It depends on assumptions about the breadth of the tax base, tax evasion and avoidance, and the effects on economic growth. It also depends on how the tax rate is measured.

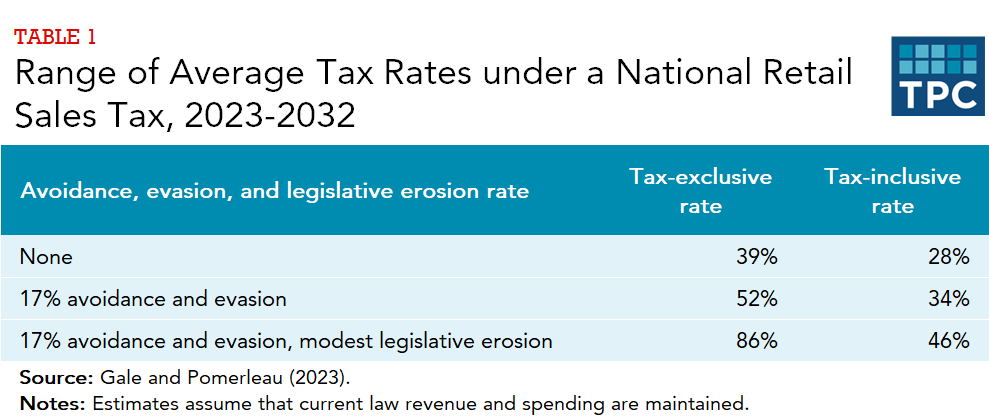

Perhaps the most controversial aspect of the national retail sales tax has been how high the tax rate would need to be to replace all revenue from the current tax system. The answer depends on four things: (1) whether the quoted rate is in tax-exclusive or tax-inclusive terms; (2) the rates of tax evasion and tax avoidance; (3) the extent to which deductions, exemptions, and credits would be retained in the tax base; and (4) the impact on economic growth.

Under the optimistic assumption of a very broad base and extremely conservative assumptions about evasion and avoidance, the tax rate would have to be 39 percent on a tax-exclusive basis, or 28 percent on a tax-inclusive basis.

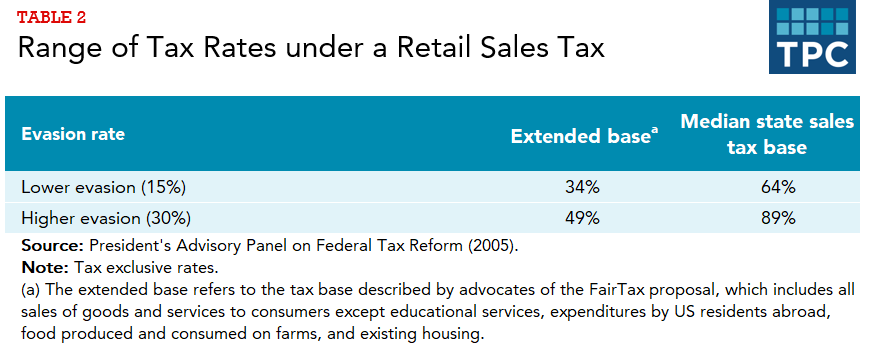

Estimates from the President’s Advisory Panel on Federal Tax Reform span an even wider range. Using reasonable assumptions about tax evasion and the breadth of the tax base, the Advisory Panel estimated the required tax-exclusive rate to be between 34 and 89 percent. Their highest estimate assumes (1) an evasion rate consistent with the current income tax for income on which taxes are not withheld and there is no third-party reporting and (2) a federal tax base equivalent to the median state sales tax base.

Note, however, that these estimates are dated.

Tax Exclusive or Tax Inclusive

A key issue in determining the required tax rate is how to define the tax rate. Suppose a product costs $100 before adding on the tax and has a $30 sales tax. The “tax-exclusive” tax rate would be 30 percent, because the tax is 30 percent of the pre-tax selling price. The “tax-inclusive” rate would be about 23 percent, which is obtained by dividing the $30 tax by the total cost to the consumer ($100 + $30). Sales tax rates are typically quoted in tax-exclusive terms, but income tax rates are typically quoted as tax-inclusive rates. For example, a household that earns $130 and pays $30 in income taxes would normally think of itself as facing roughly a 23 percent ($30 ÷ $130) income tax rate.

Although there is no single correct way to report the sales tax rate, it is crucial to understand which approach is being used. The tax-inclusive rate will always be lower than the tax-exclusive rate, and the difference grows as the rate rises. At a rate of 1 percent, the difference is negligible, but a 50 percent tax-exclusive rate corresponds to a 33 percent tax-inclusive rate, a 17 percentage-point difference.

Other Factors would Raise the Rate Even Higher

Households’ total sales tax rate would be significantly higher than the federal rates indicated above, after existing state sales tax were added. In addition, most or all state income taxes would probably be abolished in the absence of a federal income tax system because state income tax systems depend on the federal system for reporting income and other information. Today’s state income taxes would likely be converted to sales taxes, adding considerably to the combined sales tax rate.

Other reforms would further raise the required rate. Transition relief for households would reduce the tax base and raise the required rate even higher. And if major consumption items such as food, housing, or health care were exempted from the base (the assumptions above do not allow for such large exemptions), the rate on the remaining goods and services would rise still higher.

Updated January 2024

Gale, William G. 2005. “The National Retail Sales Tax: What Would the Rate Have to Be?” Tax Notes, May 16.

Gale, William G., and Kyle Pomerleau. 2023. “Deconstructing the Fair Tax.” Tax Notes Federal, March 27, 2023.

President’s Advisory Panel on Federal Tax Reform. 2005. Simple, Fair, and Pro-Growth: Proposals to Fix America’s Tax System. Washington, DC: President’s Advisory Panel on Federal Tax Reform.