Tax expenditures will decline as a share of GDP through 2024, as temporary provisions of the 2021 American Rescue Plan Act expire, and then will increase after 2026 as most individual income tax provisions in the 2017 Tax Cuts and Jobs Act expire. Throughout the decade, tax expenditures as a share of GDP will remain about the same, but itemized deductions will increase while refundable tax credits will decline.

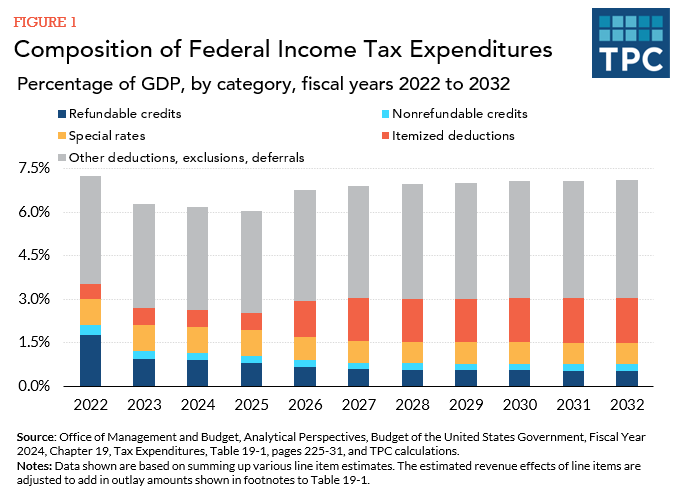

According to the Office of Management and Budget, tax expenditures as a share of GDP will remain roughly constant over the next 10 years, declining only slightly from 7.2 percent of GDP in 2022 to 7.1 percent of GDP in 2032 (figure 1). They will decline from 7.2 to 6.2 percent of GDP between 2022 and 2024 as provisions of the 2021 American Rescue Plan Act expire. They will then increase from 6.1 percent to 7.0 percent of GDP between 2025 and 2028 as the individual income tax provisions of the 2017 Tax Cuts and Jobs Act (TCJA) expire.

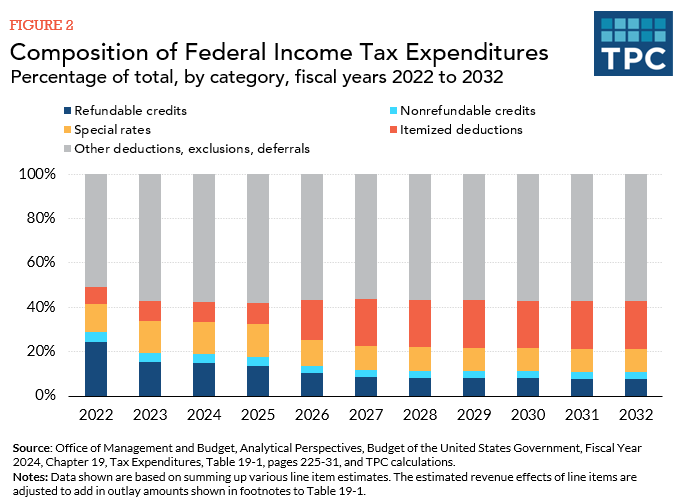

The composition of tax expenditures will change substantially, however, with the cost of itemized deductions increasing from 7.4 percent to 21.8 percent of tax expenditures between 2022 and 2032 and the cost of refundable credits declining from 24.4 percent to 7.6 percent of tax expenditures over the same period (figure 2).

The decline in refundable credits is mainly attributable to the expiration of the temporary increase and full refundability of the child credit after tax year 2021 and the further decline in the credit amount from $2,000 to $1,000 per eligible child after the expiration of TCJA at the end of 2025.

The increase in the itemized deductions after 2025 is primarily attributable to the expiration of two key provisions of TCJA: the doubling of the standard deduction amount and the $10,000 ceiling on the itemized deduction for state and local taxes (SALT deduction). The decline in the standard deduction will increase the number of taxpayers who itemize deductions on their tax returns and the total amount of itemized deductions greater than the standard deduction amount that they claim. And the expiration of the $10,000 ceiling on the SALT deduction directly increases that deduction, and by increasing the number of itemizers, it also increases the use of other itemized deductions.

Updated January 2024

Office of Management and Budget. “Tax Expenditures.” In Analytical Perspectives, Budget of the United States Government, Fiscal Year 2024. Washington, DC: The White House.