A host of tax preferences for health care cost the federal government roughly $300 billion in income tax revenue in 2022. The largest is the exclusion from taxable income of employer contributions for health insurance premiums.

In 2022, the federal government lost roughly $300 billion in income tax revenue from at least thirteen tax preferences for health care. By far the most costly is the exclusion of employer contributions for health insurance premiums from taxable income.

Exclusion For Employer Contributions To Health Insurance

Employer and most employee contributions to health insurance premiums are excluded from income taxes. The Joint Committee on Taxation estimates that the income tax expenditure for the exclusion of employer-sponsored health insurance was over $187 billion in fiscal year 2022.

Employer contributions for health insurance premiums are also excluded from employees’ taxable wages when calculating payroll taxes. Including its impact on both income and payroll taxes combined, the exclusion reduced government revenue by $299 billion in 2022. (Some of the revenue loss from the exclusion of health insurance premiums from the payroll tax base will be recovered in the form of reduced future Social Security retirement benefits.)

Other Major Tax Expenditures for Health Care

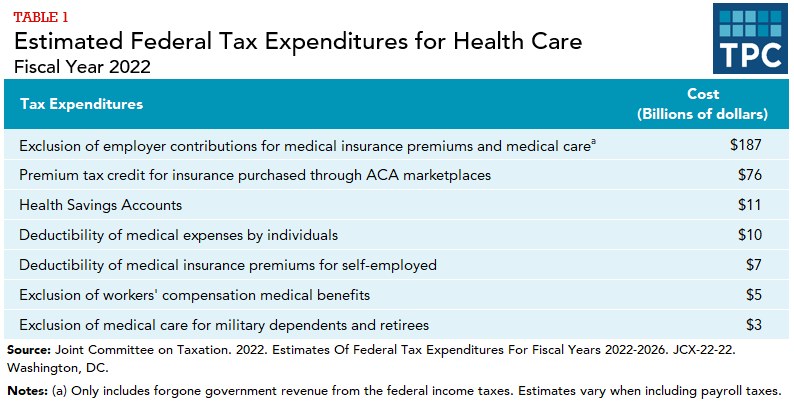

Table 1 outlines the other major federal tax expenditures for health care:

- Individuals ineligible for employer-sponsored or public health insurance may receive subsidies to purchase insurance on Affordable Care Act Marketplaces ($76 billion).

- Individuals younger than 65 covered by high-deductible health insurance plans may take an income tax deduction for contributions to health savings accounts (HSAs). Employers may make HSA contributions that are excluded from income and payroll taxes. Additionally, HSA balances grow tax-free, and withdrawals for medical expenses are not subject to income tax ($11 billion).

- Individuals may claim as an itemized deduction out-of-pocket medical expenses and health insurance premiums paid with after-tax dollars and exceeding 7.5 percent of their income ($10 billion).

- Self-employed individuals may deduct health insurance premiums from their income ($7 billion).

- Medical benefits provided by workers’ compensation insurance are excluded from taxable income ($5 billion).

- Coverage for military retirees and dependents is excluded from taxable income ($3 billion).

Updated January 2024

Gruber, Jonathan. 2011. “The Tax Exclusion for Employer-Sponsored Health Insurance.” National Tax Journal 64 (2, part 2): 511–30.

Smith, Karen and Eric Toder. 2014. “Adding Employer Contributions to Health Insurance to Social Security’s Earnings and Tax Base.” Chestnut Hill, MA: Center for Retirement Research at Boston College.