It does not appear to spur economic growth significantly. But lower rates can foster tax avoidance strategies and increase complexity.

Throughout the history of the income tax, capital gains generally have been taxed at lower rates than ordinary income. In 1988, 1989, and 2000, the top tax rate on capital gains was the same as the top tax rate on ordinary income. Since 2003, qualified dividends have also been taxed at the same lower rates as capital gains. Proponents of the tax preference argue that lower tax rates for capital gains and dividends offset taxes already paid at the corporate level, spur economic growth, encourage risk taking and entrepreneurship, offset the effects of inflation, prevent “lock-in” (the disincentive to sell assets), and mitigate the tax penalty on savings under the income tax. Critics, for their part, complain that the lower tax rate disproportionately benefits the wealthy and encourages tax-sheltering schemes.

The double-taxation argument goes only so far. Capital gains from the sale of stock are only about half of all capital gains. And even when a gain arises from the sale of corporate stock, corporate profits can often escape full taxation through business tax preferences.

Economic Growth

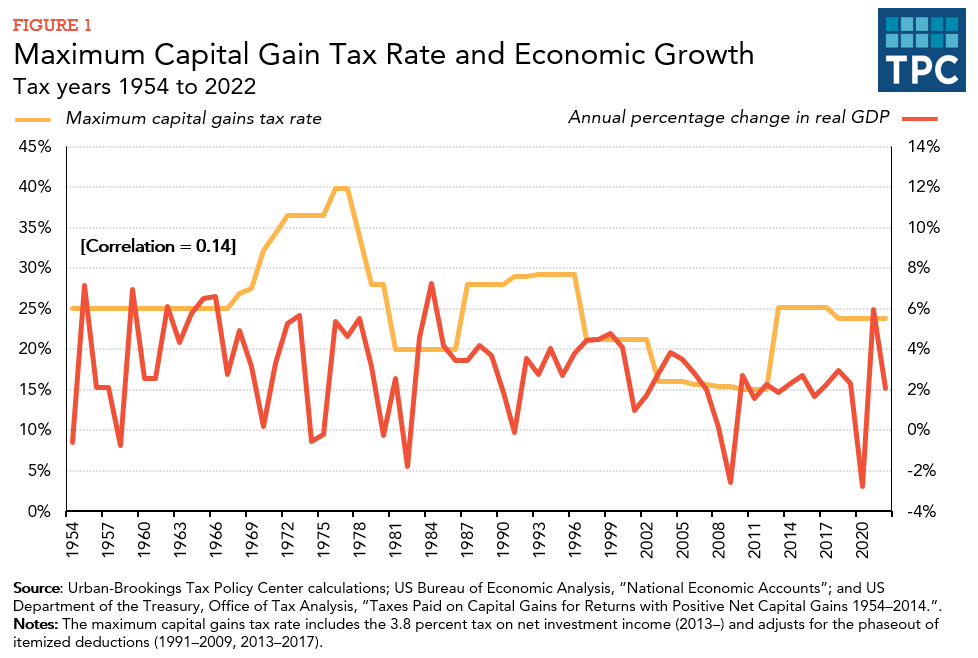

Do lower taxes on capital gains spur economic growth? By reducing the disincentive to invest, a lower capital gains tax rate might encourage more investment, leading to higher economic growth. Many factors determine growth, but the tax rate on capital gains does not appear to be a major factor, as evidenced in figure 1, which shows the top tax rates on long-term capital gains along with real economic growth from 1954 to 2022; though the COVID-19 pandemic impacts the data for years 2020 onwards.

Capital gains may arise from risky investments, and a lower capital gains tax rate might encourage such risk taking. Even without a tax preference, taxing gains while allowing full current deductions for losses on a symmetric basis would reduce risk by reducing the after-tax variance of returns. However, deductibility of losses is limited, which limits the risk-reduction benefit of capital gains taxation for some taxpayers. Under current law, taxpayers can use capital losses to offset capital gains and, for noncorporate taxpayers, up to $3,000 of additional taxable income other than capital gains. The unused portion of a capital loss may be carried over to future years. Noncorporate taxpayers also can carry any remaining capital losses forward to future years indefinitely.

It is true that inflation causes part of almost any nominal capital gain. But inflation actually affects the returns on currently taxed assets (interest, dividends, rents, and royalties) more than it affects capital gains, which are taxed when an asset is sold.

Beneficiaries of a Lower Tax Rate

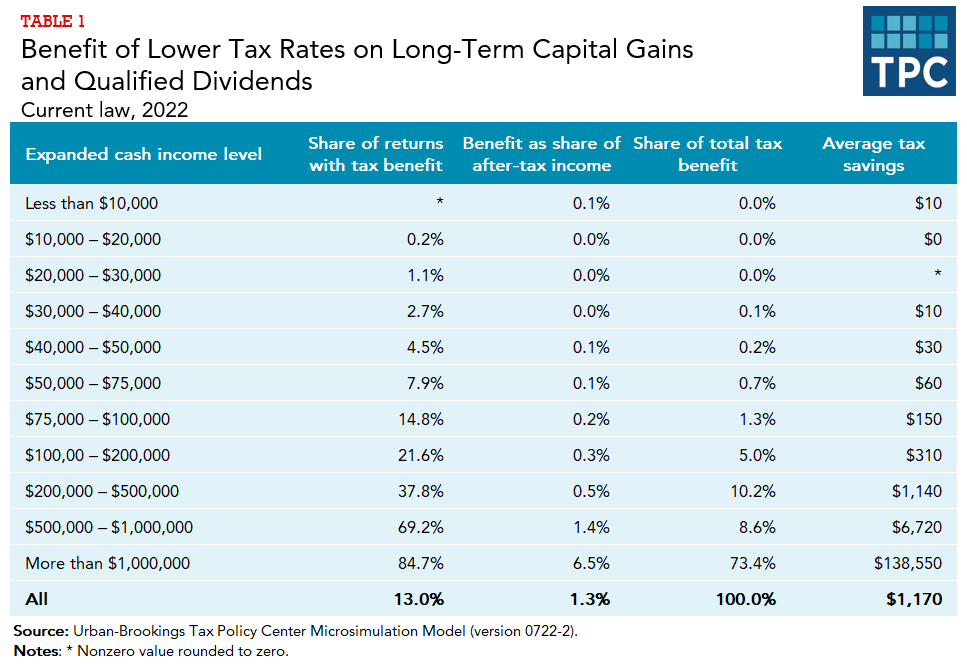

Critics are correct that low tax rates on capital gains and dividends accrue disproportionately to the wealthy. The Urban-Brookings Tax Policy Center estimates that in 2022, more than 70 percent of the tax benefit of the lower rates went to taxpayers with income over $1 million (table 1).

Low tax rates on capital gains contribute to many tax shelters that undermine economic efficiency and growth. These shelters employ sophisticated financial techniques to convert ordinary income (such as wages and salaries) to capital gains. For top-bracket taxpayers, tax sheltering can save up to 17 cents per dollar of income sheltered. The resources that go into designing, implementing, and managing tax shelters could otherwise be used for productive purposes.

Finally, the low rate on capital gains complicates the tax system. A significant portion of tax law and regulations is devoted to policing the boundary between lightly taxed returns on capital assets and fully taxed ordinary income.

Updated January 2024

Burman, Leonard E. 1999. The Labyrinth of Capital Gains Tax Policy: A Guide for the Perplexed. Washington, DC: Brookings Institution Press.

Burman, Leonard E. 2007. “End the Break on Capital Gains.” Washington Post. July 30.

Burman, Leonard E. 2018. “Should Treasury Index Capital Gains?.” TaxVox (blog). May 10. Washington, DC: Urban-Brookings Tax Policy Center.

Gale, William G. 2022. “Tackling the Tax Code: Evaluating Fairness, Efficiency, and Potential to Spur Inclusive Economic Growth.” Testimony before the House Select Committee on Economic Disparity and Fairness in Growth, Washington, DC, June 22.