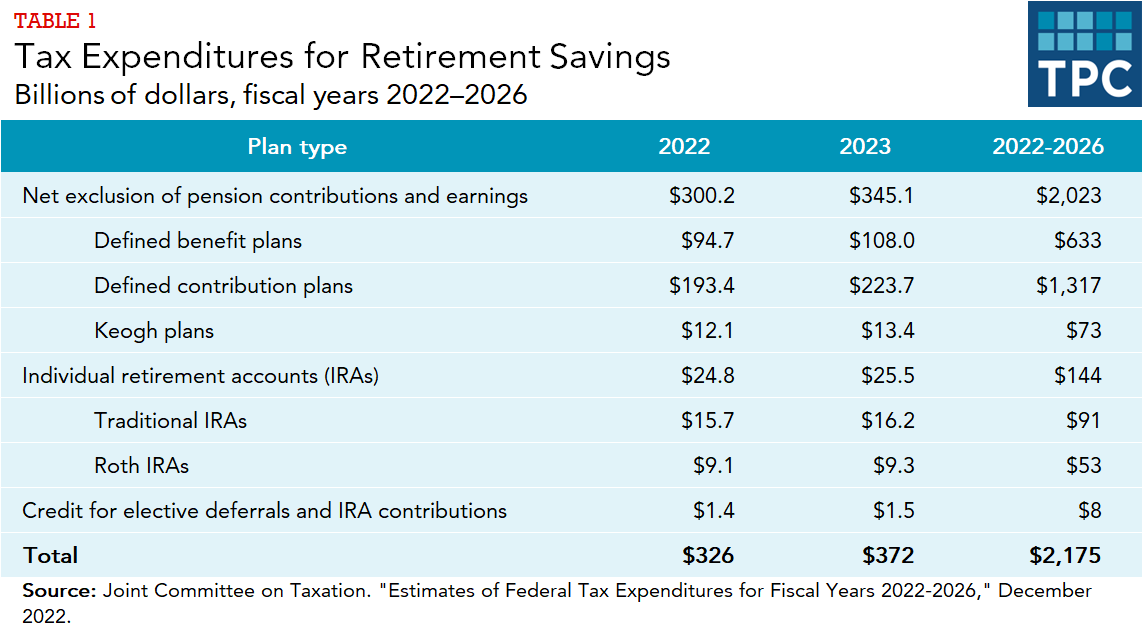

Tax expenditures for retirement savings are very large. They were over $300 billion in 2022 and will likely exceed $2 trillion over the 2022-2026 period.

Tax expenditures are revenue losses attributable to special exclusions, exemptions, deductions, credits, and other provisions in the tax code. The Congressional Joint Committee on Taxation (JCT) calculates the tax expenditure for retirement savings as the sum of the revenue loss attributable to the tax exclusion for current-year contributions and earnings on account balances, minus the revenue from taxation of current-year pension and individual retirement account distributions (table 1).

The 2017 Tax Cuts and Jobs Act modestly reduced the cost of these tax expenditures by reducing individual income tax rates. Lower marginal tax rates reduce the cost of tax expenditures that take the form of exclusions and deductions because reducing taxable income provides smaller tax benefits at lower rates.

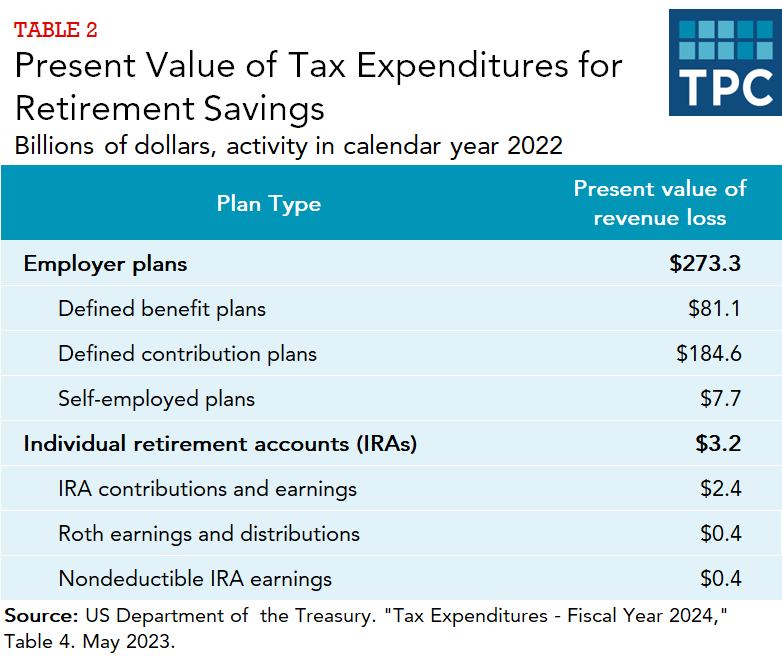

The White House Office of Management and Budget also publishes tax-expenditure estimates for retirement savings, calculated by the US Department of the Treasury’s Office of Tax Analysis (OTA) in a similar fashion as the JCT. The OTA also publishes alternative estimates that measure the net lifetime tax benefit from current year contributions. That benefit is calculated as the sum of the immediate revenue loss attributable to retirement savings contributions, plus the “present value” of the revenue loss that occurs because of the tax exemption for accrued earnings on that contribution in future years, minus the present value of the revenue due upon future withdrawals (table 2).

Updated January 2024

Toder, Eric, Surachai Khitatrakun, and Aravind Boddupalli. 2020. “Tax Incentives for Retirement Savings.” Washington, DC: Urban-Brookings Tax Policy Center.

Urban-Brookings Tax Policy Center. 2020. “Tax Expenditures.” Washington, DC.