(251.955078125 KB)

Display Date

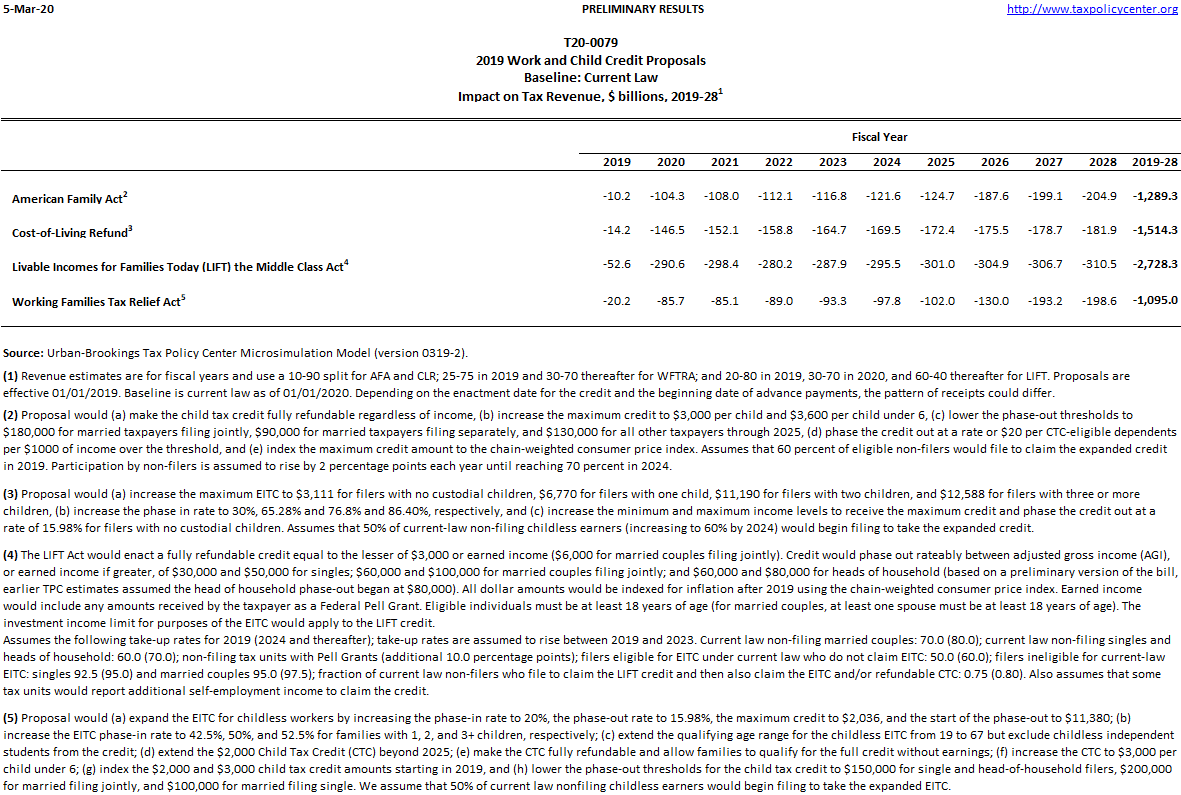

Expenditure effects of 2019 Work and Child Credit proposals, compared to current law as of January 1, 2020. Estimates shown for fiscal years and calendar years 2019-2028.

Image

T20-0091 - Child Tax Credit; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2019

T20-0090 - Earned Income Tax Credit; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019

T20-0089 - Earned Income Tax Credit; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2019

T20-0088 - Earned Income Tax Credit and Child Tax Credit; Current law benefits; Tax expenditures, $ billions, 2019-28

T20-0087 - Working Families Tax Relief Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019

T20-0086 - Working Families Tax Relief Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2019

T20-0085 - Livable Incomes for Families Today (LIFT) the Middle Class Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019

T20-0084 - Livable Incomes for Families Today (LIFT) the Middle Class Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2019

T20-0083 - Cost-of-Living Refund Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019

T20-0082 - Cost-of-Living Refund Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2019

T20-0081 - American Family Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019

T20-0080 - American Family Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2019

T20-0092 - Child Tax Credit; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019