The standard deduction reduces a taxpayer’s taxable income. It ensures that only households with income above certain thresholds will owe any income tax.

Taxpayers can claim a standard deduction when filing their tax returns, thereby reducing their taxable income and the taxes they owe. In addition to the regular standard deduction, taxpayers can claim an additional deduction if they or their spouse are 65 or older or blind.

Rather than taking the standard deduction, taxpayers can choose to itemize their deductions. Prior to 2018, around 70 percent of taxpayers chose to take the standard deduction. Most chose it because it was larger than the itemized deductions they could claim, but some did so because it was easier than identifying and totaling the expenses they could itemize or because they did not realize that itemizing would reduce their tax liability.

The Tax Cuts and Jobs Act (TCJA), passed in December 2017, changed how tax filers benefit from the standard deduction versus itemizing deductions. It increased the standard deduction amounts for 2018 well beyond what they would have been in that year, raising the deduction from $6,500 to $12,000 for singles, from $13,000 to $24,000 for married couples, and from $9,550 to $18,000 for heads of household. The additional deduction for those 65 and over or blind was $1,300 in 2018 ($1,600 if the person is unmarried and not filing as a surviving spouse). As under prior law, the deduction amounts were indexed for inflation.

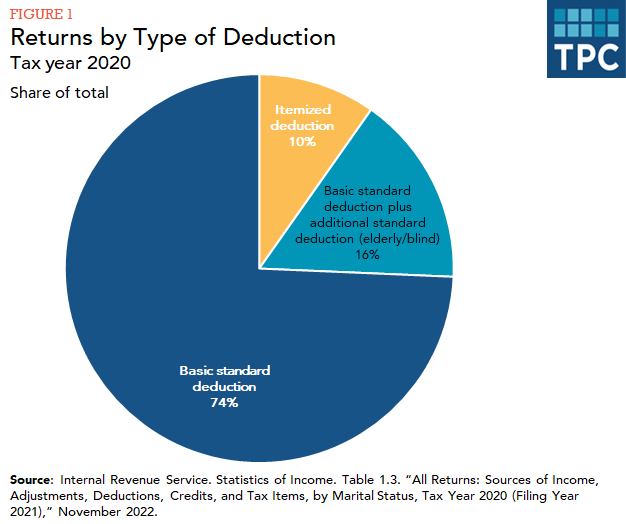

As a result, TCJA substantially increased the share of taxpayers using the standard deduction. For example, in tax year 2020 (filed in 2021), about 90 percent of tax filers claimed the standard deduction, compared with about 70 percent in 2017. Nearly three in four tax filers claimed the basic standard deduction, 16 percent claimed it in addition to the additional standard deduction for the elderly or blind, and only 10 percent itemized their deductions (figure 1).

The standard deduction amount for tax year 2023 (filed in 2024) is $27,700 for a married couple filing jointly, $13,850 for single or married filing separately filers, and $20,800 for heads of household (table 1). The additional deduction for single filers or heads of household who are either age 65 or over or blind is $1,850 ($3,700 if the person is both age 65 or over and blind).

The Effect of TCJA on Taxable Income Thresholds

Before 2018, taxpayers could also claim a personal exemption for themselves and their dependents in addition to the standard deduction. Together, the standard deduction and personal exemptions created taxable income thresholds, ensuring that taxpayers with income below those thresholds would not pay any income tax.

For example, in 2017, the standard deduction was $12,700 for a married couple filing jointly, $6,350 for a single or married filing separately filer, and $9,350 for a head of household; each personal exemption was $4,050. Thus, the taxable income threshold for a married couple without dependents was $20,800 (the standard deduction plus two personal exemptions) and the threshold for a single person was $10,400 (the standard deduction plus one exemption). Couples and singles with income below those amounts did not owe any income tax.

TCJA raised the standard deduction but also set the personal exemption amount, which would have been $4,150 in 2018, to zero. The loss of personal exemptions offset some of the gain from higher standard deductions, but the net result was an increase in the taxable income threshold in 2018 from $10,650 to $12,000 for singles and from $21,300 to $24,000 for couples without children. Because most of the individual income tax provisions of TCJA expire after 2025, the taxable income thresholds will revert to what they would have been under prior law unless Congress extends or makes permanent current law.

The zero personal exemption amount also applies to the exemptions taxpayers could claim for each of their dependents. However, TCJA also increased the child tax credit, which offset the loss of personal exemptions for many taxpayers with dependents. In many cases, taxpayers with income above the taxable income thresholds can still pay no income tax if they qualify for tax credits such as the child tax credit and the earned income tax credit.

Updated January 2024

Joint Committee on Taxation. 2019. Overview of the Federal Tax system in Effect for 2019. JCX-9-19. Washington, DC.

Joint Committee on Taxation. 2018. Overview of the Federal Tax system in Effect for 2018. JCX-3-18. Washington, DC.

Gale, William G., Hilary Gelfond, Aaron Krupkin, Mark J. Mazur, and Eric Toder. 2018. “Effects of the Tax Cuts and Jobs Act: A Preliminary Analysis.” Washington, DC: Urban-Brookings Tax Policy Center.