(256 KB)

Display Date

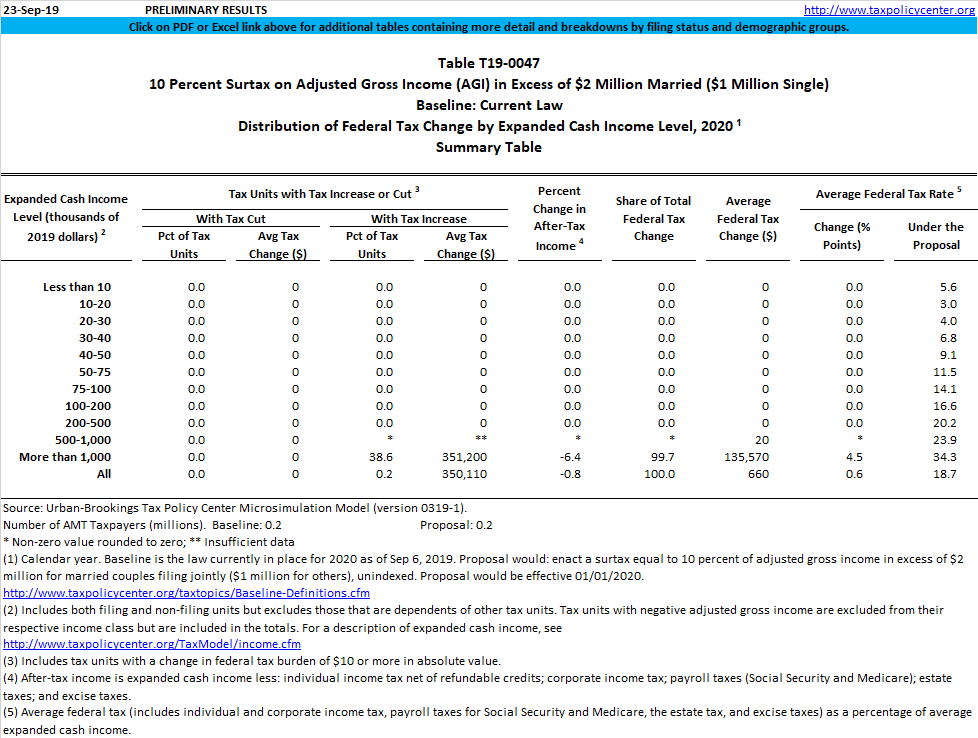

Table shows the effect on the distribution of federal tax burdens in calendar year 2020 of a 10 percent surtax on adjusted gross income in excess of $2 million if married, $1 million if single, by expanded cash income level. Supplemental sheets show the distribution by AGI levels.

Image