Carried interest, income flowing to the general partner of a private investment fund, often is treated as capital gains for the purposes of taxation. Some view this tax preference as an unfair, market-distorting loophole. Others argue that it is consistent with the tax treatment of other entrepreneurial income.

Carried interest is a contractual right that entitles the general partner of an investment fund to share in the fund’s profits. These funds invest in a wide range of assets, including real estate, natural resources, publicly traded stocks and bonds, and private businesses. Hedge funds, for example, typically trade stocks, bonds, currencies, and derivatives. Venture capital funds invest in start-up businesses. And private equity funds invest in established businesses, often buying publicly traded companies and taking them private.

Depending on the investment, the general partner’s share of the profits can take a variety of forms: interest, royalties, long- or short-term capital gains, and dividends. There is ongoing debate about whether partners receiving long-term capital gains and qualified dividends as carried interest should receive the preferential tax rates accorded to regular investors.

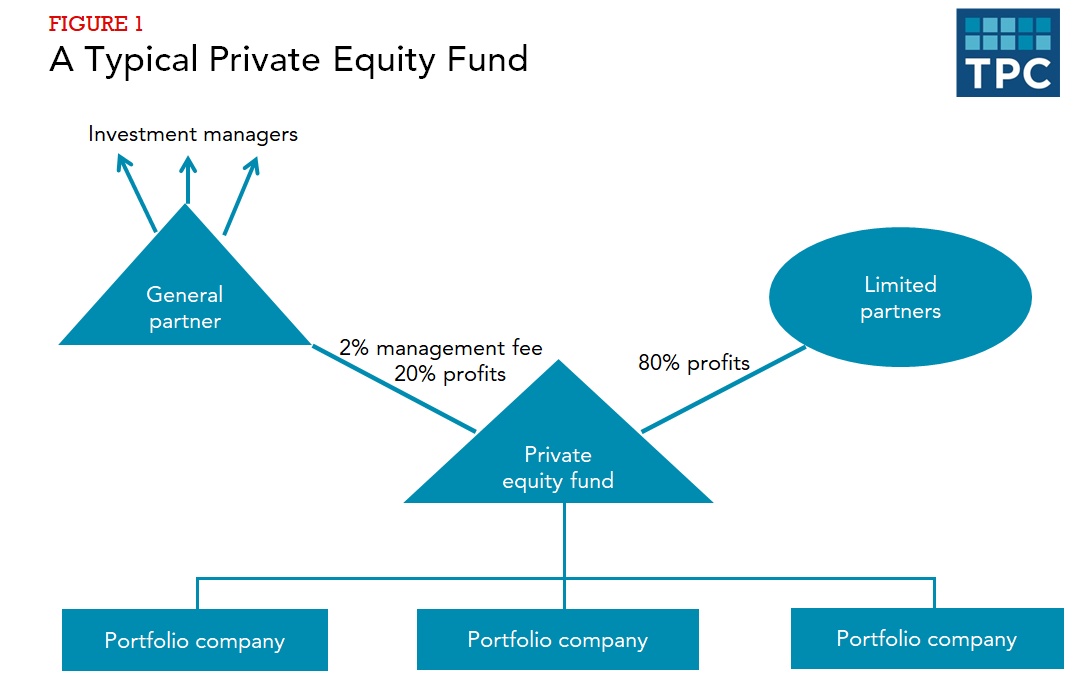

The preferential tax rate is especially important for a private equity fund and its managers. A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which, in turn, passes the gains on to the investment managers (figure 1). The managers pay a federal personal income tax on these gains at a rate of 23.8 percent (20 percent tax on net capital gains plus 3.8 percent net investment income tax).

The general partner receives its carried interest as compensation for its investment management services. (Typically, the general partner also receives a separate annual fee based on the size of the fund’s assets.) The limited partners receive the balance of the fund’s profits in proportion to their capital investment. A typical division for a private equity fund is 20 percent of the profits to the general partner and 80 percent to the limited partners.

Private equity funds use their capital to buy companies and improve their operations, governance, capital structure, and market positioning. Then they sell the companies and pass any profits to the partners.

Many commentators argue that it would be fairer and more efficient economically to tax carried interest like wage and salary income, which is subject to a top rate of 37 percent. They draw an analogy between the general partners and investment bankers, who pay tax at ordinary rates on their wages, salaries, and bonuses. They also object that most service providers are not able to treat their income as capital gains. Some commentators add, if we treat carried interest like wage and salary income for the general partners, we also should allow the limited partners to deduct the carried interest as an ordinary expense.

But others believe that the general partners are more like entrepreneurs who start a new business and may, under current law, treat part of their return as capital—not as wage and salary income—for their contribution of “sweat equity.” Our tax system largely accommodates this conversion of labor income to capital because it cannot measure and time the contribution of the sweat equity.

The Tax Cuts and Jobs Act slightly curtailed the tax preference for carried interest, requiring an investment fund to hold assets for more than three years, rather than one year, to treat any gains allocated to its investment managers as long term (Code sec. 1061). Gains from the sale of assets held three years or less would be short term, taxed at a top rate of 40.8 percent which includes, potentially, the additional tax for net investment income (Code sec. 1411). However, most private equity funds hold their assets for more than five years, so the longer holding period requirement may not affect them much.

Updated January 2024

Fleischer, Victor. 2008. “Two and Twenty: Taxing Partnership Profits in Private Equity Funds.” New York University Law Review 83 (1): 8–15.

Gergen, Mark. 1992. “Reforming Subchapter K: Compensating Service Partners.” Tax Law Review 48: 69–111.

Marron, Donald J. 2016. “Goldilocks Meets Private Equity: Taxing Carried Interest Just Right.” Washington, DC: Urban-Brookings Tax Policy Center.

Rosenthal, Steven M. 2013. “Taxing Private Equity Funds as Corporate ‘Developers’.” Tax Notes. January 21.

Steuerle, C. Eugene. 2007. “Tax Reform, Tax Arbitrage, and the Taxation of ‘Carried Interest’.” Testimony before the US House of Representatives Committee on Ways and Means, Washington, DC, September 6.

Viard, Alan D. 2008. “The Taxation of Carried Interest: Understanding the Issues.” National Tax Journal 60 (3): 445–60.

Weisbach, David A. 2008. “The Taxation of Carried Interest in Private Equity.” Virginia Law Review 94: 715–64.