The federal tax code includes a range of incentives for alternatives to fossil fuels. These provisions support electricity production from solar, wind, and other renewable sources and from nuclear facilities. They also support alternative transportation fuels, especially electricity, and encourage energy efficiency in homes and commercial buildings. The Inflation Reduction Act of 2022 greatly expanded and redesigned tax incentives for alternative energy sources.

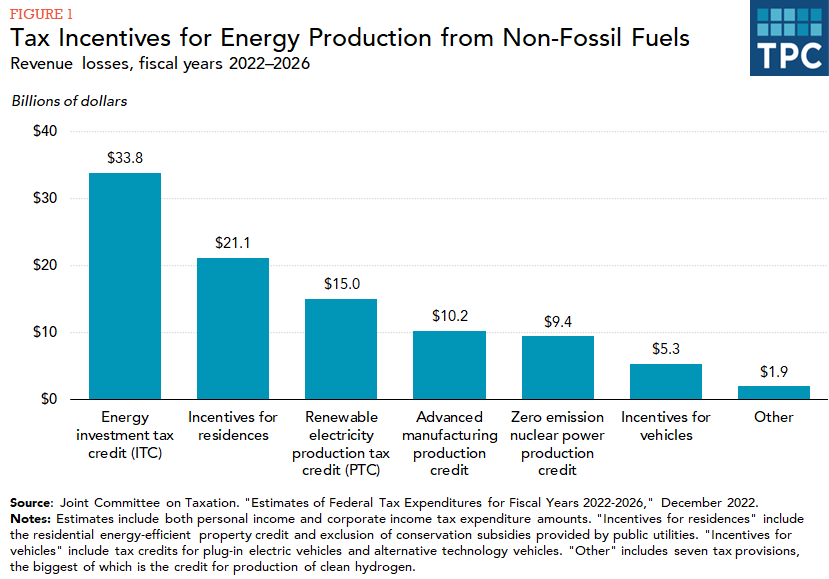

The federal government provides roughly $96.7 billion per year in tax subsidies that encourage non-fossil fuels (figure 1). The largest include tax credits for energy investment, incentives for residential energy, and tax credits for renewable electricity production.

Electricity Production

The investment tax credit (also known as the Section 48 credit) provides a one-time credit for new investment in qualifying facilities. Solar generators are its main recipients, with small amounts going to fuel cells, combined heat and power systems, and other projects. The production tax credit (also known as the Section 45 credit) provides a per kilowatt hour subsidy to qualifying facilities during their first 10 years of operation. Wind-powered generators are the main recipients, but some geothermal, biomass, solid waste, and hydro facilities also claim it.

The Inflation Reduction Act of 2022 made substantial changes to these credits. Most notably, they linked the amount of the tax credit to various attributes of the energy project (Department of Energy 2023). For example, the investment tax credit was 30 percent of qualified property in 2022, the last year before the Act took effect. The credit now has a 6 percent base level. That credit increases to 30 percent for projects that meet certain labor standards around prevailing wages and apprenticeship programs. An additional 10 percent is available for projects meeting domestic content standards. And another 10 percent is available for projects located in an energy community. Similar provisions apply for the production tax credit.

The Inflation Reduction Act also expanded tax credits for nuclear power. Before the Act, there were two very small tax subsidies also target nuclear energy. Now there is a more robust production tax credit for zero-emission nuclear production.

Electric Vehicles

The tax code provides a substantial tax credit to individuals and businesses who purchase or lease plug-in electric light passenger vehicles and trucks. The credit can range as high as $7,500 based on several factors. These include material sourcing, domestic content, and household income. (White House, undated). Electric motorcycles previously received a smaller credit, which has since expired. There are also small tax credits for fuel cell vehicles and alternative vehicle refueling.

Residential

The tax code also encourages homeowners to improve energy efficiency and switch to alternative sources. The largest of these benefits are the residential energy-efficient property tax credit, known as Section 25D, which supports home installation of solar electric and water heating systems and some battery storage systems and the newly-expanded residential energy efficiency credit for improvements in existing homes, including insulation improvements and high-efficiency heating, cooling, and water heating. Also, energy conservation subsidies provided by public utilities are excluded from taxable income.

Other

Manufacturing facilities can claim a tax credit for investment in advanced energy property that generates clean power and/or improves efficiency. Commercial buildings get a special deduction for investments in lighting, heating, cooling, water heating, and building envelopes that substantially improve energy efficiency.

The federal government also provides a financing subsidy for certain bonds issued to invest in renewable energy and energy conservation projects.

Direct Pay

Tax analysts often emphasize that credits, deductions, and other tax incentives resemble spending programs. Indeed, tax analysts often describe these incentives as “tax expenditures.” The Inflation Reduction Act made this equivalence especially vivid. Certain incentives, most notably the investment and production tax credits, are available as direct payments to entities that do not usually pay federal income tax. Potential beneficiaries of direct payment include non-profits, state and local governments, Indian Tribal governments, Alaska Native Corporations, and government-affiliated entities involved in electricity production and distribution.

Updated January 2024

Cunningham, Lynn J. and Claire M. Jordan. 2023. “Renewable Energy and Energy Efficiency Incentives: A Summary of Federal Programs.” Washington, DC: Congressional Research Service.

US Department of Energy. 2023. “Federal Solar Tax Credits for Businesses.”

US Department of Energy. n.d. “Federal Tax Credits for All-Electric and Plug-In Hybrid Vehicles.”

White House. 2022. “Clean Energy Tax Provisions in the Inflation Reduction Act.”