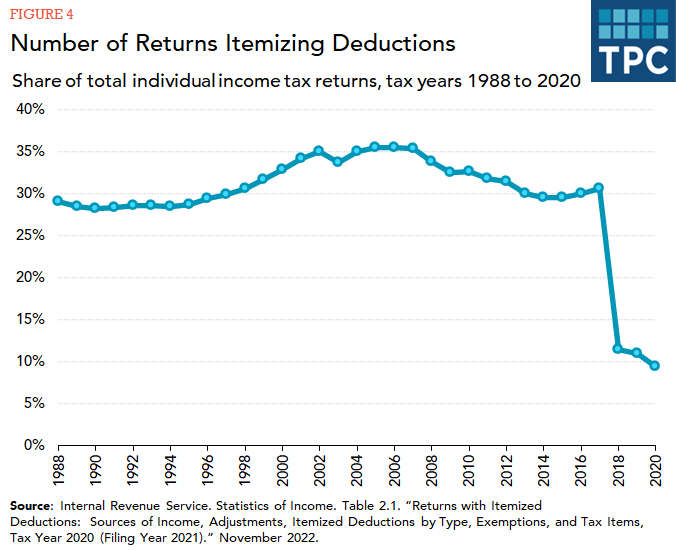

Taxpayers can choose to itemize deductions on their tax returns in lieu of claiming a standard deduction. Prior to 2018, around 30 percent of taxpayers, mostly those with higher incomes, chose to itemize, but increases in the standard deduction and limits to itemized deductions starting in 2018 have greatly reduced the number of itemizers.

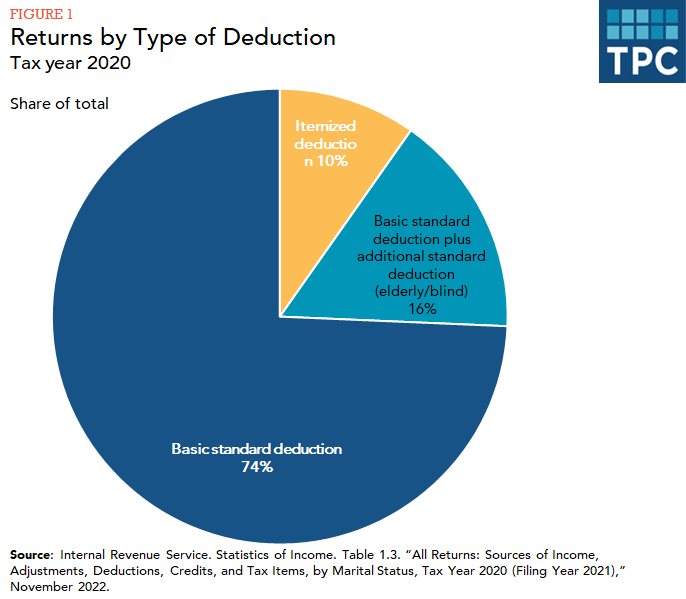

Taxpayers can either take a standard deduction or itemize their deductions to reduce the taxable income on their federal income tax return. Taxpayers typically choose to itemize when they can claim more on itemized deductions than on the standard deduction. In tax year 2020, 10 percent of taxpayers chose to itemize (figure 1).

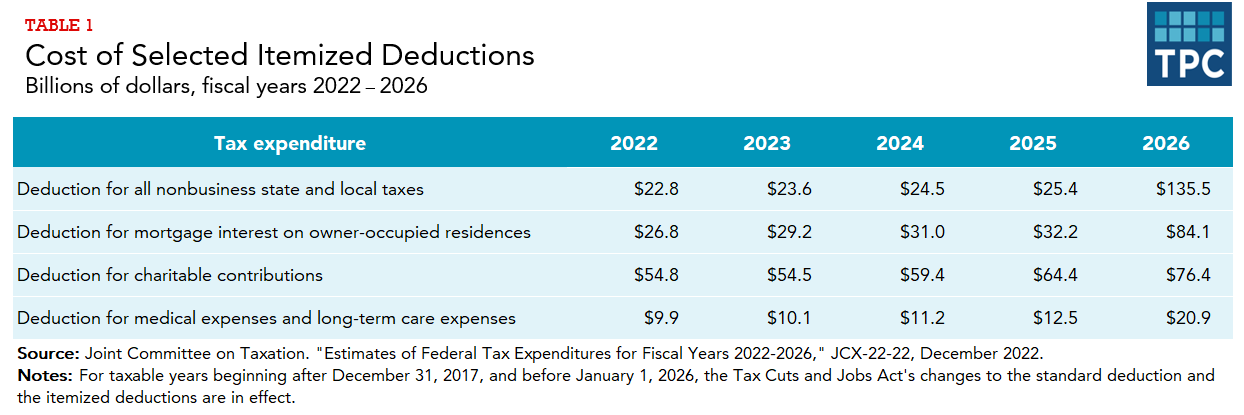

The most common itemized deductions are those for state and local taxes, mortgage interest, charitable contributions, and medical and dental expenses. The combined revenue cost of those four deductions is around $114 billion for fiscal year 2022 (table 1). However, as Toder and Berger (2019) have noted, the aggregate cost of itemized deductions in forgone tax revenue is likely less than the sum of the costs of each separate tax. They estimate, for example, that in 2019, forgone tax revenue from itemized deductions was $70 billion when accounting for their interactions, less than the $97 billion total for the cumulative costs of each separate provision.

How Did the Tax Cuts And Jobs Act Affect Itemized Deductions?

The 2017 Tax Cuts and Jobs Act (TCJA) significantly reduced the number of taxpayers who claim itemized deductions, because it substantially increased the standard deduction while also restricting or eliminating some itemized deductions for 2018 through 2025, mostly notably by placing an annual ceiling of $10,000 on the deduction for state and local taxes. In 2017, 31 percent of all individual income tax returns had itemized deductions, compared with just 9 percent in 2020.

These changes also substantially lowered the revenue costs of all itemized deductions for years 2018 through 2025 because fewer taxpayers claim them and, in some cases, the amount they claim has fallen too. When most individual income tax provisions of TCJA expire, the standard deduction will decline, itemized deductions will revert to pre-2018 rules, and the cumulative costs of the four most common itemized deductions will climb from $135 billion in 2025 to $317 billion in 2026 (table 1).

Who Itemizes?

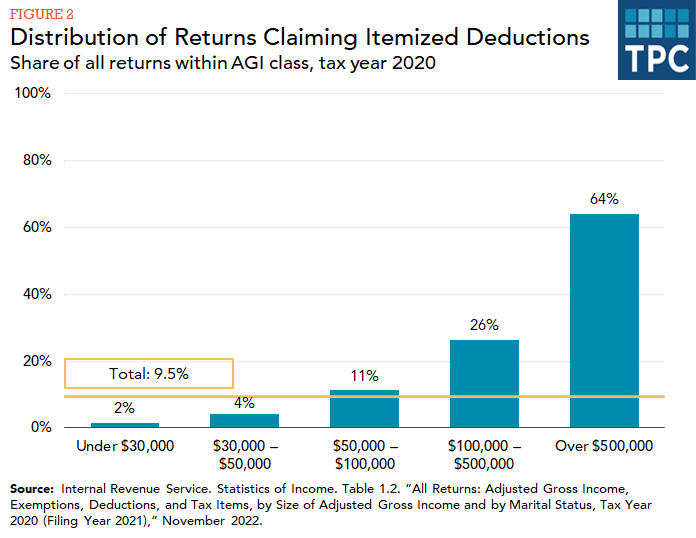

High-income taxpayers are much more likely to itemize than others. In tax year 2020, nearly two-thirds of tax returns reporting adjusted gross income (AGI) over $500,000 itemized deductions, compared with 11 percent of those with AGI between $50,000 and $100,000 and two percent of those with AGI under $30,000 (figure 2).

What Expenses Do Itemizers Deduct?

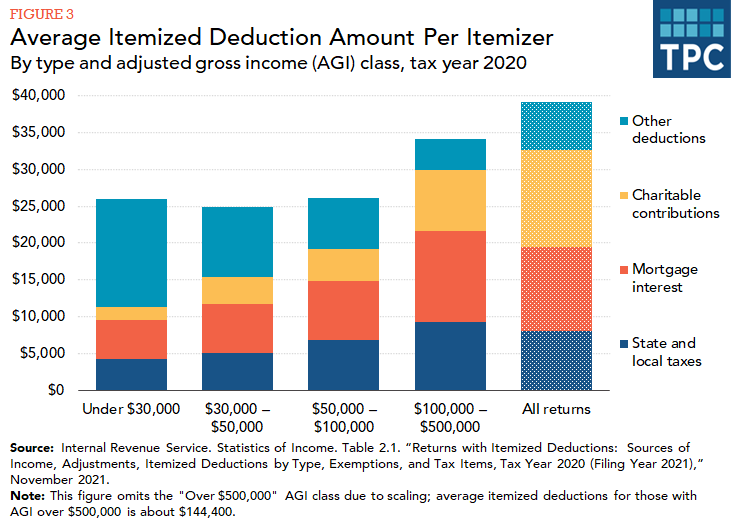

Among the 15.5 million tax returns claiming itemized deductions, the average amount claimed was around $39,000 in tax year 2020. The average amount claimed for those claiming deductions mostly rose with income, from about $26,000 for taxpayers with AGI under $30,000 (largely for medical and dental expenses) to over $144,000 for those with AGI over $500,000 (largely for charitable contributions) (figure 3). If we also take into account the share of taxpayers who did not itemize, the average amount claimed per individual income tax return was about $500 for taxpayers with AGI under $30,000, compared with about $90,000 for taxpayers with income over $500,000.

Altogether, the deduction for state and local taxes accounted for 20 percent of the total amount of itemized deductions in tax year 2020, whereas the deduction for mortgage and other interest made up 29 percent and the deduction for charitable contributions made up 34 percent (figure 3).

How Has the Share of Itemizers Changed Over Time?

The share of returns that itemize deductions climbed from 28 percent in 1994 to a peak of 36 percent in 2005, before dropping to 31 percent in 2017 and, post-TCJA, down to 9.5 percent in 2020 (figure 4).

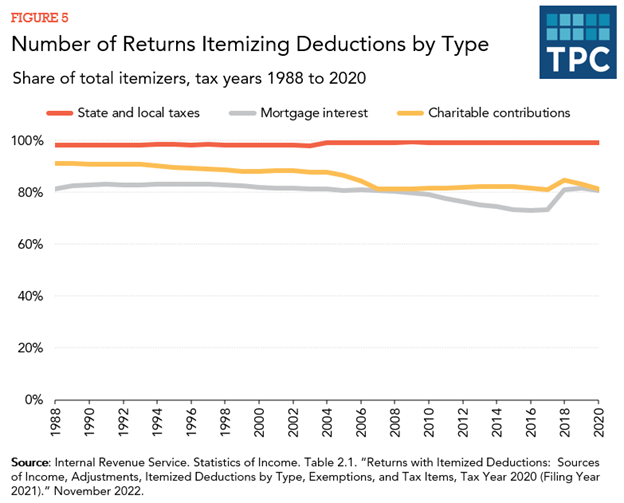

To better understand the trend pre-TCJA, a closer look at the three largest deductions—state and local taxes, home mortgage interest, and charitable contributions—helps (figure 5).

State and local taxes: Nearly all itemizers deduct state and local taxes, up to 99 percent both pre-TCJA and post-TCJA. A 2004 law that allowed taxpayers to deduct state and local sales taxes in lieu of income taxes slightly increased the number of itemizers taking this deduction.

Home mortgage interest: Before 2006, between 81 and 83 percent of itemizers deducted mortgage interest. But that share steadily dropped to a low of 73 percent in 2016, consistent with the decline in homeownership following the housing bubble collapse and falling mortgage interest rates. The amount of mortgage interest deducted by taxpayers increased sharply from 2004 to 2008 but fell through 2017 because of falling housing values and historically low mortgage rates, before climbing back up to over 80 percent in 2020.

Charitable contributions: The share of itemizers reporting charitable contributions declined from 91 percent in 1988 to 81 percent in 2020. Much of that drop occurred between 2005 and 2007, after Congress required written confirmations of cash gifts and limited deductions for donations of clothing and used vehicles.

A change in any one of these deductions affects the overall number of itemizers. For example, a decline in home mortgage interest might be enough to discourage a taxpayer from itemizing at all. Thus, the number of taxpayers itemizing state and local taxes or charitable contributions would also decrease.

Updated January 2024

Joint Committee on Taxation. 2001. Study of the Overall State of the Federal Tax System and Recommendations for Simplification, Pursuant to Section 8022(3)(B) of the Internal Revenue Code Of 1986. Vol. 2. JCS-3-01 [Individual income tax proposals 5, 6, 7, and 10]. Washington, DC.

President’s Advisory Panel on Federal Tax Reform. 2005. Simple, Fair, and Pro-Growth: Proposals to Fix America’s Tax System. [Chapters 3 and 5]. Washington, DC.