(19.21484375 KB)

Display Date

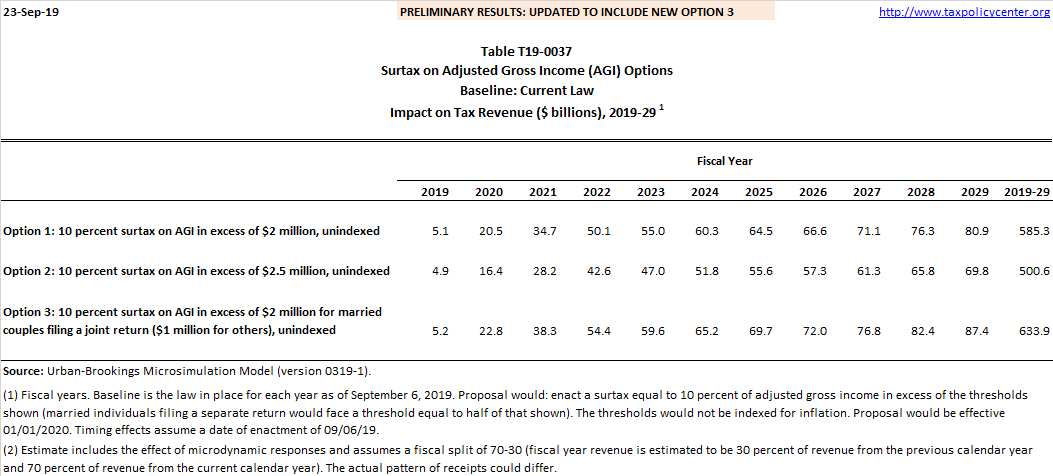

Table shows the effect on federal tax revenue of options to impose a surtax on adjusted gross income (AGI).

Image

T19-0049 - 10 Percent Surtax on Adjusted Gross Income (AGI) in Excess of $2 Million Married ($1 Million Single); Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2029

T19-0048 - 10 Percent Surtax on Adjusted Gross Income (AGI) in Excess of $2 Million Married ($1 Million Single); Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T19-0047 - 10 Percent Surtax on Adjusted Gross Income (AGI) in Excess of $2 Million Married ($1 Million Single); Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2020

T19-0050 - 10 Percent Surtax on Adjusted Gross Income (AGI) in Excess of $2 Million Married ($1 Million Single); Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2029