TPC estimates that just over 7,100 estate tax returns will be filed for people who die in 2023, of which only about 4,000 will be taxable—less than 0.2 percent of the 2.8 million people expected to die in the year.

Because of a series of increases in the estate tax exemption, few estates pay the tax. The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) raised the estate tax exemption from $675,000 in 2001 to $1 million in 2002 and to $3.5 million in a series of steps through 2009, sharply reducing the number of estates that paid estate taxes. EGTRRA repealed the estate tax for 2010 but after that, the estate tax was scheduled to revert to pre-EGTRRA rules.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reinstated the estate tax and generation-skipping transfer tax and extended them through 2012, with a $5 million estate tax exemption (indexed for inflation after 2011) and a top rate of 35 percent. The American Taxpayer Relief Act of 2012 permanently extended the exemption, but the top rate was increased to 40 percent.

The Tax Cuts and Jobs Act doubled the exemption to $11.18 million in 2018 (indexed for inflation after 2018), but the estate tax cut is scheduled to expire after 2025 (along with most other provisions of the new law).

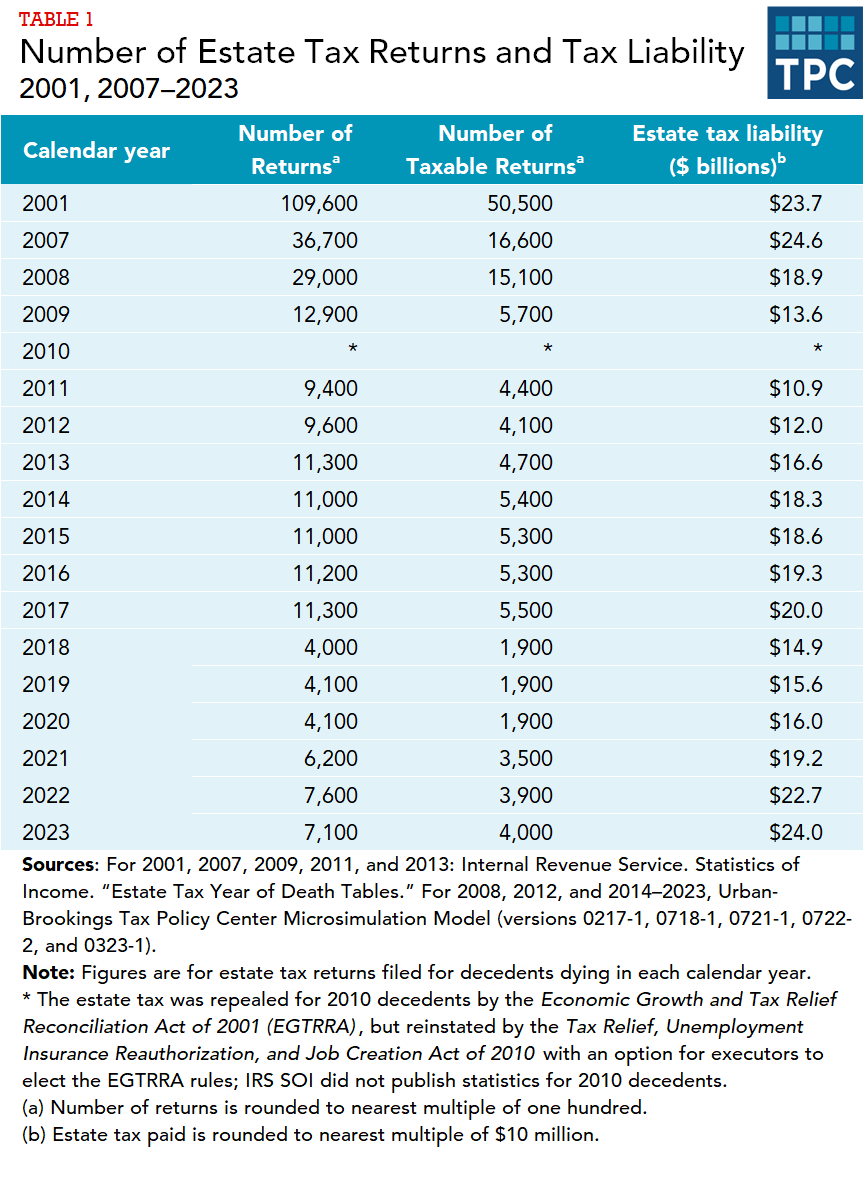

Internal Revenue Service data show that roughly 109,600 estate tax returns were filed for decedents in 2001, the year before the EGTRRA changes began to go into effect. Fewer than half—about 50,500—of those estates had any estate tax liability after credits. Estate tax liability totaled $23.7 billion (table 1).

For decedents in 2009, the year the final increase in the estate tax exemption under EGTRRA went into effect, only about 12,900 estate tax returns were filed, of which only 5,700 were taxable. Estate tax liability totaled $13.6 billion (table 1).

For those who died in 2010, executors could elect to have the EGTRRA rules apply, which meant that no estate tax was imposed. However, instead of recipients of bequests receiving a full step-up in basis, they were limited to $1.3 million (plus an additional $3 million for surviving spouses), with any additional unrealized gains required to be carried over. Recipients, therefore, will pay deferred income tax on these additional unrealized gains when the gains are realized.

For decedents in 2021 (with an exemption of $11.7 million), the Urban-Brookings Tax Policy Center estimated that only about 6,200 estate tax returns were filed, of which only 3,500 were taxable. Estate tax liability totaled $19.2 billion after credits (table 1). The estimated number of total and taxable estate tax returns are 7,600 and 3,900 for 2022, and 7,100 and 4,000 for 2023. Estimated estate tax liability is $22.7 billion in 2022 and $24.0 billion in 2023.

To put the number of estate tax returns filed in perspective, the Population Division of the Bureau of the Census estimates that about 2.8 million people died in 2022. Thus, an estate tax return will be filed for only about 0.25 percent of decedents, and only about 0.14 percent will pay any estate tax.

Updated January 2024

Gleckman, Howard. 2017. “Only 1,700 Estates Would Owe Estate Tax in 2018 under the TCJA.” TaxVox (blog). Urban-Brookings Tax Policy Center. Washington, DC.

Harris, Benjamin. 2013. “Estate Taxes after ATRA.” Tax Notes. February 25.

Joint Committee on Taxation. 2015. “History, Present Law, and Analysis of the Federal Wealth Transfer System.” JCX-52-15. Washington, DC.

Joint Committee on Taxation. 2018. “Overview of the Federal Tax System as in Effect for 2018.” JCX-3-18. Washington, DC.

US Department of Health and Human Services, Centers for Disease Control and Prevention. “Deaths: Final Data for 2014.” National Vital Statistics Report 65 (4).

McClelland, Robert. 2019. “Fixing the TCJA: Restoring The Estate Tax’s Exemption Levels.” TaxVox (blog). Urban-Brookings Tax Policy Center. Washington, DC.