Most countries with a value-added tax use the credit-invoice method. Under this method, businesses are taxed on their sales at each stage of production but obtain credits for the taxes they paid on inputs.

Credit-Invoice Method

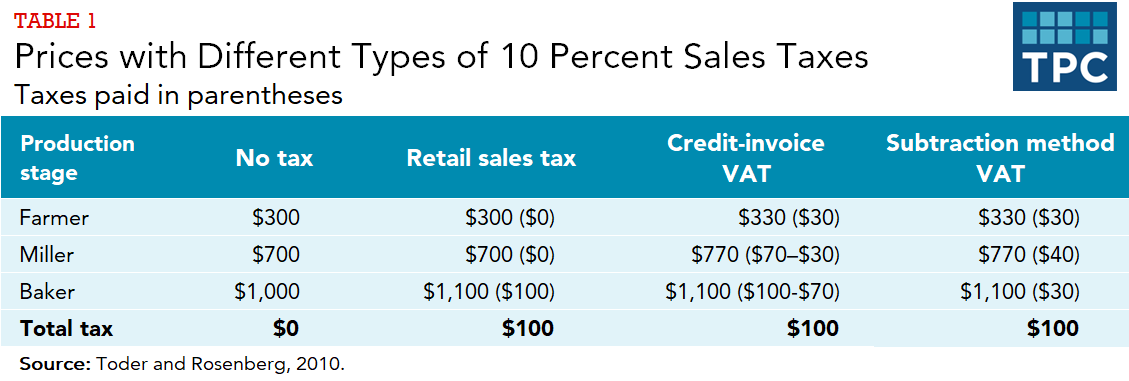

Most countries with a value-added tax (VAT) use the credit-invoice method. All sales by businesses are taxable, but sellers pass invoices on to the VAT-registered business taxpayers who purchase the sellers’ goods and services. These purchasers, in turn, claim a credit for taxes paid but then pay VAT on the full value of their sales. The result is that there are no net taxes on sales between registered VAT businesses, while the full value of the final sale to the consumer bears tax (Table 1).

Subtraction Method

Under a subtraction-method VAT, sometimes called a business transfer tax, businesses pay tax on the difference between the value of their sales and the value of their purchases from other businesses. As with the credit-invoice VAT, the sum of all the amounts subject to tax, without exemptions, is equal to the value of final sales. Japan uses a subtraction-method VAT, but it contains all the invoice requirements and rules of the credit-invoice method, so in practice it is not that different from the VATs used in other countries.

Updated January 2024

Tax Analysts. 2011. The VAT Reader: What a Federal Consumption Tax Would Mean for America. Falls Church, VA: Tax Analysts.

Toder, Eric, and Joseph Rosenberg. 2010. “Effects of Imposing a Value-Added Tax to Replace Payroll Taxes or Corporate Taxes.” Washington, DC: Urban-Brookings Tax Policy Center.

Toder, Eric, Jim Nunns, and Joseph Rosenberg. 2012. “Using a VAT to Reform the Income Tax.” Washington, DC: Urban-Brookings Tax Policy Center.