Almost all taxpayers may establish IRAs, but high-income taxpayers are more likely to have an account. Taxpayers may either contribute to IRAs annually—or roll over balances from employer-sponsored plans.

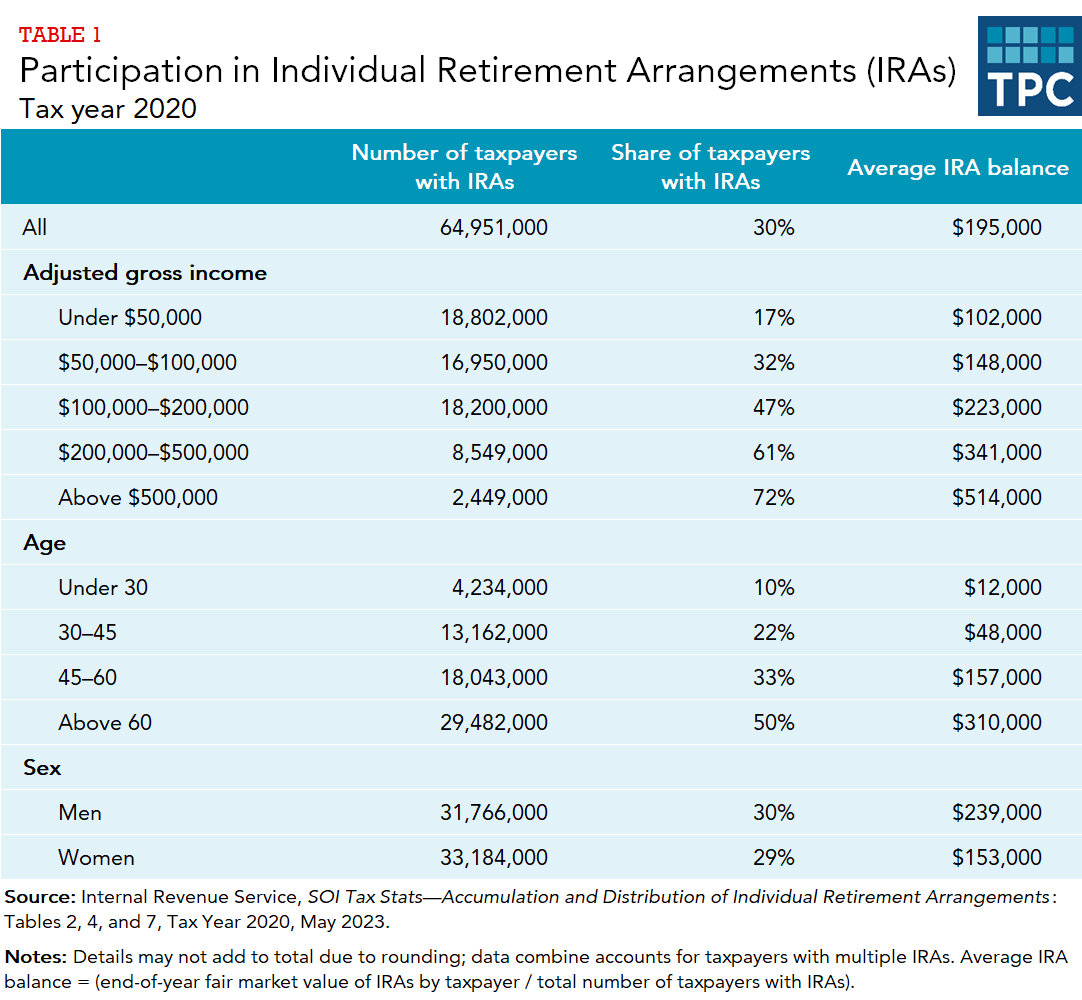

Nearly 65 million taxpayers own individual retirement accounts (IRAs), which include traditional IRAs, Roth IRAs, Simplified Employee Pensions (SEP IRAs), and Savings Incentive Match Plans for Employees (SIMPLE IRAs). The average IRA balance for taxpayers with IRAs is about $195,000. Ownership of IRAs increases with income and with age, as does the average IRA balance. Men and women are about equally likely to own an IRA (table 1).

Over the course of 15 years, the average IRA balance more than doubled. In inflation adjusted 2020 dollars, it grew from about $91,000 in 2005 to $195,000 in 2020.

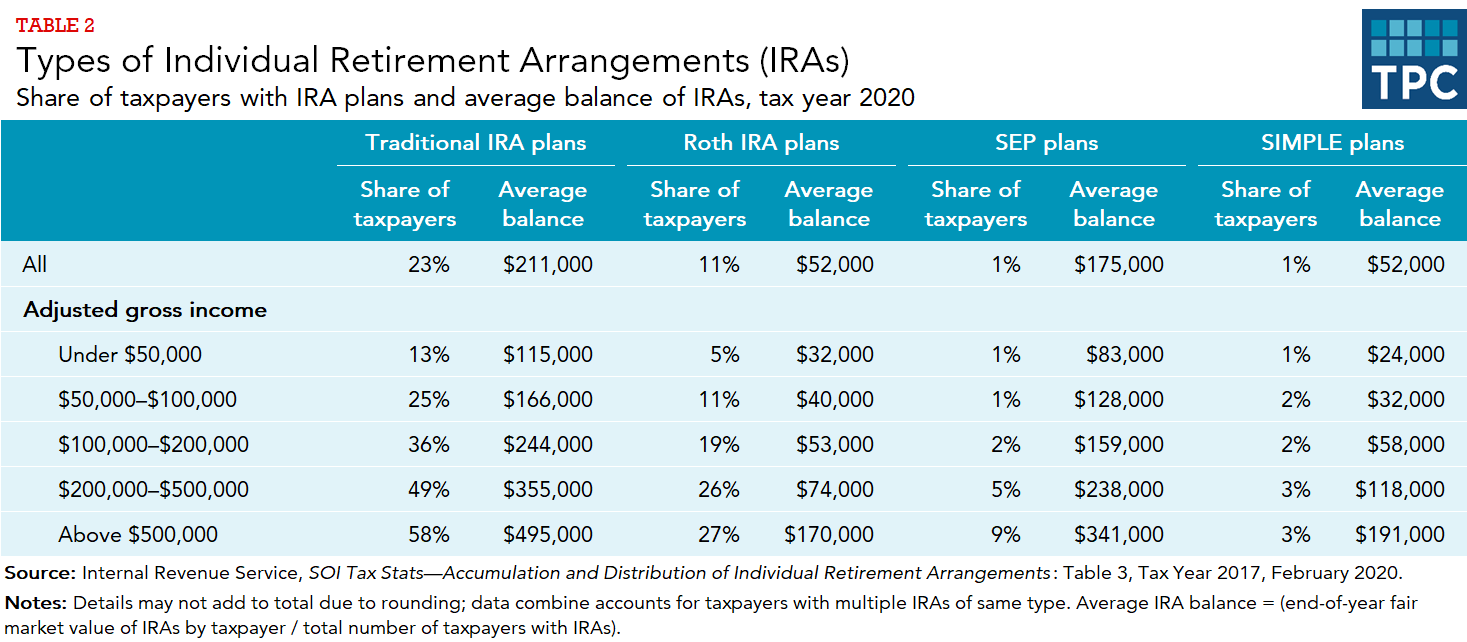

About 23 percent of taxpayers own traditional IRAs, while about 11 percent own Roth IRAs. Taxpayers can own multiple types of IRAs. Only a small percentage of taxpayers own SEP IRAs or SIMPLE IRAs. The average balance in traditional IRAs ($211,000) is much larger than that in Roth IRAs ($52,000). Traditional IRA owners with adjusted gross income above $500,000 have an average balance of $495,000 (table 2).

Taxpayers in 2023 may contribute the lesser of $6,500 per year ($7,500 for taxpayers age 50 or older) or the amount of their taxable compensation to traditional or Roth IRAs. There is no age limit in 2020 and later years on making regular contributions to traditional or Roth IRAs. Prior to 2020, taxpayers could not make annual contributions to a traditional IRA once they reached age 70 ½, but they could still contribute to a Roth IRA.

Employees can make contributions of up to $15,500 to a SIMPLE IRA plan in 2023 and an additional $3,500 if they are 50 or older. Employers must either match employee contributions dollar for dollar up to 3 percent of compensation or make a nonelective contribution of 2 percent of compensation. SEP IRAs only allow employer contributions. For a self-employed individual, contributions are limited to 25 percent of net earnings from self-employment, up to $66,000 in 2023.

Taxpayers also may roll over their balances from employer-sponsored contribution plans to an IRA, typically after changing jobs. Rollovers are usually much larger than regular contributions. The average IRA holding that included rollovers in mid-2022 was $150,000 compared to $42,500 IRA balance without rollovers. Taxpayers can make rollover contributions to a Roth or traditional IRA regardless of age.

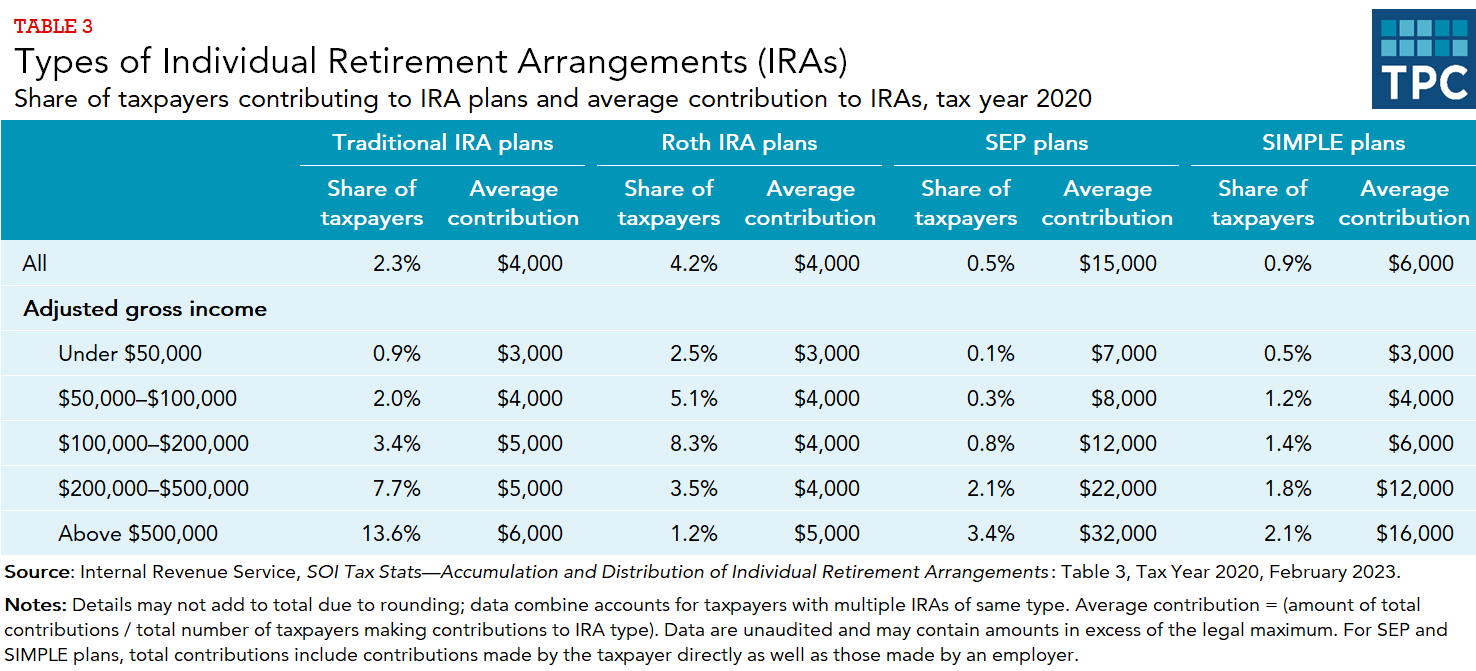

Only a small percentage of taxpayers contributed to traditional or Roth IRAs in tax year 2020 (table 3). The share of taxpayers who contributed increased with income, except for those owning Roth IRAs, which have income limits for eligibility. Traditional IRAs have no income limits on contributions, but income limits and other restrictions affect whether contributions are tax deductible. The average contribution to SEP IRAs was greater than for other types of IRA, reflecting the significantly higher contribution limits.

Updated January 2024

Burman, Leonard E., William G. Gale, Matthew Hall, and Peter R. Orszag. 2004. “Distributional Effects of Defined Contribution Plans and Individual Retirement Accounts.” Discussion Paper 16. Washington, DC: Urban-Brookings Tax Policy Center.

Congressional Budget Office. 2011. “Use of Tax Incentives for Retirement Saving in 2006.” Washington, DC.

Holden, Sarah and Daniel Schrass. 2023. “The Role of IRAs in US Households’ Saving for Retirement, 2022.” Washington, DC: Investment Company Institute.