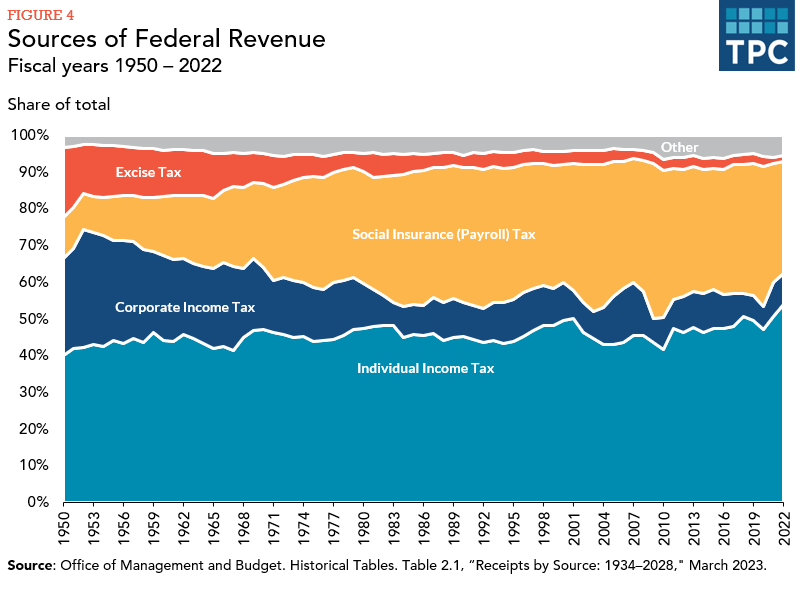

Over half of federal revenue comes from individual income taxes, 9 percent from corporate income taxes, and another 30 percent from payroll taxes that fund social insurance programs (figure 1). The rest comes from a mix of sources.

TOTAL REVENUES

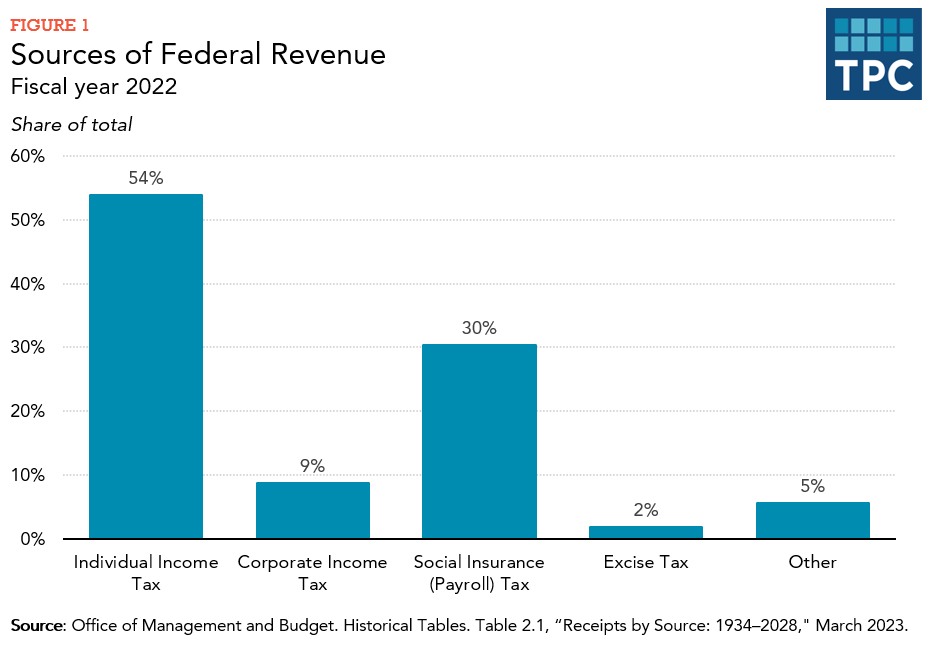

The federal government collected revenues of $4.9 trillion in 2022—equal to 19.6 percent of gross domestic product (GDP) (figure 2). Over the past 50 years, federal revenue has averaged 17.4 percent of GDP, ranging from 20.0 percent (in 2000) to 14.5 percent (in 2009 and 2010).

INDIVIDUAL INCOME TAX

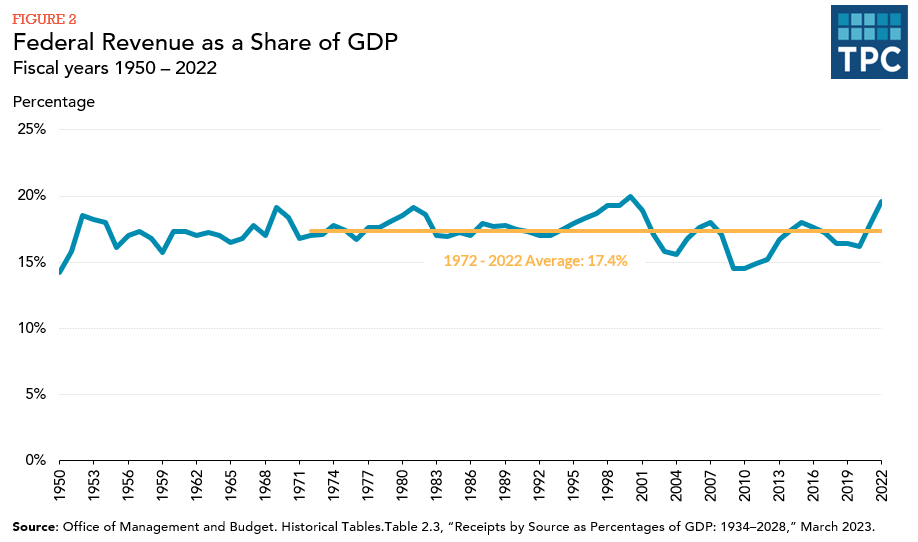

The individual income tax has been the largest single source of federal revenue since 1944, and in 2022, it comprised 54 percent of total revenues and 10.5 percent of GDP in 2022 (figure 3). Individual income tax revenue in 2022 was the highest ever recorded. The last time it was around 10 percent or more of GDP was in 2000, at the peak of the 1990s economic boom. Whereas, the last significant drop was following the 2007-2009 Great Recession, when it was 6.0 percent of GDP in 2010. Per the Congressional Budget Office’s projections, individual income tax revenues will decline to 8.8 percent of GDP by 2025, before averaging 9.6 percent in subsequent years.

CORPORATE INCOME TAX

The tax on corporate profits yielded 9 percent of federal government revenue in 2022. Revenue from the tax has largely fallen from an average of 3.7 percent of GDP in the late 1960s to an average of just 1.5 percent of GDP over the past ten years, with its share of GDP increasing to 1.7 percent of GDP in 2022 (figure 3).

SOCIAL INSURANCE (PAYROLL) TAXES

The payroll taxes on wages and earnings that fund Social Security and the hospital insurance portion of Medicare make up the largest portion of social insurance receipts. Other sources include payroll taxes for the railroad retirement system and the unemployment insurance program, and federal workers’ pension contributions. In total, social insurance levies were 30 percent of federal revenue in 2022.

The creation of the Medicare program in 1965, combined with periodic increases in Social Security payroll taxes, caused social insurance receipts to grow from 1.6 percent of GDP in 1950 to over 6.0 percent since the 1980s (figure 3). A temporary reduction in employees’ contributions to Social Security taxes—part of the stimulus program following the financial meltdown—reduced social insurance receipts to 5.3 percent of GDP in 2011 and 2012. Social Insurance tax receipts have since climbed back up to around 6.0 percent of GDP since then (5.9 percent in 2022).

FEDERAL EXCISE TAXES

Taxes on purchases of goods and services, mostly from gasoline, cigarettes, alcoholic beverages, and airline travel, generated 1.8 percent of federal revenue in 2022. These taxes, too, are on the wane: excise tax revenues have fallen steadily from an average of 1.7 percent of GDP in the late 1960s to an average of 0.5 percent in the last ten years, most recently 0.4 percent of GDP in 2022 (figure 3).

OTHER REVENUES

The federal government also collects revenue from estate and gift taxes, customs duties, earnings from the Federal Reserve System, and various fees and charges. In total, these sources generated 5.0 percent of federal revenue in 2022. As a share of GDP, they have ranged between 0.5 to 1.1 percent of GDP since 1950 (figure 3). In recent years, the figure has been on the high end of that range because of unusually high profits of the Federal Reserve Board relating to its efforts to stimulate the economy since 2008.

SHARES OF TOTAL REVENUE

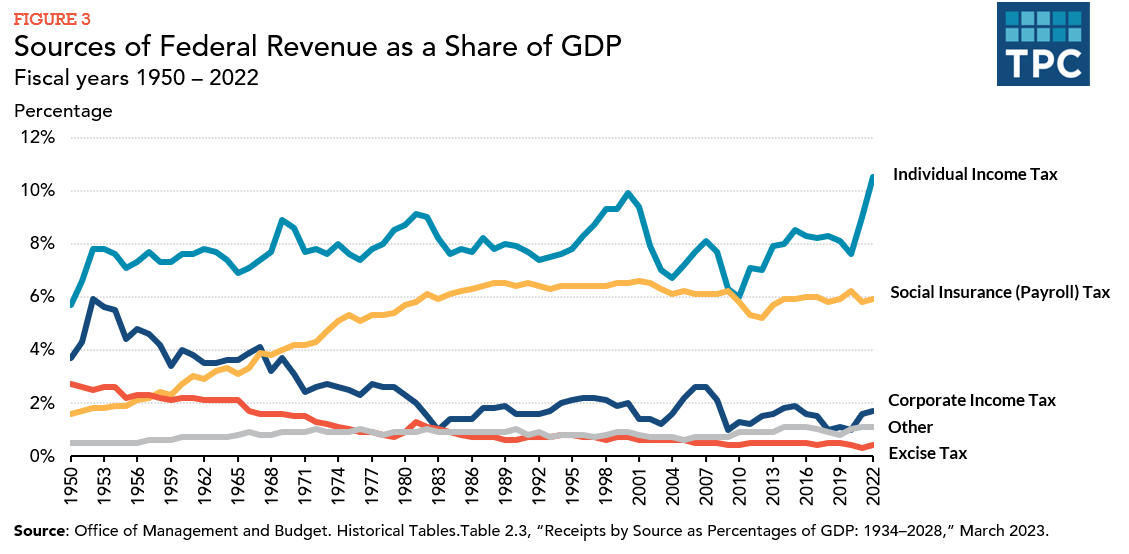

The individual income tax has provided nearly half of total federal revenue since 1950, while other revenue sources have waxed and waned (figure 4). Excise taxes brought in 19 percent of total revenue in 1950, but only about 2 percent in recent years. The share of revenue coming from the corporate income tax dropped from about one-third of the total in the early 1950s to under 10 percent in most years since the early 1980s. In contrast, payroll taxes provided nearly one-third of revenue since the early 1990s, compared with under 15 percent in the 1950s.