A major rewrite of the federal tax code awaits the winners of the upcoming 2024 elections. Unless Congress passes new legislation, the 2017 Tax Cuts and Jobs Act (TCJA) individual income and estate tax provisions will expire after 2025. Lawmakers may also seek to alter business tax deductions made less generous by the TCJA to offset the cost of the original bill.

Below are Tax Policy Center analyses and model estimates of the TCJA to help you better understand the choices facing the next president and Congress. They include research on the following topics:

- Who would benefit from extending the TCJA individual income tax provisions?

- What are the TCJA business tax extenders?

- What were the economic consequences of the TCJA?

- How might Congress expand the child tax credit?

This page will serve as a hub for all Tax Policy Center analysis of the TCJA during the 2024 campaign. Check back for additional content as the election approaches.

Who would benefit from extending the TCJA individual income tax provisions?

**Update**: The last paragraph of this section and accompanying chart were both updated on July 9, 2024 to reflect recently published TPC model estimates.

The TJCA reduced statutory income tax rates at almost all levels of taxable income, nearly doubled the standard deduction, increased the child tax credit (CTC) and established a new $500 tax credit for dependents not eligible for the CTC, created a new 20 percent deduction for eligible pass-through business income, and raised the exemption levels and thresholds for the alternative minimum tax.

To partially offset some of those tax cuts, it also repealed the personal and dependent exemptions; capped the deduction for state and local taxes at $10,000; and limited the mortgage interest deduction to the first $750,000 in principal debt (down from $1 million).

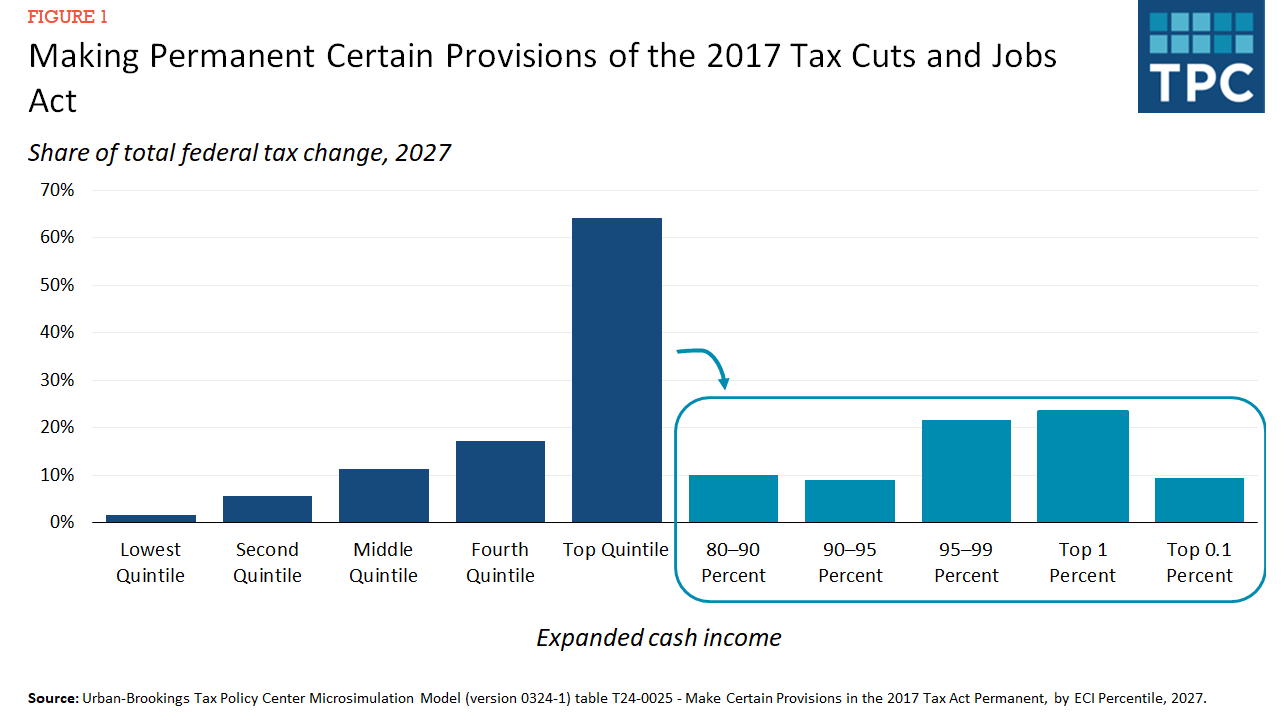

TPC recently estimated that if Congress extends all these individual income tax changes (and restoring the generosity of certain business tax deductions discussed in detail below), about 45 percent of the tax cut benefits would go to households in the top 5 percent of earners.

Additional Reading:

Effects of the Tax Cuts and Jobs Act: A Preliminary Analysis (June 2018)

How Did the Tax Cuts and Jobs Act Change Tax Expenditures? (Jan. 2020)

Tax Incentives for Pass-Through Income (July 2020)

Making The TCJA’s Individual Tax Cuts Permanent Would Add More than $3 Trillion To The Federal Debt, Mostly Benefit High-Income Households (Nov. 2022)

What are the TCJA business tax extenders?

The TCJA permanently lowered the corporate income tax rate from 35 percent to 21 percent, but it also reduced the value of some business tax breaks to help keep the lost revenue within the Senate's budget reconciliation parameters.

For example, as of 2022, businesses can no longer immediately expense research and development costs and there are tighter restrictions imposed on net interest expense deductions.

Furthermore, the TCJA rule that allowed businesses to fully expense most equipment—known as “bonus depreciation”—began phasing down after 2022 and will completely expire at the end of 2026. (Congress considered a temporary legislative fix to some of these business tax provisions, but the proposal stalled in the Senate.)

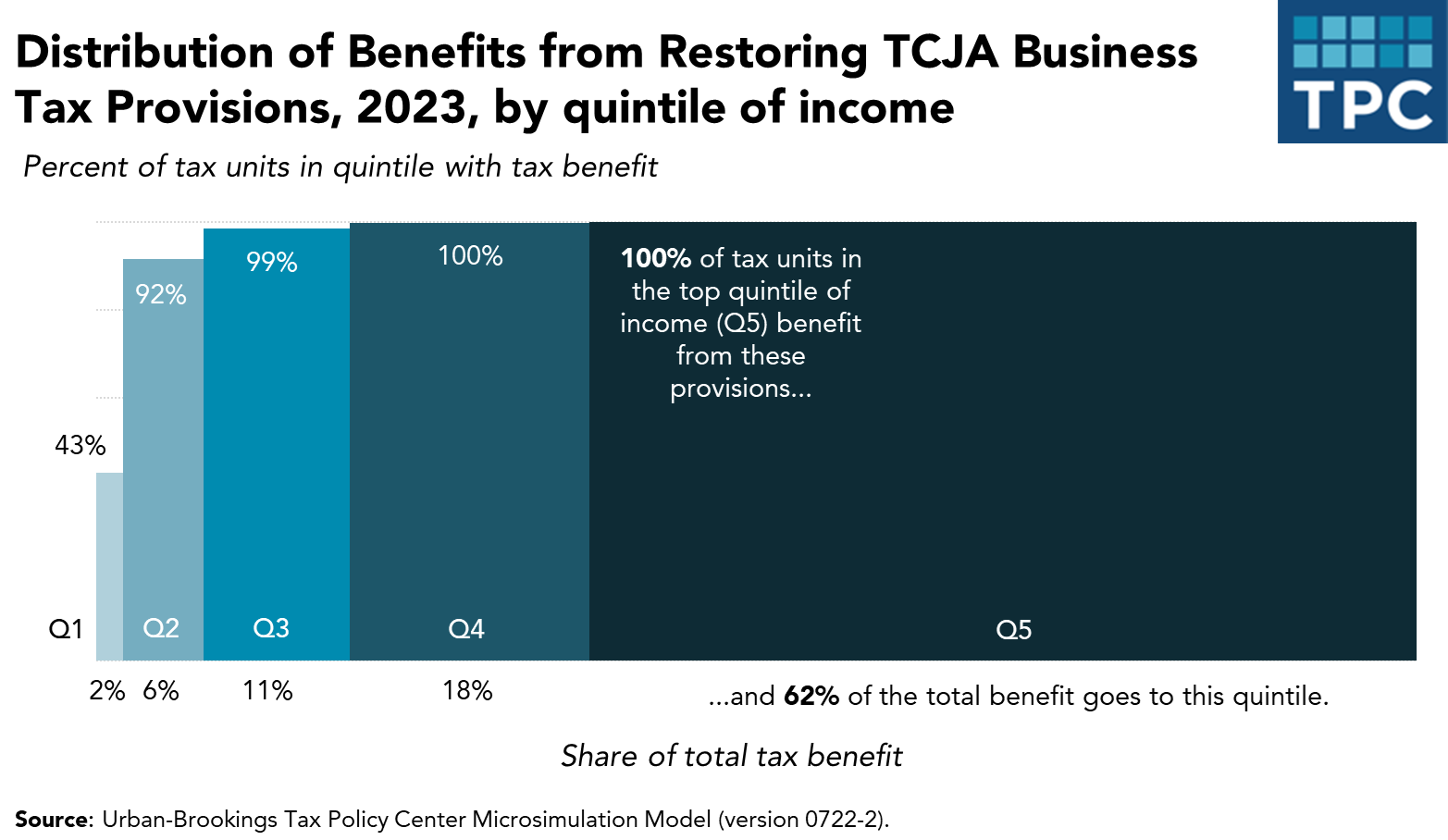

TPC's previous model estimate of restoring these tax breaks to their pre-2022 rules found that higher-income earners would benefit more.

In addition to these model estimates, Tax Policy Center staffers have taken a closer look at how some of these business tax provisions work and who they benefit.

Additional Reading:

Looming R&D Capitalization Would Hit Manufacturing And Tech Sectors Hardest (Oct. 2021)

TCJA Led Foreign-Owned Corporations to Retain More Earnings in the US (May 2022)

What were the economic consequences of the TCJA?

When the TCJA was enacted, proponents argued that the law would help stimulate the economy by lowering taxes on business income and providing incentives to invest. A few advocates even suggested that the economic response would be more than enough to cover the estimated $1.9 trillion 10-year fiscal cost of the law.

While the COVID-19 pandemic and recession complicated efforts to examine the TCJA's impact, economic data suggests the more optimistic scenarios promoted by the law's supporters did not pan out for either the US economy or its revenue collections.

A TPC paper examining pre-pandemic data (i.e., through 2019) found the TJCA had little impact on business investment. While overall investment growth increased after 2017, much of that increase was concentrated in oil and related industries—and thus appeared to be a response to oil price increases and not lower tax rates. Investment only grew modestly in other sectors and petered out by the end of 2019.

As for economic growth paying for the tax cut, in late 2019 the Congressional Budget Office estimated the TCJA would add $1.9 trillion to deficits from 2018 to 2028, even after accounting for the law's economic benefits.

TPC publications in recent years have examined the TCJA and the relationship between taxes and the economy more broadly.

Additional Reading:

The Tax Cuts and Jobs Act: Searching for Supply-side Effects (July 2021)

Rethinking the Incidence of the Corporate Income Tax (May 2022)

Effects of 2017 US Federal Tax Overhaul on the Energy Sector (May 2022)

The Booming Economy, Not The 2017 Tax Act, Is Fueling Corporate Tax Receipts (June 2022)

How might Congress expand the child tax credit?

Both the TCJA and the 2021 American Rescue Plan Act (ARPA) made the CTC more generous. While only in place for one year, the ARPA went much further. It raised the maximum credit amount to $3,600 (for children younger than age 6) and gave families the option to receive the tax break in advance payments from the IRS. It also made the credit fully refundable, allowing families with little or no income to receive the full benefit. The expansion proved key in temporarily lowering child poverty.

The TCJA version is now back in place until the end of 2025, but there are continued efforts to return to the ARPA levels. For example, the House—with a bipartisan vote—approved legislation that would have temporarily expanded the CTC alongside business tax deduction changes mentioned above, but it is currently stalled in the Senate.

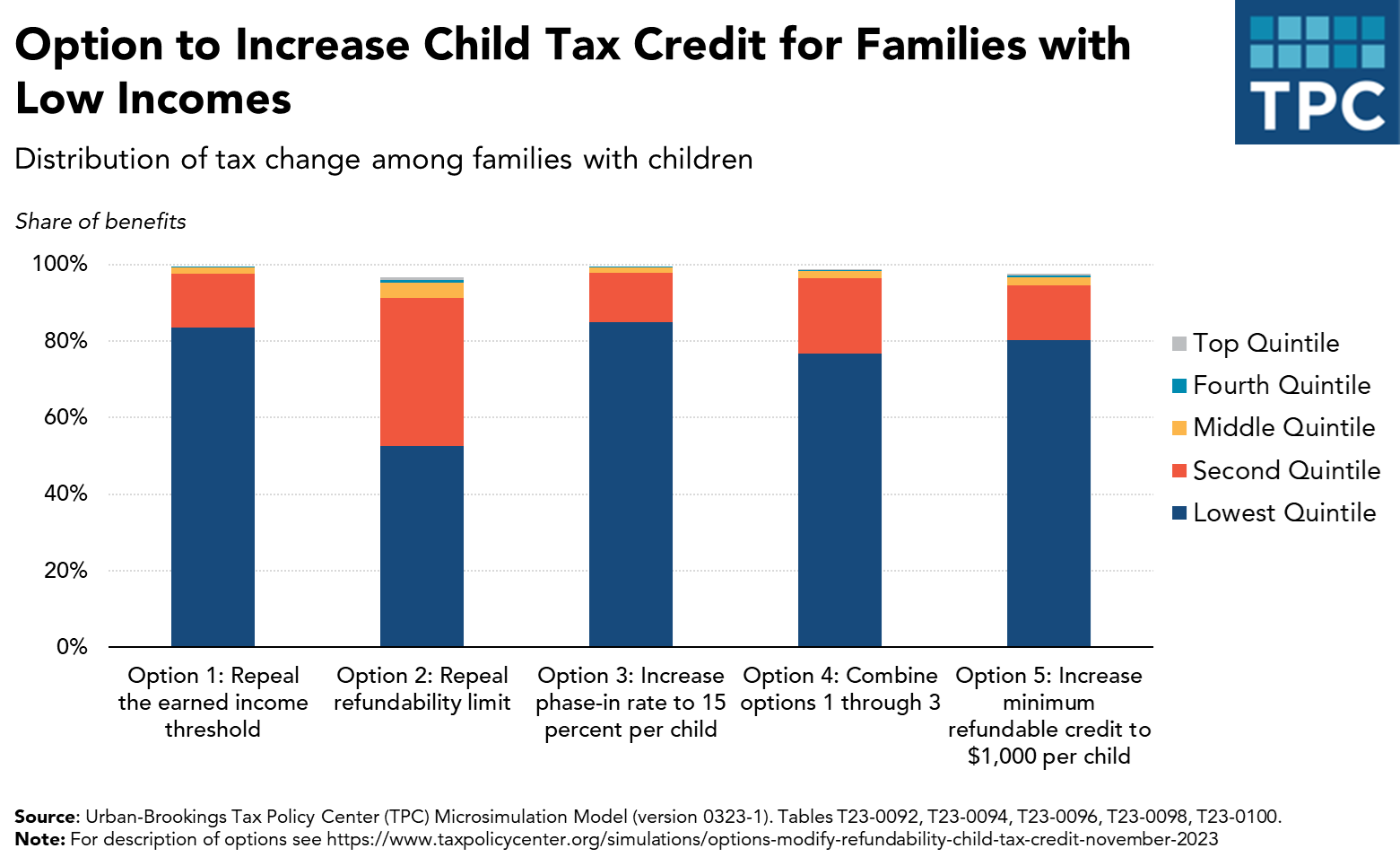

With so much recent debate and attention to the CTC, there are now numerous options to expand the CTC that could target benefits to lower-income households.

TPC has both explored how previous CTC changes affected families and what future reforms could look like.

Additional Reading:

Comparing The Fiscal Costs Of Tax Breaks For Children Versus Businesses (Oct. 2022)

Does The Child Tax Credit Reduce Child Poverty Or Discourage Work? (Dec. 2022)

Congress Can More Modestly Expand The Child Tax Credit And Still Help Very Low-Income Families (April 2022)