When you sell or exchange an asset like stocks or real estate at a price higher than what you paid, you pay tax on your profit, or capital gain. Right now, capital gains face no tax until they are realized, or sold.

A maximum tax rate of 37 percent applies to “short-term” capital gains, or gains on an asset held for less than a year. This relatively high short-term rate incentivizes many people to hold onto their gains for more than a year, so they can pay a lower long-term maximum rate of 20 percent. Beyond capital gains taxes, taxpayers with modified adjusted gross income (AGI) over $200,000 (for single filers), may also face a 3.8 percent net investment income tax (NIIT) on either type of capital gain.

Not all taxpayers who have capital gains pay the maximum rates because rates depend on taxpayer income. However, many do because taxpayers with capital gains are highly concentrated at the top of the income distribution.

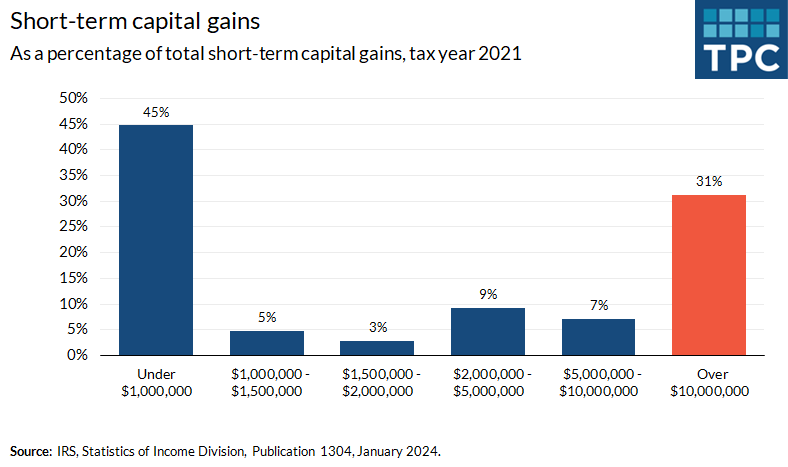

For example, tax filers earning at least $1 million realized 55 percent of all short-term capital gains in 2021, with those earning at least $10 million realizing 31 percent of the total.

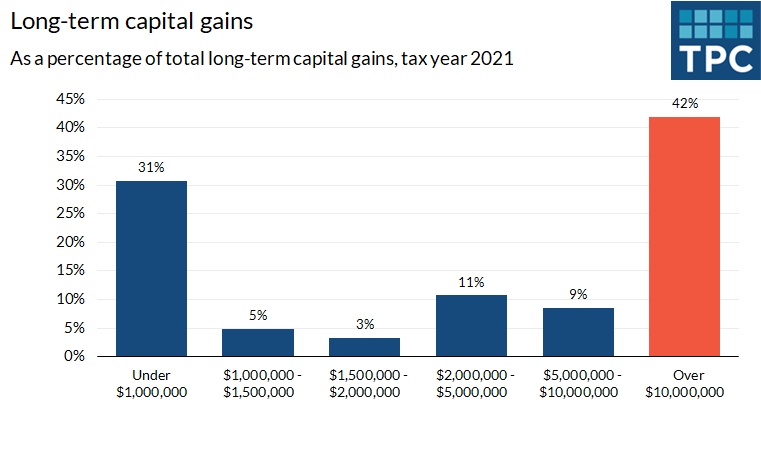

Those earning at least $1 million realized 69 percent of all long-term capital gains in 2021, with those earning at least $10 million realizing 42 percent of the total.

Learn more about this topic by visiting our Briefing Book page “How are capital gains taxed?”, reading “The Rich are Different From You and Me, with Trillions of Dollars Escaping Taxation”, and “The Sensitivity of the Tax Elasticity of Capital Gains to Lagged Tax Rates and Migration”.