The federal government spent nearly $1.5 trillion on health care in fiscal year 2022. In addition, income tax expenditures for health care totaled $300 billion.

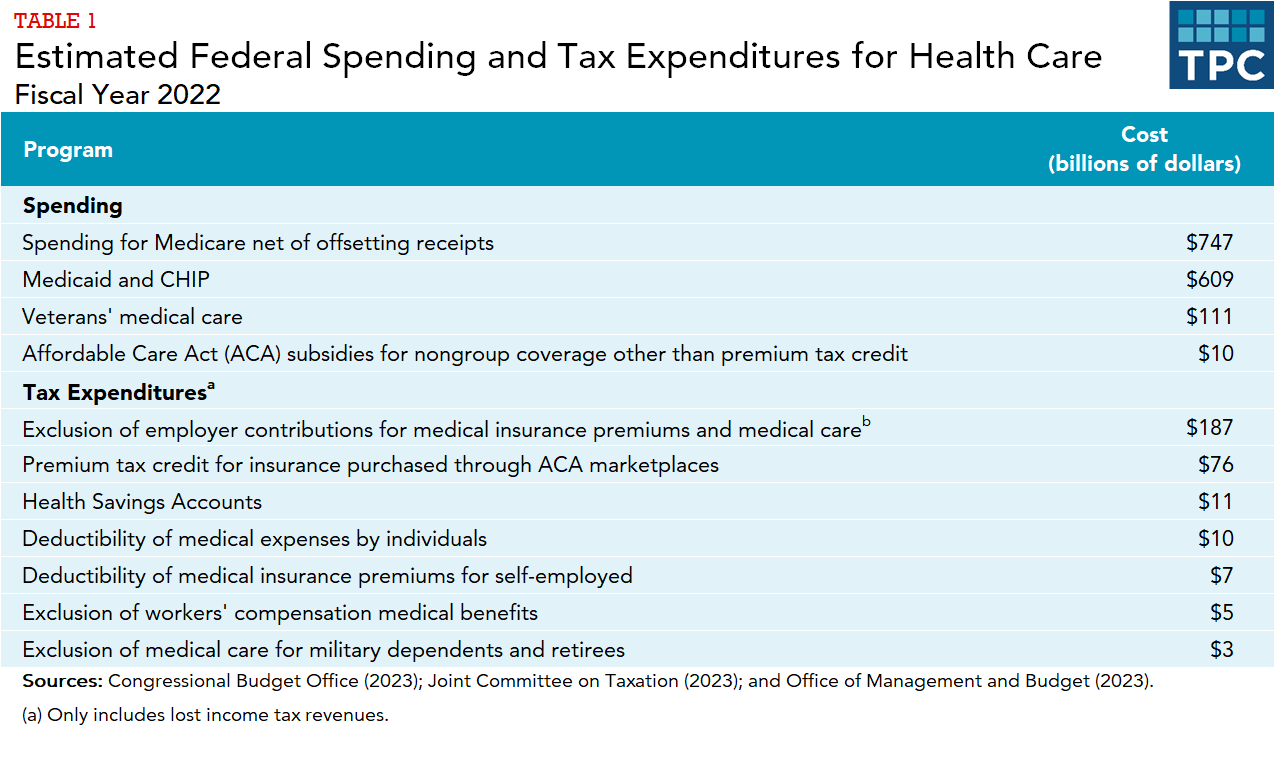

The federal government spent nearly $1.5 trillion on health care in fiscal year 2022 (table 1). Of that, Medicare claimed $747 billion, Medicaid and the Children’s Health Insurance Program (CHIP) claimed $609 billion, and veterans’ medical care claimed $111 billion.

In addition to these direct outlays, various tax provisions for health care reduced income tax revenue by nearly $300 billion. Over $185 billion of that figure comes from the exclusion from taxable income of employers’ contributions for medical insurance premiums and medical care. The exclusion of employer contributions to medical care also substantially reduced payroll taxes, though that impact is not included in official tax expenditure estimates. Including its impact on both income and payroll taxes, the exclusion reduced government revenue by $300 billion in 2022.