Direct File allows millions of taxpayers to prepare and file their federal income tax returns electronically and directly with the Internal Revenue Service (IRS) for free. It is an optional government service that was successfully piloted by over 140,000 tax filers with simple tax situations across 12 states in the 2024 tax filing season. After filing, 90 percent of users rated their experiences as positive, with many noting Direct File’s ease of use, trustworthiness, and free services. Since then, Direct File has expanded to cover more tax situations and more states. As a result, an estimated 30 million taxpayers across 25 states can use Direct File in 2025.

Like other tax preparation software, Direct File guides taxpayers through a series of questions, in a step-by-step “interview style” manner to prepare and file their tax returns online. It is available in English and Spanish, provides live chat and customer service support, and is mobile-friendly. Through partnerships with states, eligible users of Direct File can also prepare and file their state income tax returns electronically for free. Direct File also has “data importing” functionality, giving taxpayers the ability to pre-populate their income tax return with some data the IRS already has on file, including information from W-2 forms. Unlike some other tax-filing options, including those in the IRS’s Free File program, Direct File is always free and does not promote service upgrades that filers must pay for.

This factsheet uses December 2024 data from the Urban Institute’s Well-Being and Basic Needs Survey (WBNS) to examine interest in using Direct File. Unlike prior surveys that have examined the experiences of Direct File users, the WBNS is a nationally representative survey of adults ages 18 to 64 and hence paints a fuller picture of national interest in this government service. We also examine what motivated respondents to choose their most recent tax filing methods to better understand their priorities when preparing and filing their taxes.

Most tax filers are interested in using Direct File

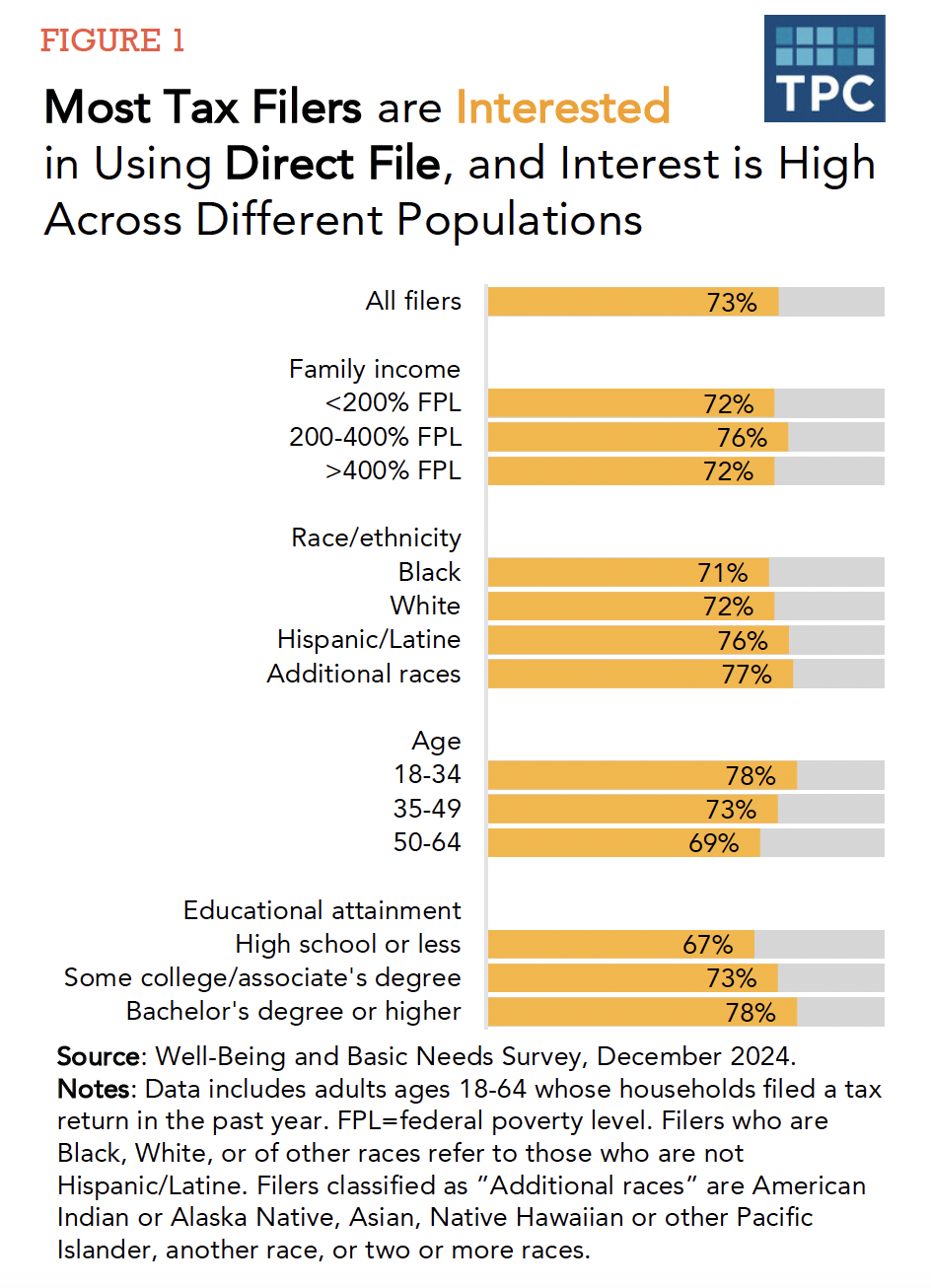

Among those who filed a tax return last year, about three-quarters (73 percent) reported they would be somewhat or very interested in using Direct File if they had access to it (figure 1). Although the shares of tax filers who are interested varied by demographic characteristics, a majority in each group expressed interest in using Direct File.

Interest in Direct File was high both among those who had paid to file their taxes (69 percent) and those who filed their taxes for free (85 percent) in 2024 (data not shown).

However, two-thirds of tax filers (68 percent) also agreed with the statement that they do not know enough about Direct File to feel comfortable using it, and 88 percent agreed with the statement that their most-recent filing method met their needs (data not shown).

Ease of use and cost are the top reasons when choosing a tax filing method

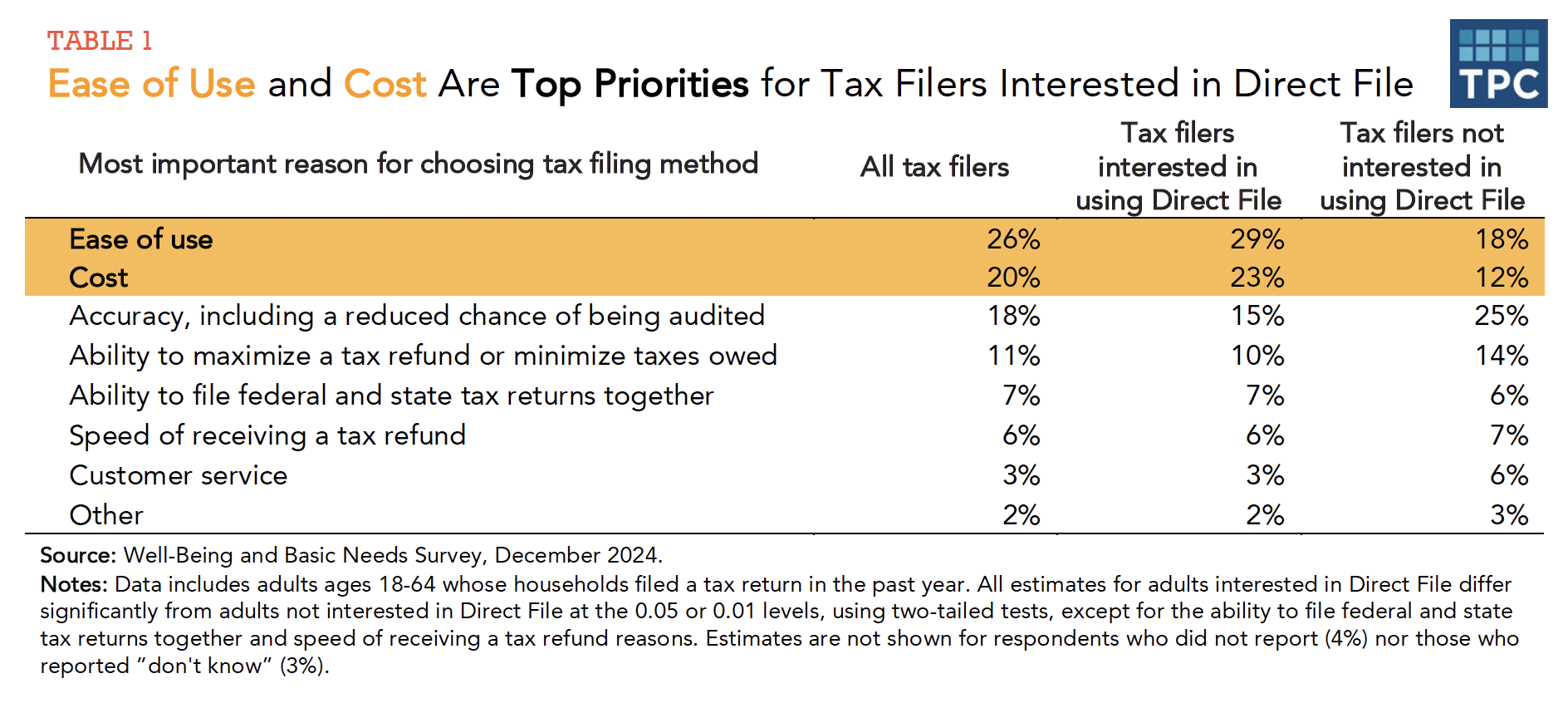

American taxpayers interested in Direct File prioritize ease of use and cost when choosing how to file their tax returns. Those not interested in using Direct File were more likely to prioritize accuracy, including a reduced chance of being audited, followed by ease of use (table 1).

Notably, Direct File is free for eligible users, which may save filers $160 on average in annual tax filing fees.

For tax filers who prioritize ease of use, the expansion of Direct File’s pre-population functionality, mobile-friendly portal, integrated state-level tax return filing, access to live customer support, and the ability to use Direct File in both English and Spanish may be especially important factors.

Further evidence on the accuracy of Direct File-prepared tax returns and how the share of returns audited compares with other filing methods (commercial tax software, accountants, or volunteer income taxpayer assistance (VITA) tax clinics), may be important information for taxpayers to know when deciding their tax filing method of choice.