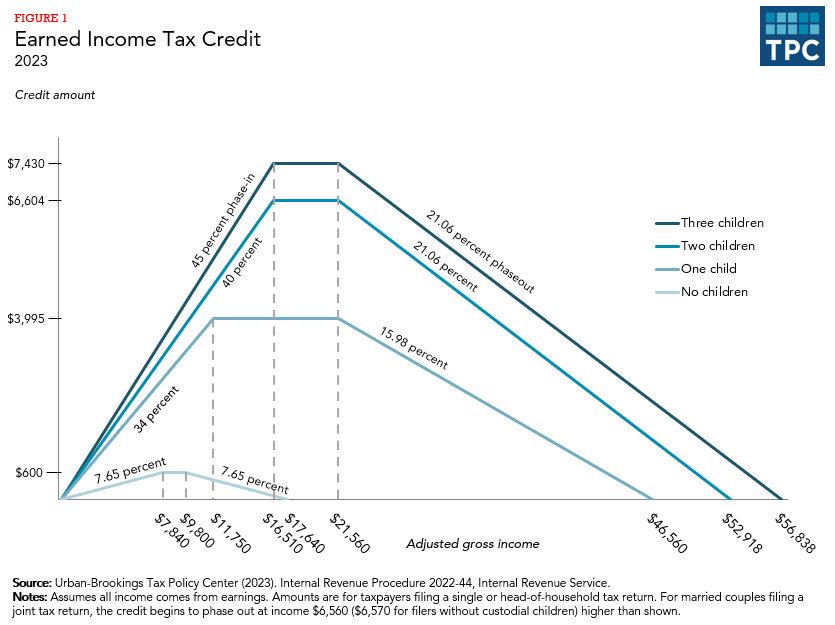

The earned income tax credit subsidizes low-income working families. The credit equals a fixed percentage of earnings from the first dollar of earnings until the credit reaches its maximum. The maximum credit is paid until earnings reach a specified level, after which it declines with each additional dollar of income until no credit is available.

How the EITC Works

The earned income tax credit (EITC) provides substantial support to low- and moderate-income working parents who claim a qualifying child based on relationship, age, residency, and tax filing status requirements. It provides a much smaller amount of support to workers without qualifying children (often called childless workers).

By design, the EITC only benefits people who work. Workers receive a credit equal to a percentage of their earnings up to a maximum credit. Both the credit rate and the maximum credit vary by family size, with larger credits available to families with more children. After the credit reaches its maximum, it remains flat until earnings reach the phaseout point. Thereafter, it declines with each additional dollar of income until no credit is available (figure 1).

In 2023, the maximum credit for families with one child is $3,995, while the maximum credit for families with three or more children is $7,430.

In contrast to the substantial credit for workers with children, childless workers can receive a maximum credit of only $600. Moreover, the credit for childless workers phases out at much lower incomes. Also, childless workers must be at least 25 and not older than 64 to qualify for a subsidy—restrictions that do not apply to workers with children. As a result of these tighter rules, 97 percent of benefits from the credit go to families with children.

Impact of the EITC

In general, research shows that the EITC increaseslabor force participation of single people and primary earners in married couples (Dickert, Houser, and Scholz 1995; Eissa and Liebman 1996; Meyer and Rosenbaum 2000, 2001). The credit, however, appears to have little effect on the number of hours they work once employed. Although the EITC phaseout could cause people to reduce their hours (because credits are lost for each additional dollar of eanings, which is effectively a surtax on earnings in the phaseout range), there is little empirical evidence of this happening (Meyer 2002).

The one group of people that may reduce hours of work in response to the EITC incentives is lower-earning spouses in a married couple (Eissa and Hoynes 2006). On balance, the overall increase in work resulting from the EITC much exceeds the decline in labor force participation among second earners in married couples.

Some recent analysis sheds some doubt on earlier estimates of the extent to which the EITC increased labor force participation (Kleven 2020). Possibly, a strong economy and welfare reform played a larger role than the EITC in increasing work for single mothers during the 1990s, when most EITC studies found the credit increased work. However, subsequent analysis found robust evidence that the EITC increased labor force participation (Schanzenbach and Strain 2020).

Tax credits are typically not included in official measures of the poverty rate. However, if the EITC included in earnings, it would have been the single most effective antipoverty program for working-age people, lifting about 5.6 million people out of poverty in 2018, including 3 million children (CBPP 2023).

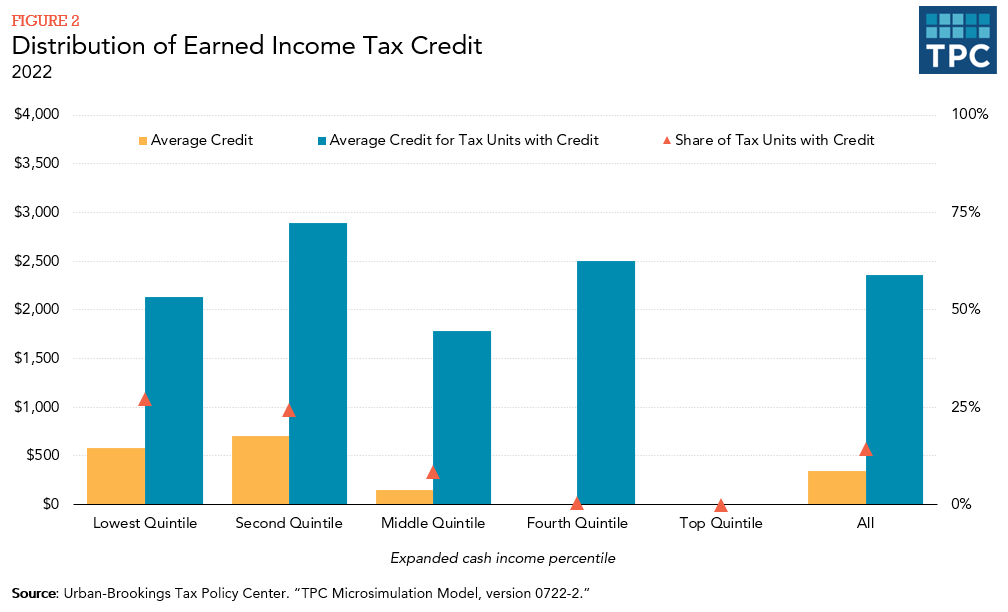

The EITC is concentrated among the lowest earners, with almost all of the credit going to households in the bottom three quintiles of the income distribution (figure 2). Very few households in the fourth quintile receive an EITC (fewer than 2 percent).

Recent Changes

As a result of legislation enacted in 2001, the EITC phases out at higher income levels for married couples than for single individuals. The threshold for married couples was further increased as part of the American Recovery and Reinvestment Act of 2009 (ARRA) (Congressional Research Service 2018). The same act increased the maximum EITC for workers with at least three children. The American Taxpayer Relief Act of 2012 made the 2001 EITC changes permanent (a $3,000 higher (indexed) phaseout threshold for married couples than for singles) and extended the ARRA changes (a $5,000 higher (indexed) phaseout threshold for married couple than for singles, and a higher credit maximum for workers with at least three children) through the end of 2017. The Protecting Americans from Tax Hikes Act of 2015 made these latter changes permanent. The Tax Cuts and Jobs Act, enacted in 2017, adopted the chained CPI, an inflation measure that usually grows more slowly than the CPI, for use in the determining values of indexed parameters of the federal income tax system, beginning in 2018. As a result, the EITC will probably grow more slowly over time in the future.

The American Rescue Plan, enacted in March 2021, temporarily expanded the childless EITC for 2021 in several ways. The maximum credit for childless workers increased from $543 to $1,502. Single filers with incomes up to about $21,000 and joint filers with income up to about $27,000 were made eligible for the EITC, up from $16,000 for single people and $22,000 for married couples under previous law. The minimum eligibility age for the credit was lowered from age 25 to 19 for most workers, to 24 for students attending school at least half-time, and to 18 for former foster children and homeless youth. The restriction on filers ages 65 and older claiming the credit was removed. All of these changes expired at the end of 2021.

Proposals for Reform

Both Democrats and Republicans have proposed amendments to provide a substantial EITC for childless workers (Marr 2015). These proposals typically involve expanding the eligible age limits for the childless EITC—lowering the age of eligibility from 25 to 21 and increasing the age of eligibility from 64 to 67—increasing the maximum credit, and expanding the income range over which the credit is available. The changes in the American Rescue Plan for childless workers were similar to reforms previously proposed by both congressional Democrats and Republicans (Marr 2015). A more far-reaching approach to reform that would also expand benefits to childless workers would be to separate the credit into two pieces—one focused on work and one focused on children. There are many examples of this type of reform proposal, including the President’s Advisory Panel on Federal Tax Reform (2005), the Bipartisan Policy Center (2013), and Maag (2015b).

Error Rates and the EITC

The EITC likely delivers more than a quarter (28.5 percent) of all payments in error, according to a recent Internal Revenue Service (IRS) compliance study. The largest source of error was determining whether a child claimed for the EITC actually qualified (IRS 2014). The child must live with the parent (or other relative) claiming the EITC for more than half of the year to qualify. The IRS receives no administrative data that can verify where a child resided for the majority of the year, making it difficult for the agency to monitor compliance. Attempts to use administrative data from other programs to verify child residence have not proven successful (Pergamit et al. 2014).

To reduce overclaims of the credit, the Protecting Americans from Tax Hikes (PATH) Act of 2015 requires the IRS to delay tax refunds for taxpayers who claim an EITC or additional child tax credit on their returns until at least February 15. Delaying refunds was paired with a requirement that third-party income documents related to wages and income be provided to the IRS by January 31 (in prior years, this information was due the last day of February for paper filing and March 31 for electronic filing, and employers were automatically granted a 30-day extension, if requested). As a result, information needed to verify wages often got to the IRS well after the first returns had been processed. Together, these measures allowed earlier systemic verification of EITC claims, which protected more revenue than in prior years (Treasury Inspector General for Tax Administration 2018).

Updated January 2024

Bipartisan Policy Center. 2013. “Bipartisan Policy Center (BPC) Tax Reform Quick Summary.” Washington, DC.

Center on Budget and Policy Priorities. 2023. “Policy Basics: The Earned Income Tax Credit.” Washington, DC.

Congressional Research Service. 2018. “The Earned Income Tax Credit (EITC): A Brief Legislative History.” Washington, DC.

DaSilva, Bryann. 2014. “New Poverty Figures Show Impact of Working-Family Tax Credits.” Off the Charts (blog). October 17.

Dickert, Stacy, Scott Houser, and John Karl Scholz. 1995. “The Earned Income Tax Credit and Transfer Programs: A Study of Labor Market and Program Participation.” Tax Policy and the Economy¸ volume 9. Cambridge MA: MIT Press.

Eissa, Nada, and Hilary Hoynes. 2006. “Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply.” Working Paper 11729. Cambridge, MA: National Bureau of Economic Research.

Eissa, Nada, and Jeffrey B. Liebman. 1996. “Labor Supply Response to the Earned Income Tax Credit.” Working Paper 5158. Cambridge, MA: National Bureau of Economic Research.

Executive Office of the President and Department of the Treasury. 2014. “The President’s Proposal to Expand the Earned Income Tax Credit.” Washington, DC: The White House.

Internal Revenue Service. 2014. “Compliance Estimates for the Earned Income Tax Credit Claimed on 2006–2008 Returns.” Washington, DC.

Kleven, Henrik. 2020. “The EITC and the Extensive Margin: A Reappraisal.” NBER Working Paper No. 26405. Revised, first issued October 2019.

Maag, Elaine. 2015a. “Earned Income Tax Credit in the United States.” Journal of Social Security Law 22 (1).

Maag, Elaine. 2015b. “Investing in Work by Reforming the Earned Income Tax Credit.” Washington, DC: Urban Institute.

Marr, Chuck. 2015. “EITC Could be Important Win for Obama and Ryan.” Washington, DC: Center on Budget and Policy Priorities.

Meyer, Bruce D. 2002. “Labor Supply at the Extensive and Intensive Margins: The EITC, Welfare, and Hours Worked.” American Economic Review 92 (2): 373–79.

Meyer, Bruce D., and Dan T. Rosenbaum. 2000. “Making Single Mothers Work: Recent Tax and Welfare Policy and Its Effects.” National Tax Journal (53): 1027–62.

Meyer, Bruce D., and Dan T. Rosenbaum. 2001. “Welfare, the Earned Income Tax Credit, and the Labor Supply of Single Mothers.” Quarterly Journal of Economics 116 (3): 1063–1114.

Pergamit, Mike, Elaine Maag, Devlin Hanson, Caroline Ratcliffe, Sara Edelstein, and Sarah Minton. 2014. “Pilot Project to Assess Validation of EITC Eligibility with State Data.” Washington, DC: Urban Institute.

President’s Advisory Panel on Federal Tax Reform. 2005. “Simple, Fair, and Pro-Growth: Proposals to Fix America’s Tax System.” Washington, DC: US Department of the Treasury.

Short, Kathleen. 2013. “The Research Supplemental Poverty Measure: 2012.” Current Population Reports P60-247. Washington, DC: US Census Bureau.

Treasury Inspector General for Tax Administration. 2018. “Employer Noncompliance with Wage Reporting Requirements Significantly Reduces the Ability of Verify Refundable Tax Credit Claims Before Refunds are Paid.” Reference No. 2018-40-015. Washington, DC: Department of the Treasury.