Federal excise tax revenues—collected mostly from sales of motor fuel, airline tickets, tobacco, alcohol, and health-related goods and services—totaled nearly $90 billion in 2022, or 1.8 percent of total federal tax receipts.

Excise taxes are narrowly based taxes on consumption, levied on specific goods, services, and activities. They can be either a per unit tax (such as the per gallon tax on gasoline) or a percentage of price (such as the airline ticket tax). Generally, excise taxes are collected from producers or wholesalers, and are embedded in the price paid by final consumers.

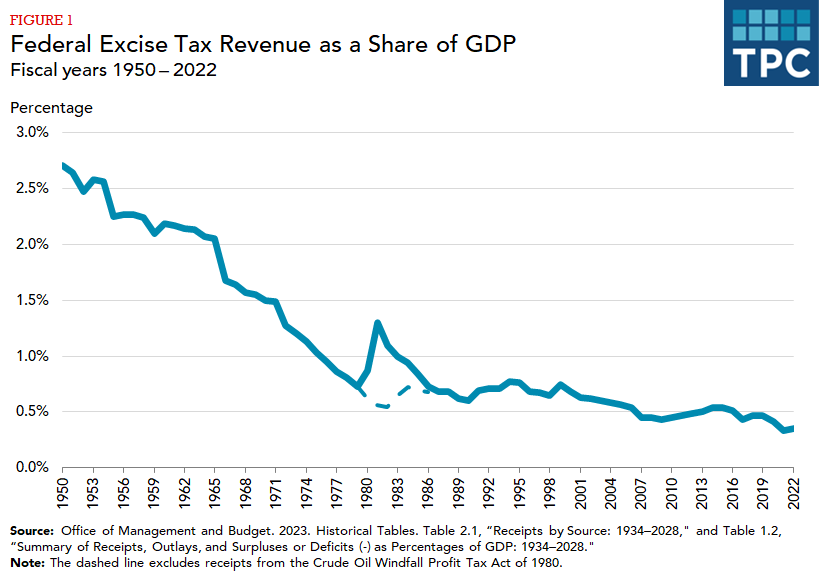

Federal excise tax revenue has declined over time relative to the size of the economy. As a percentage of gross domestic product (GDP), excise tax revenue fell from 2.7 percent in 1950 to 0.7 percent by 1979 (figure 1). Receipts temporarily increased because of the crude oil windfall profit tax imposed in 1980, but excluding that tax, (the dashed line in figure 1) revenue was about 0.7 percent of GDP through the 1980s and 1990s. Excise tax revenues as a percentage of GDP gradually declined again throughout the 2000s to roughly 0.4 percent in recent years.

General Fund or Trust Fund Revenues

Excise tax revenue is either transferred to the general fund or allocated to trust funds dedicated to specified purposes. General fund excise taxes account for roughly one-quarter of total excise receipts, with the remaining three-quarters going to trust funds.

General fund excise taxes are imposed on many goods and services, the most prominent of which are alcohol, tobacco, and health insurance. Other general fund excise taxes include taxes on local telephone service, vehicles with low-mileage ratings (“gas guzzlers”), ozone-depleting chemicals, and indoor tanning services.

Excise taxes dedicated to trust funds finance transportation as well as environmental- and health-related spending. The Highway Trust Fund and the Airport and Airway Trust Fund account for over 90 percent of trust fund excise tax receipts, mostly from taxes on gasoline and other transportation fuels (Highway Trust Fund), and air travel (Airport and Airway Trust Fund).

Major Federal Excise Taxes

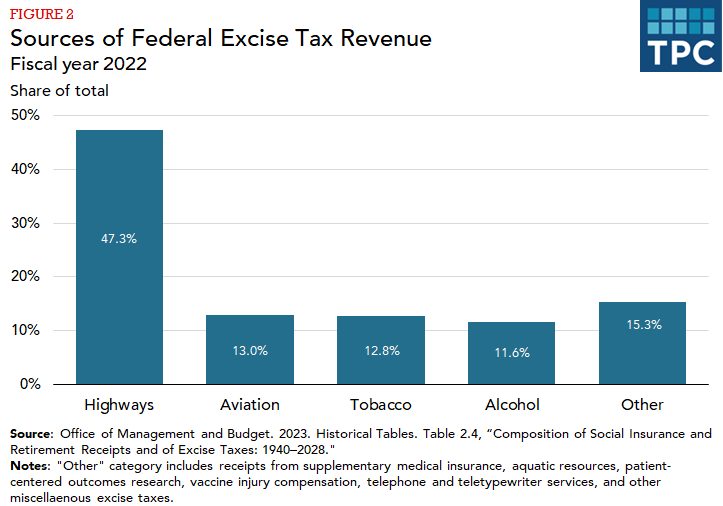

Five categories of excise taxes—highway, aviation, tobacco, alcohol, and health—accounted for the vast majority of total excise tax receipts in 2022 (figure 2).

Excise Taxes Dedicated to the Highway Trust Fund

Highway-related excise tax revenue totaled $41.5 billion in 2022, 47 percent of all excise tax revenue. Gasoline and diesel taxes, which are 18.4 and 24.4 cents per gallon, respectively, make up over 85 percent of total highway tax revenue, with the remaining from taxes on other fuels, trucks, trailers, and tires. (The tax rates for gasoline and diesel include a 0.1 percent tax earmarked for the Leaking Underground Storage Tank Trust Fund.) Most other motor fuels are also subject to excise taxes, although “partially exempt” fuels produced from natural gas are taxed at much lower rates. Tax credits for producers of certain fuels deemed environmentally superior—including biodiesel, renewable diesel mixtures, alternative fuel, and alternative fuel mixtures—have been extended through 2024.

Excise Taxes Dedicated to the Airport and Airway Trust Fund

Revenue from excise taxes dedicated to the Airport and Airway Trust Fund totaled $11.4 billion in 2022, accounting for 13 percent of all excise tax receipts. According to Congressional Budget Office data, more than 90 percent of aviation excise taxes came from taxing passenger airfares, with the remaining coming from taxes on air cargo and aviation fuels.

Domestic air travel is subject to a 7.5 percent tax based on the ticket price plus $4.50 (in 2022) for each flight segment (one takeoff and one landing). A 6.25 percent tax is charged on domestic cargo transportation. International arrivals and departures are taxed at $19.7 per person (in 2022); there is no tax on international cargo. Both the domestic segment fee and the international arrivals and departures fee are indexed for inflation. Taxes charged on aviation fuels include 19.3 cents per gallon on general aviation gasoline, 21.8 cents per gallon on general aviation jet fuel, and 4.3 cents per gallon on commercial jet fuel (in 2022).

Tobacco Excise Taxes

Revenue from tobacco taxes totaled $11.3 billion in 2022, accounting for nearly 13 percent of all excise tax revenue. Federal excise taxes are imposed on tobacco products, which include cigarettes, cigars, snuff, chewing tobacco, pipe tobacco, and roll-your-own tobacco. The tax is calculated per thousand cigars or cigarettes or per pound of tobacco, depending on the product. The tax equals about $1.01 per pack of 20 cigarettes. Cigarette papers and tubes are also subject to tax. Tobacco taxes are collected when the products leave bonded premises for domestic distribution. Exported products are exempt. Unlike other excise taxes collected by the IRS, alcohol and tobacco taxes are collected by the Alcohol and Tobacco Tax and Trade Bureau of the US Treasury Department.

Alcohol Excise Taxes

Excise tax revenue from alcoholic beverages amounted to $10.2 billion in 2022, 12 percent of total excise receipts. There are different tax rates for distilled spirits, wine, and beer. Distilled spirits generally are taxed at $13.50 per proof gallon (a proof gallon is one liquid gallon that is 50 percent alcohol). Tax rates on wines vary based on type and alcohol content, ranging from $1.07 per gallon for wines with 16 percent alcohol or less to $3.40 per gallon for sparkling wines, but lower rates apply for the first 750,000 gallons in a given year. Beer is typically taxed at $18.00 per barrel, although reduced rates apply for breweries producing less than two million barrels. Note that the alcohol content of beer and wine is taxed at a much lower rate than the alcohol content of distilled spirits.

Updated January 2024

Joint Committee on Taxation. 2023. Overview Of The Federal Tax System As In Effect For 2023. JCX-9R-23. Washington, DC.

Looney, Adam. 2018. Who Benefits from the ‘Craft Beverage’ Tax Cuts? Mostly Foreign and Industrial Producers. Washington, DC: Brookings Institution.

Rosenberg, Joseph. 2015. The Distributional Burden of Federal Excise Taxes. Washington, DC: Urban-Brookings Tax Policy Center.