(176.1953125 KB)

Display Date

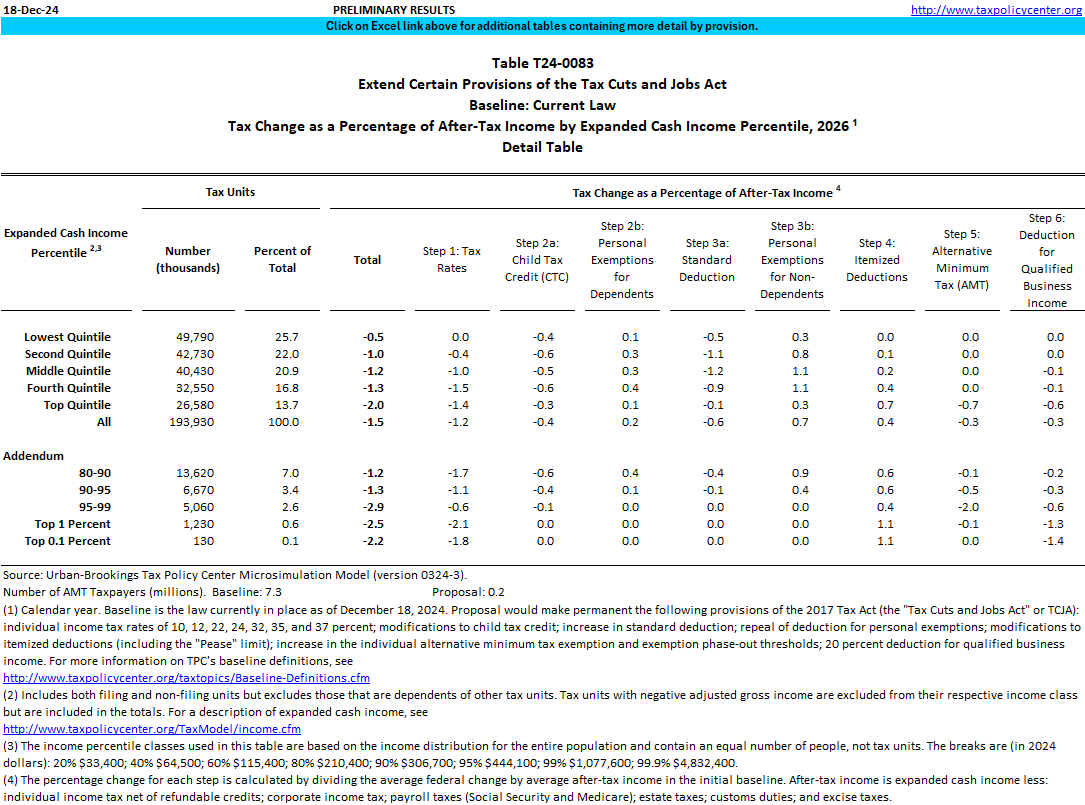

Table shows the change in the distribution of federal taxes, by expanded cash income percentile in 2026, of extending major individual provisions of the 2017 Tax Cuts and Jobs Act (TCJA). The table shows the change in taxes as a percentage of current law after-tax income for the following major provisions: reduced individual income tax rates; modifications to child tax credit; increase in standard deduction; repeal of deduction for personal exemptions; modifications to itemized deductions (including the "Pease" limit); increase in the individual alternative minimum tax exemption and exemption phase-out thresholds; 20 percent deduction for qualified business income. Results are shown for all provisions and each set of provisions separately.

Image