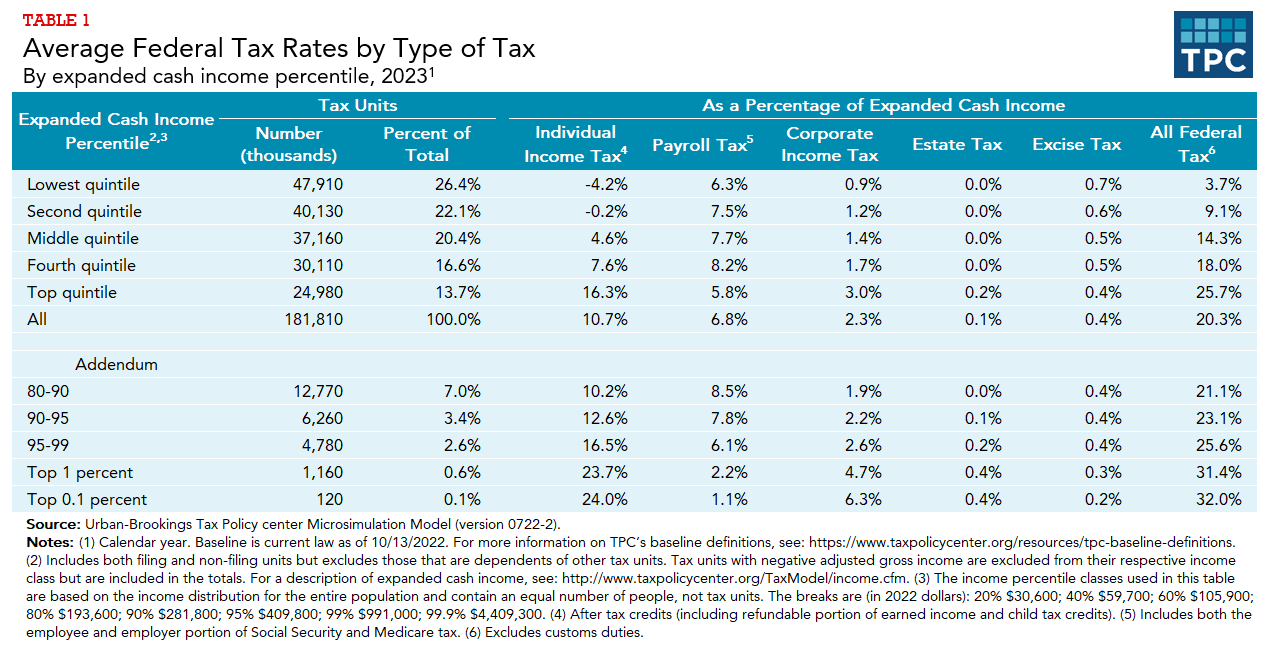

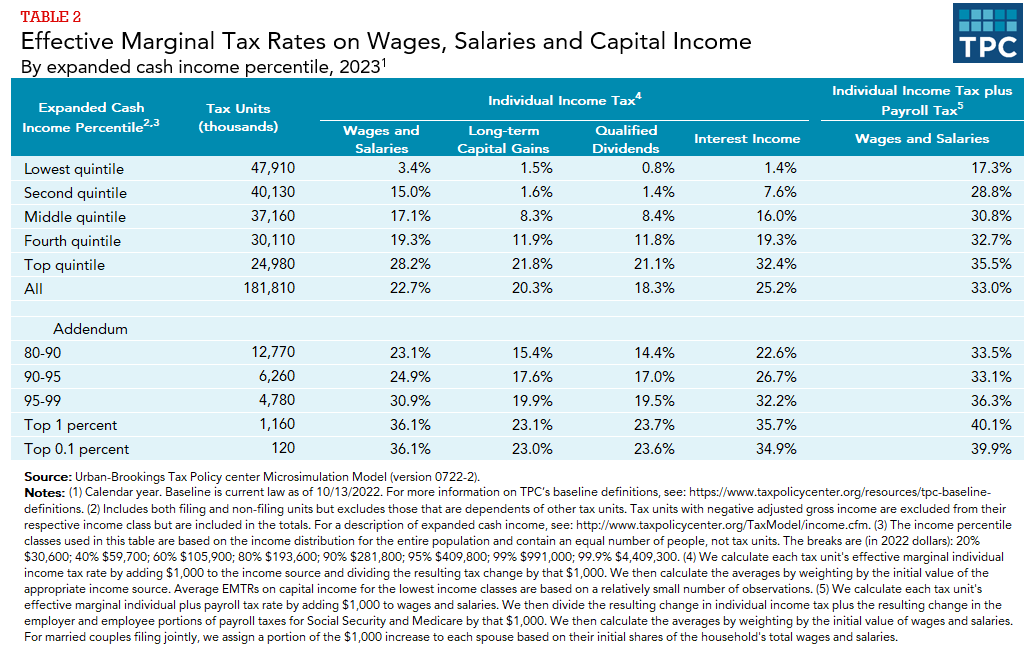

Average tax rates measure tax burden, while marginal tax rates measure the impact of taxes on incentives to earn, save, invest, or spend an additional dollar.

The average tax rate is the total amount of tax divided by total income. For example, if a household has a total income of $100,000 and pays taxes of $15,000, the household’s average tax rate is 15 percent. The marginal tax rate is the incremental tax paid as a percentage of additional income. If a household were to earn an additional $10,000 in wages on which they paid an additional $1,530 of payroll tax and $1,500 of income tax, the household’s marginal tax rate would be 30.3 percent.

Average tax rates are a measure of a household’s tax burden; that is, how taxes affect the household’s ability to consume. Marginal rates measure the degree to which taxes affect household (or business) economic incentives such as whether to work more, save more, accept more risk in investment portfolios, or change what they buy. Higher marginal rates reduce incentives to engage in more of a particular activity (such as work) or (in the case of sales taxes) consume more of a particular item.

Updated January 2024

Joint Committee on Taxation. 2015. “Fairness and Tax Policy.” JCX-48-15. Washington, DC: Joint Committee on Taxation.

Maag, Elaine, C. Eugene Steuerle, Ritadhi Chakravarti, and Caleb Quakenbush. 2012. “How Marginal Tax Rates Affect Families at Various Levels of Poverty.” National Tax Journal 65 (4): 759–82.