The Affordable Care Act provides families with refundable, advanceable tax credits to purchase health insurance through exchanges. Premium credits cap contributions as a share of income for families with incomes over 100 percent of the federal poverty. After 2025, the credit will be less generous and only be available to families with incomes below 400 percent of FPL.

ACA Tax Credits for Health Insurance

The Affordable Care Act (ACA) provides families with refundable tax credits to purchase health insurance through both state and federal Marketplaces. Tax filers can claim premium credits if they (1) have incomes over 100 of the federal poverty level (FPL), (2) are ineligible for adequate and affordable health insurance from other sources, and (3) are legal residents of the United States. Tax filers with incomes between 100 and 138 percent of the FPL are generally ineligible for premium credits if they reside in states that take advantage of the ACA’s Medicaid-eligibility expansion. After 2025, enhancements made by the American Rescue Plan Act of 2021 and extended by the Inflation Reduction Act of 2022 will expire and premium credits will be less generous and only be available to families with incomes below 400 percent of FPL.

Calculation of Premium Credits

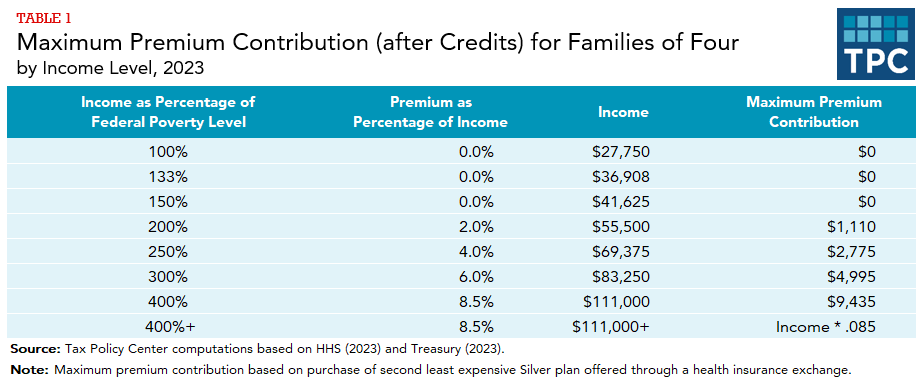

Premium credits effectively cap family contributions as a share of income for those purchasing midrange “benchmark” plans. In 2023, families with incomes below 200 percent of FPL pay nothing for a benchmark plan. For families with higher incomes, maximum family contributions range from 2.0 percent of income for families at 200 percent of FPL to 8.5 percent of income for families at 400 percent of FPL and higher. (table 1). Premium credits equal the difference between gross premiums and maximum family contributions.

For example, consider a family of four with income equal to 200 percent of FPL in 2023 purchasing an insurance plan costing $15,000. Multiplying family income (here, $55,500) by the applicable 2.0 percent maximum premium results in a family contribution of $1,110 and thus a premium credit of $13,890 ($15,000- $1,110).

The example above assumes family purchases the second least expensive (Silver) plan from the menu of Bronze, Silver, Gold, and Platinum health insurance plans offered through Marketplaces. If the family purchased a more expensive plan, the credit would remain the same and the family would pay the full difference in premiums.

Advance Premium Credits and Reconciliation

Premium credits are based on a household’s income in the tax year premiums are paid. The credits are calculated the following year, when households file their income tax returns. However, the Treasury usually sends advance payment of premium credits directly to the insurance company, and the household pays a reduced premium. The advance payment of credits is based on estimated income, generally from the last tax return filed before enrollment in health insurance. If actual income in the year of enrollment is less than estimated income, families qualify for additional credit amounts when filing their returns. If actual income is greater than estimated income, families must repay part or all of the advance credit.

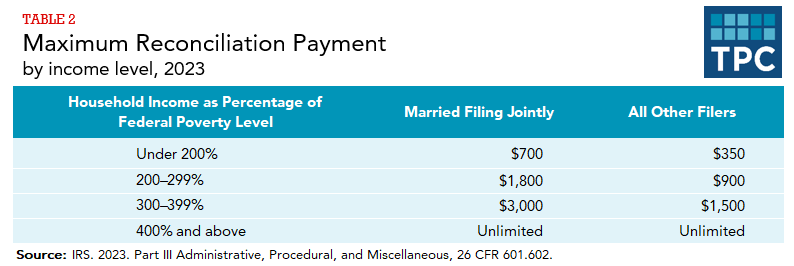

Fortunately for most households with large income increases, the maximum reconciliation payment is limited. In tax year 2023, the maximum payment ranged from $700 for married couples with incomes below 200 percent of FPL to $3,000 for couples with incomes of at least 300 but less than 400 percent of FPL (table 2). Families whose income equals 400 percent or more of FPL have no limit on reconciliation payments.

For tax year 2020, 40 percent of families receiving advanced credits had to make reconciliation payments. Analysis of tax refund data suggests that for most lower-income filers, reconciliation payments will reduce tax refunds rather than require additional payments. Still, reconciliation will likely present hardships for some families receiving advanced premium credits, even if they do not have tax payments due, because many low-income households have grown to rely on tax refunds for pressing needs.

Updated January 2024

Burman, Leonard E., Gordon B. Mermin, and Elena Ramirez. 2015. “Tax Refunds and Affordable Care Act Reconciliation.” Washington, DC: Urban-Brookings Tax Policy Center.

Internal Revenue Service. 2023. “Premium Tax Credit.” Publication 974. Washington, DC.

Internal Revenue Service. 2022. “Revenue Procedure 2022-38.” Washington, DC.

Jacobs, Ken, Dave Graham-Squire, Elise Gould, and Dylan Roby. 2013. “Large Repayments of Premium Subsidies May Be Owed to the IRS If Family Income Changes Are Not Promptly Reported.” Health Affairs 32 (9): 1538–45.

US Department of Health and Human Services. 2023. “Annual Update of the HHS Poverty Guidelines.” Washington, DC.

US Department of the Treasury. 2023. “General Explanations of the Administration’s Fiscal Year 2024 Revenue Proposals.” Washington, DC.