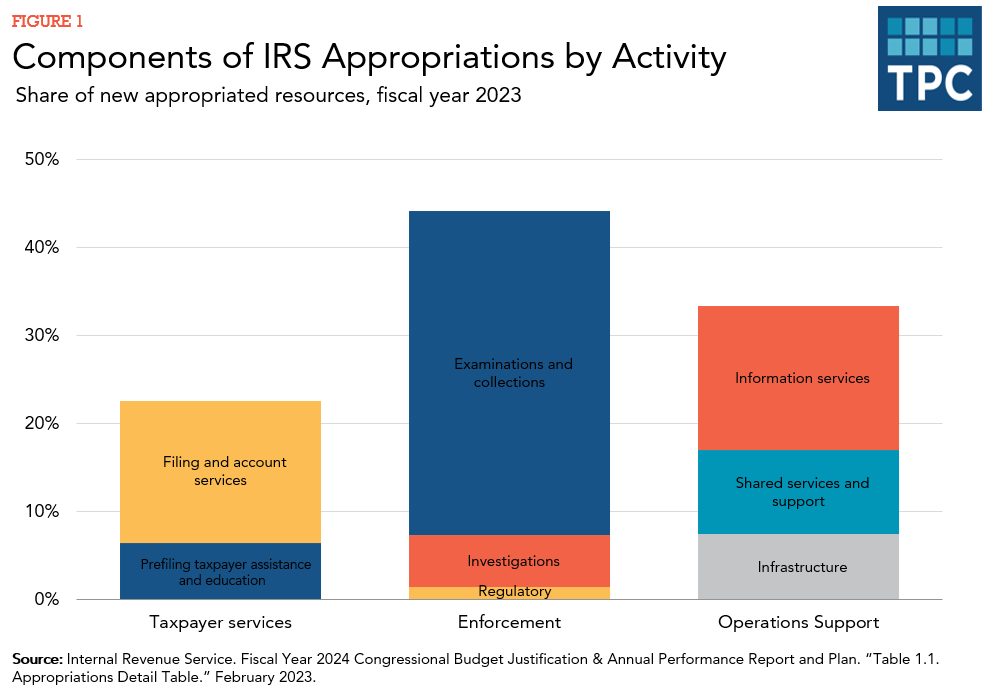

For fiscal year 2023, Congress appropriated $12.3 billion for the Internal Revenue Service—with 44 percent allocated to tax enforcement, 33 percent to operations support, and 23 percent to taxpayer services (figure 1). In an unusual move, Congress did not set aside any funds for business systems modernization, citing the separate funding received for that account in the IRA. In recent years, the appropriation acts had contained $200 million to $400 million for modernization.

Congress leaves it up to the IRS to divide those aggregate amounts among activities. The IRS delegated about 83 percent of the enforcement budget to examinations of taxpayer returns (audits) and collections. The IRS distributed the remainder to criminal investigations and regulatory activities, including the development of guidance materials, interpretation of tax laws, granting of tax-exempt status to qualifying organizations, and approval of qualified retirement plans.

Nearly half of the appropriation for operations support was allocated to information services, with the balance split between infrastructure and shared services and support.

Another 23 percent supports taxpayer services. Three-quarters of the funding for taxpayer services was set aside for filing and account services; the rest was for prefiling assistance and education.

The Decline in Resources

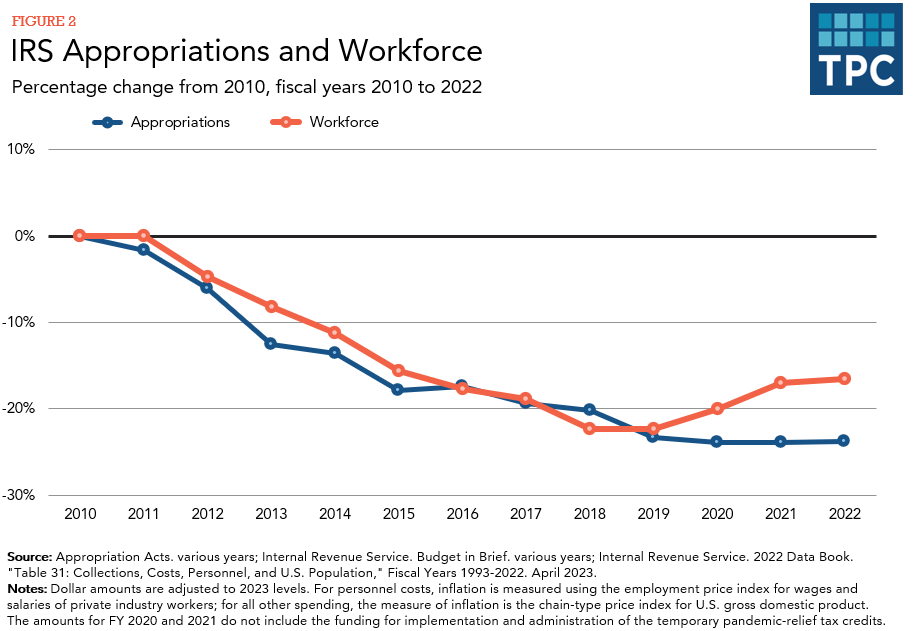

Between 2010 and 2022, Congress cut the IRS’s appropriations by 24 percent, in 2023 dollars (figure 2). The biggest cutbacks were in funding for enforcement—down 28 percent over the period.

Over a longer time, IRS employment dropped by 30 percent, from about 113,500 full-time equivalent employees (FTE) in 1993 to 79,000 in 2022. Over half of the drop in FTE occurred since 2010 (figure 2)—in large part because of the combination of a seven-year hiring freeze and a workforce reaching retirement age.

Budget cutbacks contributed to delays in upgrading the IRS’s technology. Legacy systems make it more difficult to respond to changes in the tax code, to view taxpayers’ accounts in real time, to ensure data security, and to hire programmers familiar with fifty-year old code still in use in some of the IRS systems.

While IRS resources have shrunk, the agency’s workload has increased. With the taxpayer population increasing, the IRS must process more returns, administer more deposits and refunds, and expend more resources to keep taxpayers compliant. Changes in the economy have created other challenges for tax enforcement and compliance. Those include the globalization of corporate activity and an increase in the share of income taxed through partnerships and other pass-through entities.

A major source of increased workload has been the IRS’s expanded role in adminstering social programs. The IRS today manages a wide range of benefits for low- and middle-income families and families with children. Those include the earned income tax credit, the child tax credit, the child and dependent care tax credit, tax subsidies for higher education, and premium subsidies under the Affordable Care Act. When Congress creates new programs for the IRS to administer, it often does not provide additional funding to administer them.

The pandemic placed additional pressures on the IRS. The IRS was tasked with issuing three waves of economic impact payments during 2020 and 2021. An additional responsibility was to quickly build a new infrastructure for delivering advance payments of the child tax credit in monthly installments in 2021—something the IRS had not done before. The IRS was able to get most payments to taxpayers with unprecedent speed, perhaps in part due to the $3 billion provided by Congress for administrative costs.

Yet, the pandemic compounded the IRS’s struggles with meeting its normal responsibilities. The closing of service centers during the early months of the pandemic in 2020 created a backlog of unprocessed paper tax returns and delayed refunds, as well as unopened correspondence between taxpayers and the IRS.

Inflation Reduction Act

In 2022’s Inflation Reduction Act (IRA), Congress provided the Internal Revenue Service with additional funding of nearly $80 billion through 2031.

The goal of IRA’s $80 billion budget boost was to improve the IRS’s ability to administer the federal tax system efficiently, effectively, and fairly. The unique multi-year funding stream allows the IRS to make long-term investments in its technological infrastructure and to hire, train, and retain new staff.

Congress intended the mandatory funds to supplement the annual appropriations used to finance current operations. However, the legislation does not contain guardrails that would prevent Congress from reducing appropriations each year and forcing the IRS to use some of the $80 billion boost for maintaining its pre-IRA level of services. In the immediate aftermath of IRA’s passage, Congress set the fiscal year 2023 appropriations for enforcement, taxpayer services, and operations at 2022 levels (in nominal dollars) while funding for business systems modernization was dropped entirely.

In June 2023, the Biden Administration and Congress agreed to reduce the ten-year IRA funding by 27 percent as part of an agreement to raise the debt ceiling. The Fiscal Responsibility Act of 2023 immediately rescinded $1.4 billion in 2023 funding of enforcement and operations support. Although not included in the 2023 legislation, the administration and Congress committed to a $10 billion rescission in 2024 to be followed by another $10 billion recission in 2025.

Updated January 2024

Congressional Budget Office. 2020. Trends in the Internal Revenue Service’s Funding and Enforcement. Washington DC: Congressional Budget Office.

General Accounting Office. 2023. “Information Technology: IRS Needs to Complete Modernization Plans and Fully Address Cloud Computing Requirements.” GAO-23-104719. Washington DC: General Accounting Office.

Holtzblatt, Janet. 2021. “The Effect of Tax Enforcement on Revenues.” Testimony before the Select Revenues Subcommittee and Oversight Subcommittee, Ways and Means Committee, June 10.

Holtzblatt, Janet and Jamie McGuire. 2016. “Factors Affecting Revenue Estimates of Tax Compliance Proposals.” Congressional Budget Office Working Paper 2016-05.

Holtzblatt, Janet and Jamie McGuire. 2020. “Effects of Recent Reductions in the Internal Revenue Service’s Appropriation on Returns on Investment.” The IRS Research Bulletin: Proceedings of the 2019 IRS/TPC Research Conference. Publication 1500 (Rev. 6-20). pp. 128-143.

Toder, Eric. 2017. “IRS: What it Does and How to Reform It.” Washington, DC: Urban-Brookings Tax Policy Center.