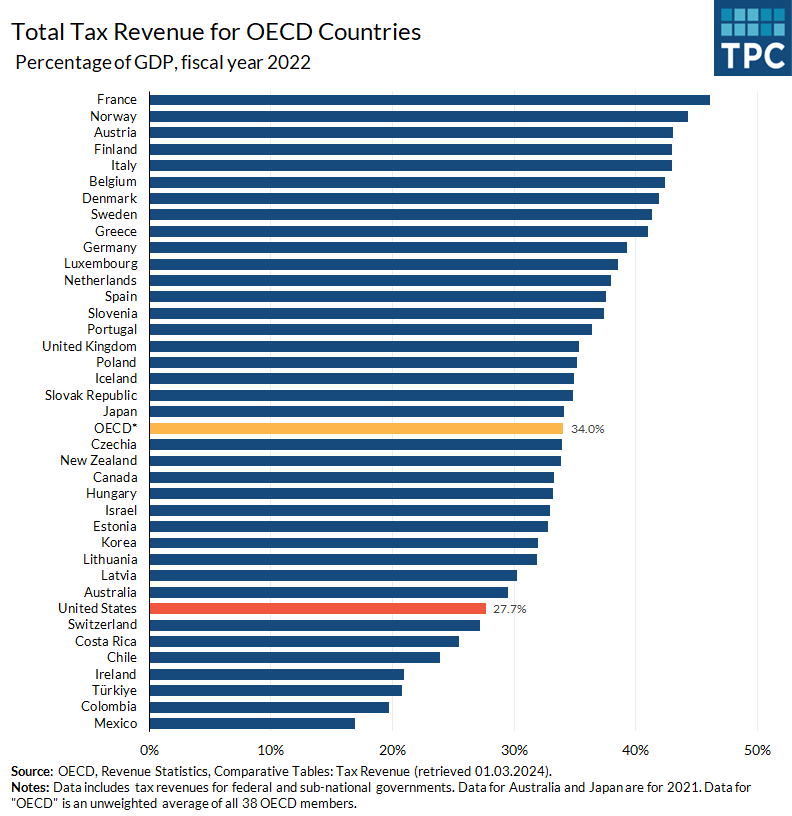

Among OECD member countries, the United States is on the low end of taxes collected at all government levels—federal, state, and local—as a share of total economic activity or gross domestic product (GDP). This differs from a few years ago, when the US was above the OECD average.

The US is a member of the Organization for Economic Cooperation and Development (OECD). The OECD includes 38 member countries who collaborate on policies that promote sustainable economic growth.

GDP measures the value of goods and services produced in a country. In 2022, as a share of all GDP from that year, total tax revenue made up 27.7 percent in the US. In comparison, the OECD's average was 34 percent. The US ranked 31st out of 38 OECD nations in this regard. In other high GDP countries, like Germany and Japan for example, their share of total tax revenue as a share of GDP was 39 percent and 34 percent, respectively.

Ultimately, tax revenue as a share of GDP reflects policy choices and priorities.

To learn more, please visit our Briefing Book page, “How do US taxes compare internationally?” or read our blog “No, The US Is Not Overtaxed”.