That depends on what exclusions, credits, and deductions are left in and whether revenue neutrality is a must.

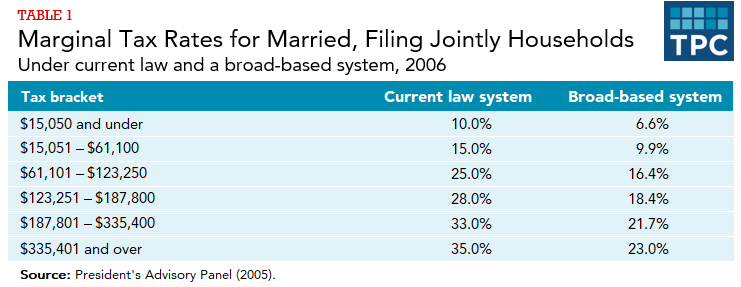

The President’s Advisory Panel on Federal Tax Reform estimated how much marginal tax rates could be reduced under a broad-based income tax that generated the same revenue as the current system. As table 1 shows, the switch would permit across-the-board cuts of about one-third. This sort of reform would not be an easy political pill to swallow, however. The panel’s version, for example, would preserve only the standard deduction and personal exemptions, and would eliminate, reduce or reform many tax credits, “above-the-line” deductions, and itemized deductions. On the plus side, a broad-based tax would eliminate the much-despised individual alternative minimum tax.

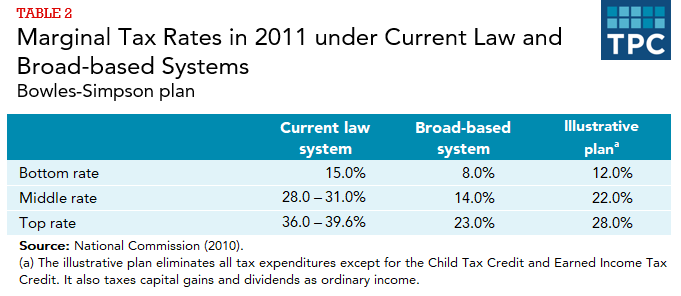

The Bowles-Simpson alternative provides similar estimates but argues that its zero-base budgeting methodology would allow the system to reduce rates and the deficit simultaneously (table 2).

Note, however, that, these estimates are very dated as both the baseline tax law and the level, composition, and distribution of income have changed since then.

Updated January 2024

Domenici-Rivlin Debt Reduction Task Force. 2010. “Domenici-Rivlin Debt Reduction Task Force Plan 2.0.” Washington, DC: Bipartisan Policy Center.

National Commission on Fiscal Responsibility and Reform. 2010. “The Moment of Truth.” Washington, DC: National Commission on Fiscal Responsibility and Reform.

President’s Advisory Panel on Federal Tax Reform. 2005. Simple, Fair, and Pro-Growth: Proposals to Fix America’s Tax System. Washington, DC: President’s Advisory Panel on Federal Tax Reform.