Roth individual retirement accounts offer no up-front tax breaks. However, withdrawals of earnings and principal (with some restrictions) are not taxed.

A Roth IRA is a form of individual retirement account in which investors make contributions with after-tax earnings. Eligibility is limited by income. There’s still a big tax break: contributions accrue tax-free in the account, and withdrawals generally are not taxed. In tax year 2020, nearly 23 million taxpayers, or 11 percent of all taxpayers, owned a Roth IRA.

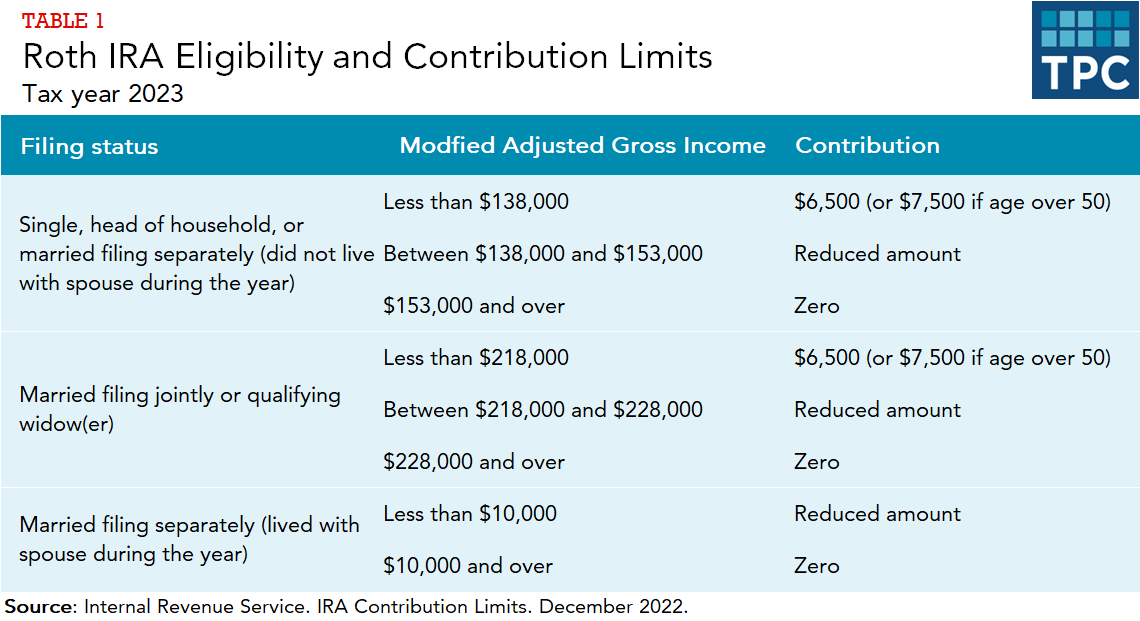

Eligibility and Contribution Limits

Only people with incomes under specified limits are eligible to contribute to a Roth IRA. In 2023, the contribution limit for IRAs is the lesser of $6,500 ($7,500 for individuals over age 50) or the taxpayer’s taxable compensation. The contribution limit falls once household income exceeds certain thresholds, eventually reaching zero (table 1).

Withdrawals

Investors can withdraw their contributions (but not investment returns earned on those contributions) at any time without being subject to tax. However, to receive tax benefits on investment returns, withdrawals must be qualified distributions. This means that the investor must wait at least five years after their first contribution and after reaching age 59 years and 6 months. Under certain other conditions, such as making a qualified first-time home purchase or becoming physically disabled, they may make qualified withdrawals before the age of 59 years and 6 months. For nonqualified distributions, the investment earnings portion of the distributions is subject to tax and possibly a 10-percent penalty tax. There are several exceptions to the penalty for early withdrawal of investment earnings.

Updated January 2024

Holden, Sarah, and Daniel Schrass. 2017. “The Role of IRAs in US Households’ Saving for Retirement, 2017.” Washington, DC: Investment Company Institute.

Topoleski, John J. 2015. “Traditional and Roth Individual Retirement Accounts (IRAs): A Primer.” Washington, DC: Congressional Research Service.