Tax-favored retirement arrangements can be sliced and diced in various ways. There are three big differences, though: who sponsors them, who bears the risk, and when Uncle Sam takes his cut.

Employer-Sponsored Plans

There are two primary types of employer-sponsored plans. Defined-benefit plans generally distribute funds regularly to retired employees according to formulas that reflect employees’ years of work and earnings. In defined-contribution plans, of which the 401(k) plan is the most common, balances depend on past employee and employer contributions, and on the investment returns accumulated on those contributions. In both defined contribution and traditional 401(k) plans, contributions to the plans and investment earnings within the plans are tax-free, while withdrawals from the plans are taxable.

Individual Retirement Accounts

Individuals also may establish their own individual retirement accounts (IRAs), and either contribute or roll over balances from employer-sponsored plans. There are two main types: traditional IRAs and Roth IRAs. Like traditional 401(k)s, traditional IRAs allow taxpayers to deduct their contributions, up to a preset limit, from taxable income and accrue income tax-free within the accounts Tax liability is only triggered when funds are distributed to the account owners. By contrast, contributions to Roth IRAs and Roth 401(k)s yield no tax deduction when they are made, but income accrued within the account and distributions to retirees are tax free.

Participation

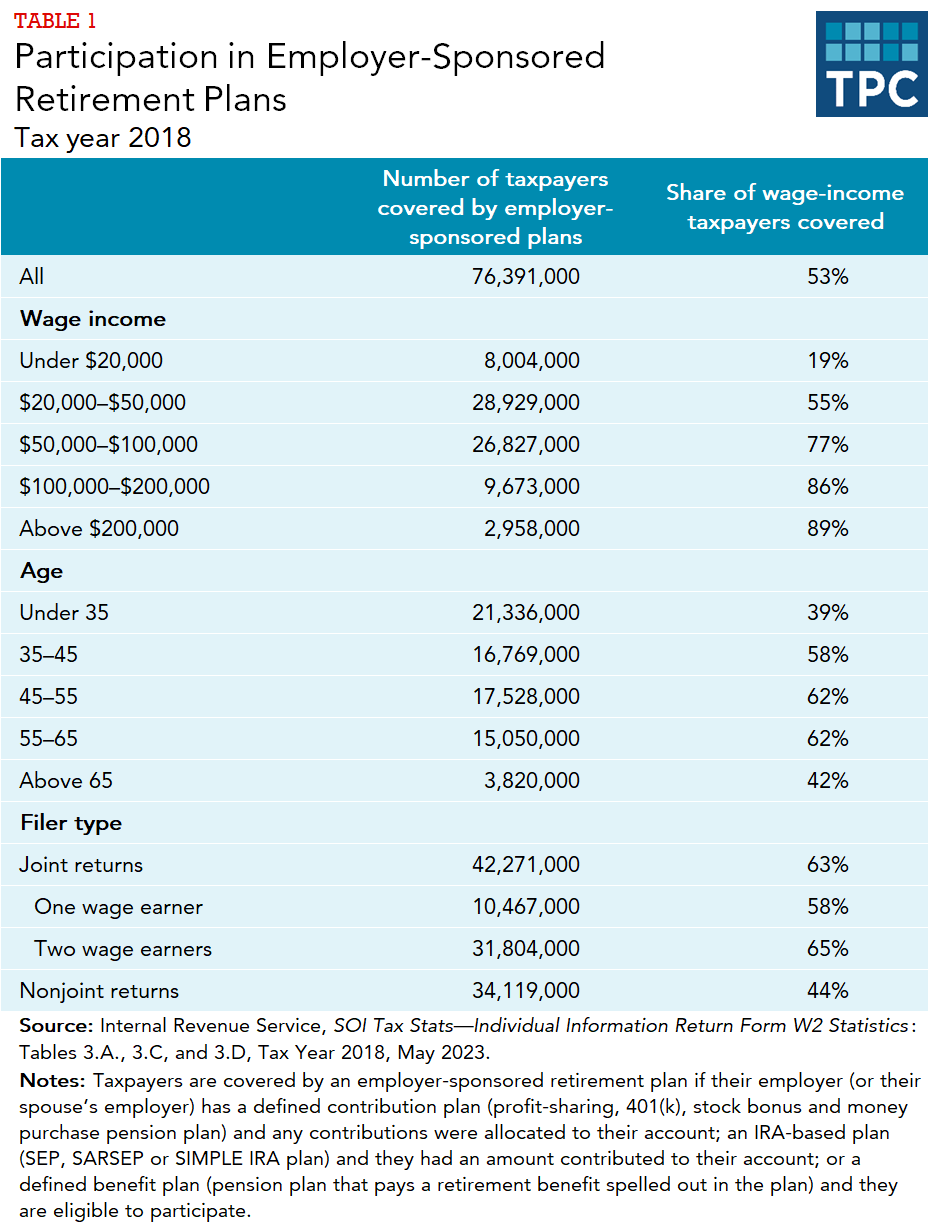

Employers are not required to offer their employees retirement benefits, and only about half of all workers were covered by an employer-sponsored plan in tax year 2018. Coverage rates were highest for workers ages 45 to 65 and for those earning more than $100,000 (table 1).

Large companies are more likely to sponsor retirement plans than small firms. In 2019, about two-thirds of full-time workers at firms with more than 100 employees participated in employer-sponsored plans, compared with about half of full-time workers at firms with less than 50 employees (National Compensation Survey 2019). In 2019, almost all full-time state and local government employees (96 percent and 90 percent respectively) participated in employer-sponsored plans of one sort or another.

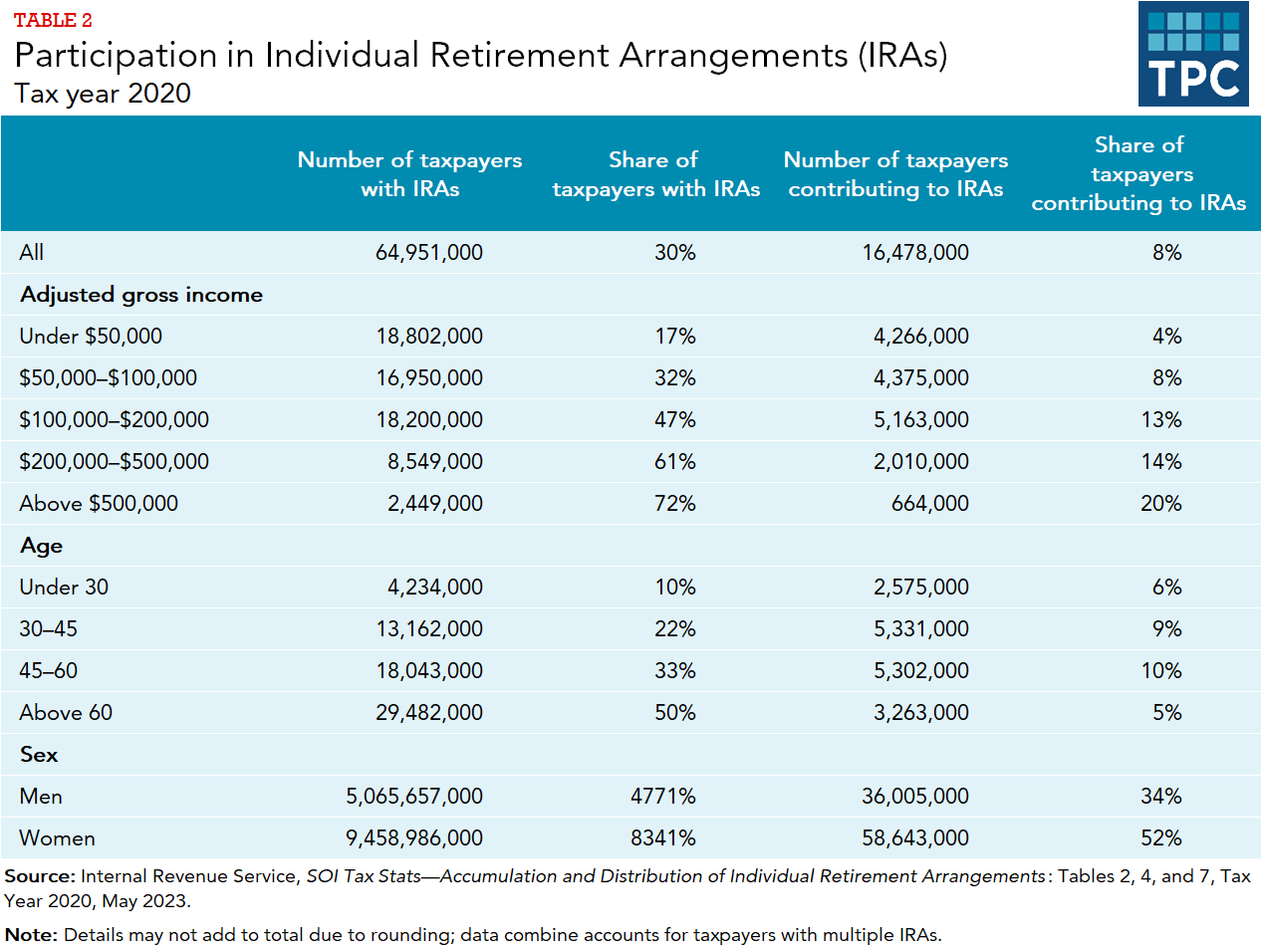

Participation in individual retirement accounts is less common than participation in employer-sponsored plans. In addition, while 30 percent of taxpayers owned an IRA in tax year 2020, only about 8 percent contributed to their plan in that year (table 2). Similar to employer-sponsored plans, participation in individual retirement accounts increases by age and income.

Distributions

Employees of employer-sponsored plans, and owners of traditional IRAs, must take required minimum distributions, which generally begin after a participant reaches 72 (or retires, if later, in the case of an employer-sponsored plan). Prior to 2020, the age was 70 ½. Required minimum distributions apply also after a participant’s death.

Updated January 2024

Congressional Budget Office 2011. “The Distribution of Major Tax Expenditures in 2019.” Washington, DC: Congressional Budget Office.

Holden, Sarah, and Daniel Schrass. 2017. “The Role of IRAs in US Households’ Saving for Retirement, 2017.” Washington, DC: Investment Company Institute.

National Compensation Survey. 2019. “Employee Benefits in the United States, March 2019.” Washington, DC: Bureau of Labor Statistics.

Toder, Eric, Surachai Khitatrakun, and Aravind Boddupalli. 2020. “Tax Incentives for Retirement Savings.” Washington, DC: Urban-Brookings Tax Policy Center.